BitcoinWorld Asset Tokenization: Malaysia Unveils Transformative 3-Year Roadmap Are you ready to witness a significant shift in the financial landscape? Bank Negara Malaysia (BNM), the nation’s central bank, is spearheading an ambitious initiative with a three-year roadmap for asset tokenization . This move is poised to redefine how real-world assets are managed and traded, promising a future of enhanced efficiency and accessibility. Forget the volatility of traditional cryptocurrencies; Malaysia’s focus is firmly on leveraging blockchain technology for tangible economic benefits. What is Malaysia’s Vision for Asset Tokenization? Malaysia’s central bank is not just talking about innovation; it’s actively building the framework for it. BNM’s newly launched Digital Asset Innovation Hub will be the crucible for this transformation, driving both proof-of-concept (PoC) projects and live pilot tests. This strategic approach ensures that the implementation of asset tokenization is robust, secure, and tailored to the country’s unique economic needs. Proof-of-Concept Projects: Exploring the feasibility and potential of various tokenization models. Live Pilot Tests: Implementing successful concepts in real-world scenarios to refine processes. The roadmap clearly distinguishes its efforts from speculative crypto trading, emphasizing the tokenization of real-world assets (RWA). This distinction is crucial for fostering trust and stability within the financial system. Why is Bank Negara Malaysia Prioritizing Real-World Asset Tokenization? The decision to focus on real-world assets (RWA) for asset tokenization is a calculated one, designed to unlock significant value without inheriting the speculative risks often associated with digital currencies. BNM recognizes the immense potential of distributed ledger technology (DLT) to streamline traditional financial processes and create new economic opportunities. This strategic direction aims to: Boost Efficiency: Automate and simplify complex transactions. Enhance Liquidity: Make illiquid assets more tradable and accessible. Reduce Costs: Cut down on intermediaries and operational overheads. By concentrating on tangible assets like property, commodities, or intellectual property, Malaysia is building a foundation for a more resilient and inclusive financial ecosystem. This approach also aligns with global trends where central banks and financial institutions are increasingly exploring the practical applications of blockchain. How Will Asset Tokenization Impact Key Malaysian Sectors? The roadmap outlines several key applications where asset tokenization is expected to make a significant difference. These areas are vital to Malaysia’s economic growth and financial inclusion, demonstrating BNM’s commitment to practical, impactful innovation. Consider these specific applications: Supply Chain Finance for SMEs: Small and Medium-sized Enterprises (SMEs) often face hurdles in accessing finance. Tokenizing invoices or other supply chain assets can unlock capital more efficiently, providing much-needed liquidity and accelerating business growth. This could revolutionize how SMEs operate and expand. Liquidity Management: For financial institutions and corporations, managing liquidity is paramount. Tokenized assets can offer new avenues for collateral and interbank lending, improving overall market efficiency and stability. Sharia-Compliant Financial Solutions: Malaysia is a leader in Islamic finance. Asset tokenization presents a unique opportunity to develop innovative, Sharia-compliant financial products that adhere to ethical principles while leveraging cutting-edge technology. This could open new markets and attract investments aligned with Islamic values. These targeted applications show a clear understanding of where blockchain can deliver the most immediate and substantial benefits to the Malaysian economy. What Challenges and Opportunities Lie Ahead for Asset Tokenization? While the vision for asset tokenization is bright, the journey will undoubtedly involve navigating various challenges. Regulatory clarity, technological infrastructure, and widespread adoption are critical factors that will shape the success of this roadmap. However, these challenges also present significant opportunities: Regulatory Innovation: BNM’s proactive stance allows it to craft a regulatory environment that fosters innovation while safeguarding financial stability. Technological Advancement: The Digital Asset Innovation Hub will drive the development of robust and secure tokenization platforms. Economic Growth: Successful implementation could position Malaysia as a regional leader in digital finance, attracting foreign investment and fostering a vibrant fintech ecosystem. The collaborative approach, involving various stakeholders, will be essential in overcoming hurdles and maximizing the benefits of this groundbreaking initiative. Malaysia’s three-year roadmap for asset tokenization marks a pivotal moment in its financial evolution. By focusing on real-world assets and practical applications, Bank Negara Malaysia is setting a clear course towards a more efficient, liquid, and inclusive financial future. This bold step promises not only to modernize existing systems but also to create entirely new avenues for economic growth and innovation. The world will be watching as Malaysia transforms its financial landscape, one tokenized asset at a time. Frequently Asked Questions (FAQs) Q1: What is asset tokenization? A1: Asset tokenization is the process of converting real-world assets (like property, art, or commodities) into digital tokens on a blockchain. These tokens represent ownership or fractional ownership of the underlying asset, making them easier to manage and trade. Q2: How does Malaysia’s roadmap for asset tokenization differ from cryptocurrencies? A2: Bank Negara Malaysia’s roadmap specifically focuses on real-world assets (RWA) and their tokenization, aiming for practical financial applications and stability. It explicitly distinguishes these efforts from speculative cryptocurrencies, which are often volatile and not backed by tangible assets. Q3: Which sectors will benefit most from this initiative? A3: Key sectors include Small and Medium-sized Enterprises (SMEs) through improved supply chain finance, financial institutions for enhanced liquidity management, and the Islamic finance sector for new Sharia-compliant solutions. Q4: What is the Digital Asset Innovation Hub? A4: The Digital Asset Innovation Hub is an initiative by Bank Negara Malaysia to conduct proof-of-concept (PoC) projects and live pilot tests for asset tokenization, driving innovation in digital assets within a controlled environment. Q5: What are the primary goals of BNM’s three-year roadmap? A5: The roadmap aims to enhance financial efficiency, improve liquidity, reduce costs, and foster the development of innovative, Sharia-compliant financial products through the secure and regulated use of asset tokenization for real-world assets. Did you find this insight into Malaysia’s groundbreaking asset tokenization roadmap valuable? Share this article with your network and join the conversation about the future of finance! Your insights can help spread awareness about this transformative development. To learn more about the latest asset tokenization trends, explore our article on key developments shaping real-world assets institutional adoption . This post Asset Tokenization: Malaysia Unveils Transformative 3-Year Roadmap first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

