The discourse around the next wave of Bitcoin adoption won’t be fueled by ideology or belief, but will be driven by pure economic advantage. As the global financial system moves toward higher costs, weaker currencies, and increasing inefficiencies, BTC is emerging as the most compelling alternative because it works more effectively. Economic Pressure Points That Will Accelerate Bitcoin Uptake In the rapidly evolving landscape of digital finance, the narrative surrounding Bitcoin’s future has often been intertwined with fervent ideological conviction. A media company, known as TFTC on X, has highlighted why BTC adoption won’t be driven by ideology, but rather by economics. Related Reading: Bitcoin Now Accepted By 4 Million Businesses, Thanks To Jack Dorsey Every merchant today is focused on handing over 2–3% of every transaction to payment processors and lives under the constant threat of chargebacks. Especially for small businesses, those costs and risks compound fast. However, BTC eliminates all of it with no processing fees, no chargebacks, just instant, final settlement straight into the merchant’s wallet. As Miles, a crypto enthusiast, consistently pointed out, the economic incentives are so overwhelmingly strong that adoption becomes inevitable. Merchants save thousands on fees, and they can pass those savings back to their customers through instant cashback rewards for using BTC. This dynamic creates a self-reinforcing flywheel effect, allowing Merchants to lower their operational costs and increase their profit margins. At the same time, consumers would get tangible rewards and better value for their money by simply using BTC. Both sides will benefit immensely, while the BTC network will grow stronger. When the underlying math is this incredibly favorable, adoption is no longer a philosophical stance, but it’s an economic certainty. The Path To Reclaiming Bullish Momentum While the economic incentives will be responsible for Bitcoin’s next rally, analyst Rekt Capital has revealed a historical demand area, marked in orange, which has played a pivotal role in dictating BTC’s next major trend. The first time price tapped this zone, it produced a sharp +20% rebound before breaking down. After this breakdown, the BTC price moved to lower levels to absorb the remaining buy-side liquidity. Related Reading: Bitcoin In Bullish Confluence: Death Cross And Key Support Signal Upside Once BTC reclaimed the orange region as support, it triggered a +37% rally to new all-time highs. On the second retest, this same support zone showed signs of strength. Currently, BTC is finding support at this same historical demand area. What would happen next will be critical in determining whether this demand area will continue to strengthen or if signs of weakening will finally emerge. Furthermore, BTC will need to break the multi-week downtrend, marked in black on the chart, to relieve fear of fading support. A rebound from this demand area that fails to break the multi-week downtrend would only result in a yield of +10% move, which suggests that the support zone may be weakening. Featured image from Getty Images, chart from Tradingview.com

NewsBTC

You can visit the page to read the article.

Source: NewsBTC

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Four Nations Buy Bitcoin as a Billion-Dollar Whale Awakens: What Happens Next?

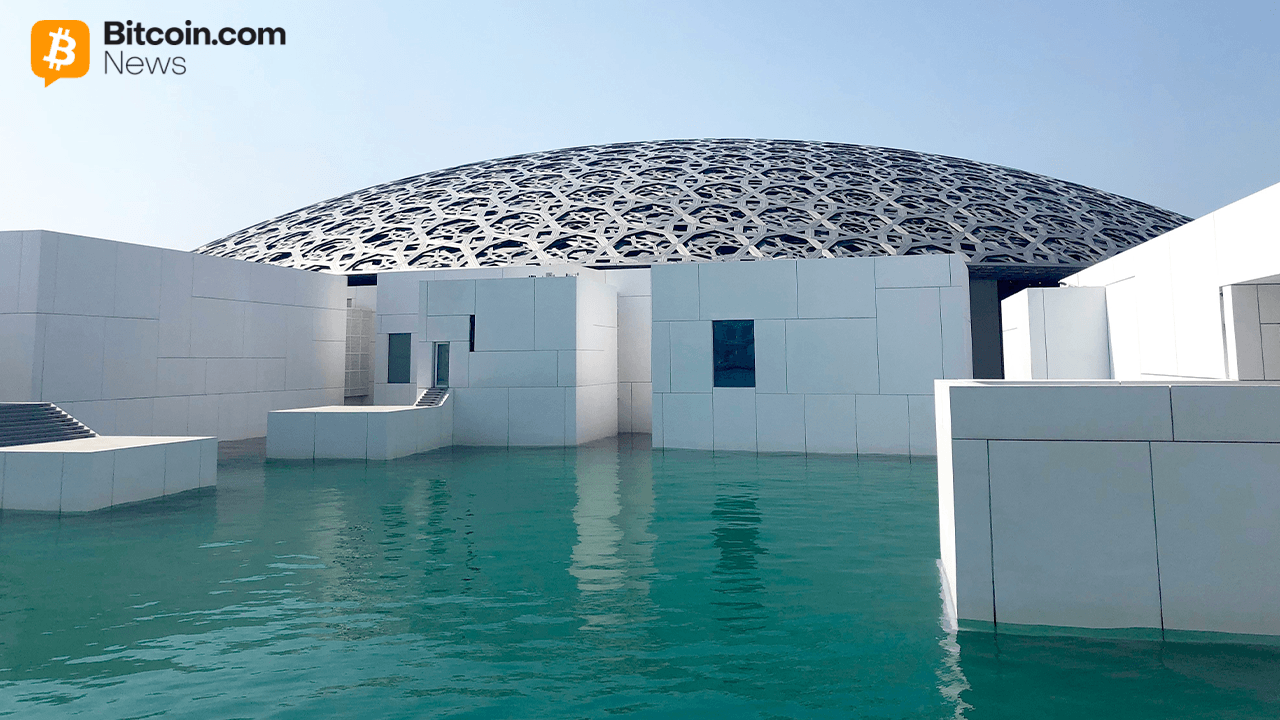

Bitcoin is drawing fresh attention from governments, whale wallets and chart analysts at the same time. This update links new state-level exposure, a billion-dollar on-chain transfer and a fragile bounce into one picture of where the market stands. Four Governments Confirm New Channels for Holding Bitcoin Four governments have recently disclosed Bitcoin exposure through mining programs, direct purchases, ETFs and test portfolios. The United Arab Emirates, El Salvador, Luxembourg and the Czech Republic now all appear in public records as nation states with some form of BTC on their books. Four Nations Add Bitcoin Exposure. Source: The Bitcoin Historian In the UAE, blockchain analysts traced several thousand BTC to wallets tied to a government-backed mining operation. The coins come from mined rewards rather than exchange buys, yet the holdings still sit under state control and now show up in on-chain data. El Salvador continues to add Bitcoin directly to its national stash. Officials have announced new acquisitions worth around $100 million in recent weeks, extending a policy of buying BTC during market pullbacks and holding it as part of the country’s long-term strategy. Luxembourg is using a fund structure instead of spot coins. Its Intergenerational Sovereign Wealth Fund plans to place a small share of assets into Bitcoin exchange-traded funds and related products, giving the state price exposure while custodians handle the underlying assets. The Czech Republic has taken a more experimental route. The Czech National Bank built a $1 million test portfolio that includes Bitcoin, a U.S. dollar stablecoin and a tokenized deposit. Officials say the basket sits outside formal foreign-exchange reserves and serves mainly as a research tool, yet it still marks disclosed central-bank exposure to BTC. While governments adjust their policies, large holders on-chain are also on the move. Whale Address Receives 10,145 BTC From BitMEX Cold Wallet Meanwhile, on-chain data show a whale address has received 10,145 BTC, valued near $1 billion at recent prices. A portfolio view for address 3JBM969wvpxEnfYLQ3LYayB3DVk52ZZpGq records a single inflow of 10.145K BTC from a BitMEX cold wallet roughly five hours ago, placing the full stack under that wallet’s control. Satoshi Era Whale 10,145 BTC Move. Source: 0xNobler As a result, traders are already debating whether the move signals long-term accumulation or simple internal rebalancing. The transfer has also revived speculation about whether a “Satoshi-era” holder is positioning for a market bottom, even though the transaction alone does not reveal the whale’s strategy. Analyst Says Bitcoin Bounce Shows Early Stabilization but Volatility Remains Elevated Bitcoin’s rebound h as offered the first signs of stabilization, even as volatility stays elevated, according to analyst Michaël van de Poppe. He noted that the recent drop left markets “overextended to the downside,” and the latest bounce reflects early attempts to find footing in a key support zone. Bitcoin Support Zone Analysis. Source: CryptoMichNL At the same time, he cautioned that reversals rarely happen quickly. Poppe expects Bitcoin to move sideways for a period as the market builds a new base following the sharp decline. The chart shows liquidity already cleared below recent lows, leaving room for consolidation before any sustained upward move can begin. He added that the current price region remains attractive for long-term positioning, emphasizing that accumulation in this zone could prove beneficial over the coming years. NewsBTC

Trump Eyes Executive Order to Rein In Patchwork State AI Policies

The White House is pushing for a federal framework as Hill Republicans explore attaching a moratorium to the defense bill. NewsBTC