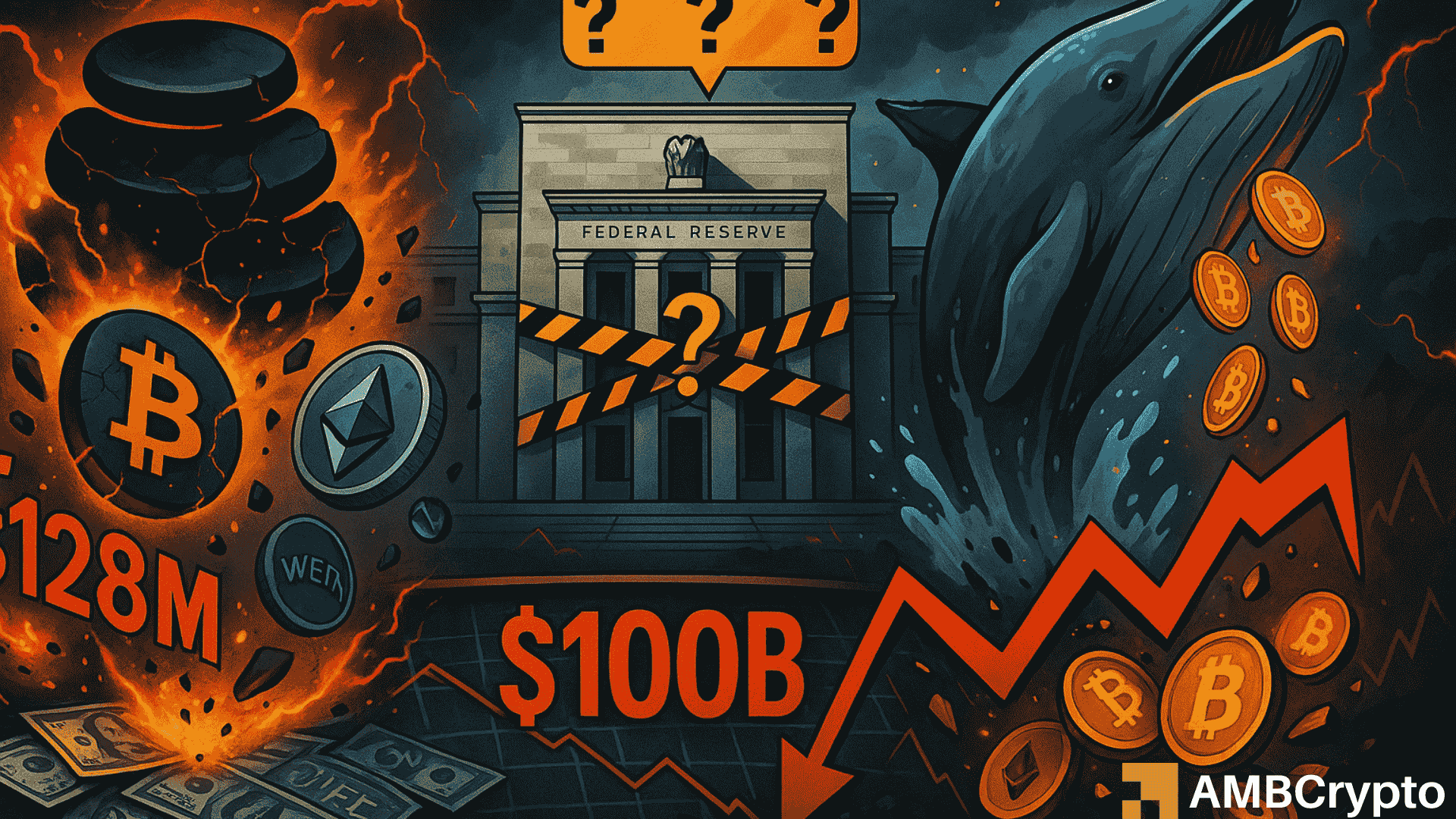

Crypto market plunges $100 billion in 24 hours

Three crisis points hit crypto markets simultaneously on Monday, erasing $100 billion in 24 hours. A DeFi exploit, Federal Reserve uncertainty, and aggressive whale selling combined. Bitcoin World

Ethereum Whales Accumulate Amid Rising Open Interest, Signaling Potential Price Surge

Ethereum is showing clear signs of accumulation as open interest rises to $19.9 billion with neutral funding rates, indicating controlled trader positioning. Whale activity has increased, and exchange supplies are Bitcoin World