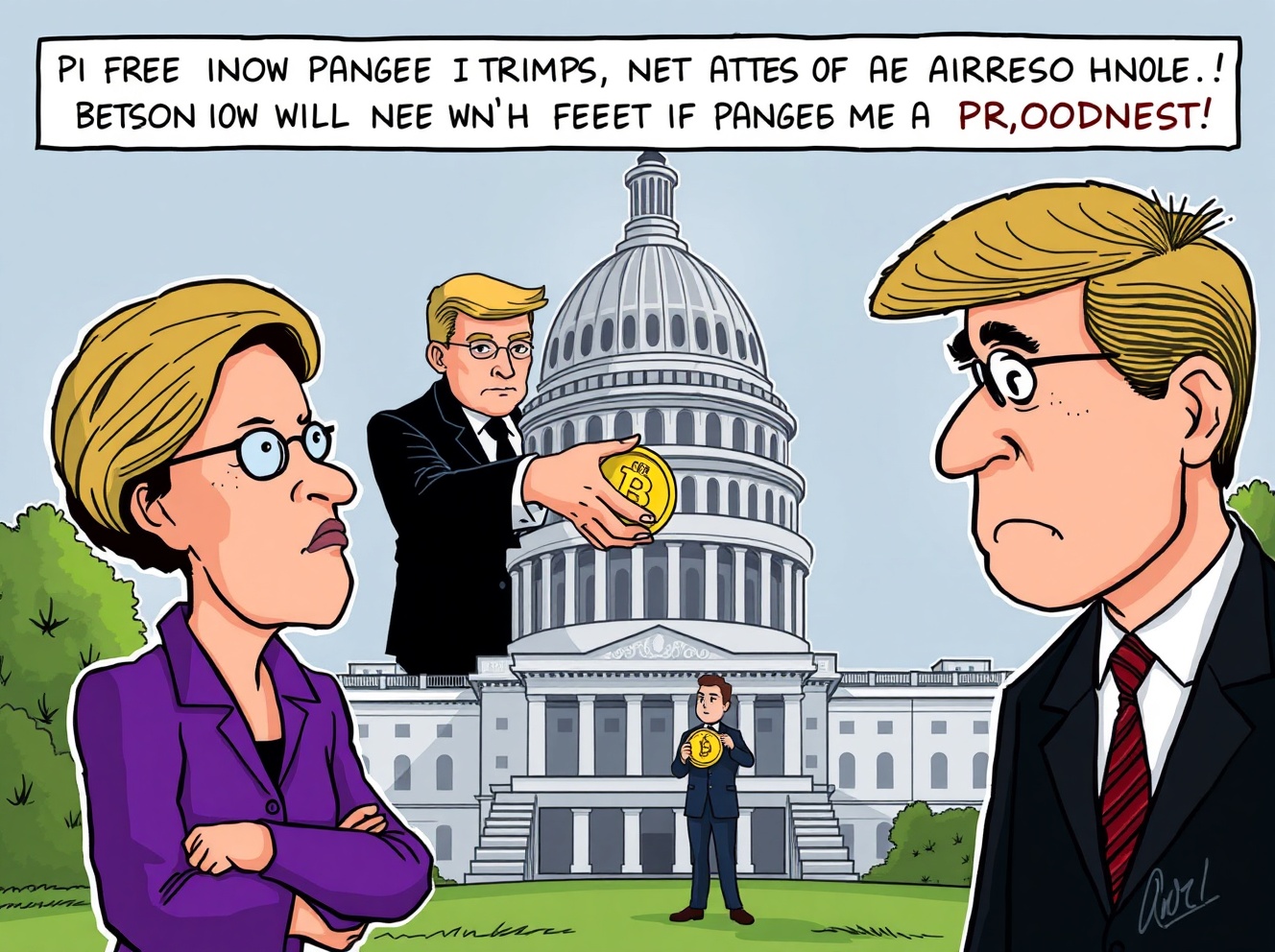

BitcoinWorld Controversial Binance Founder Pardon Sparks Urgent Senate Condemnation The cryptocurrency world is buzzing with urgent news as U.S. Senator Elizabeth Warren , a vocal critic of digital assets, prepares to introduce a Senate resolution this week. This measure specifically aims to condemn former President Donald Trump’s controversial pardon of Binance founder Changpeng Zhao , widely known as CZ. This pivotal moment underscores the escalating political scrutiny surrounding the crypto industry, particularly after the high-profile Binance founder pardon . It’s a development that demands attention from anyone invested in the future of digital finance. Why the Binance Founder Pardon is Igniting Political Fury The planned resolution, first reported by Decrypt, isn’t just a solo act. Senator Warren has garnered support from fellow Democrat Senator Adam Schiff , who, interestingly, has shown support for digital assets and was instrumental in the passage of the Genius stablecoin bill. Their joint letter to Senate colleagues today paints a stark picture: they allege Trump’s decision to issue the Binance founder pardon was the culmination of months of “deepening business ties” between Zhao and the Trump family. This bipartisan effort highlights a shared concern across the political spectrum regarding the perceived influence of financial interests on executive actions. The Senators are urging Congress to take decisive action to prevent what they describe as “blatant corruption by public officials,” including those within the presidential family. This bold move brings the ethics of executive clemency directly into the spotlight, especially when it involves a prominent figure from the often-controversial crypto space. Allegations of Corruption: A Closer Look at the Binance Founder Pardon At the heart of the controversy are the serious allegations of impropriety. Warren and Schiff’s letter suggests that the timing and nature of the Binance founder pardon are suspicious, hinting at a quid pro quo scenario. While specific details of the alleged business ties remain under wraps, the senators’ public statements have already set the stage for a contentious debate. However, it’s crucial to acknowledge the political realities. Despite the strong condemnation from these influential senators, the report notes that the resolution faces an uphill battle. With a Republican-led Senate, the chances of the measure successfully passing are slim. This dynamic underscores the deeply partisan nature of U.S. politics and how it often influences legislative outcomes, even on issues with bipartisan concern. The resolution, nevertheless, serves as a powerful statement, forcing a conversation about accountability and transparency. Crypto Regulation in the Crosshairs: The Broader Implications This development is more than just a political skirmish; it carries significant implications for the future of cryptocurrency regulation. Senator Warren has consistently advocated for stricter oversight of the crypto industry, often expressing concerns about its potential for illicit activities and market instability. The Binance founder pardon , in her view, likely exacerbates these concerns, providing further ammunition for her regulatory push. Increased Scrutiny: The incident will undoubtedly lead to heightened scrutiny of crypto executives and their interactions with political figures. Regulatory Pressure: It could fuel calls for more robust regulatory frameworks, potentially impacting how crypto businesses operate in the U.S. Political Weaponization: The pardon becomes a political tool, used to highlight perceived flaws in the system and push for legislative change. Conversely, Senator Schiff’s involvement adds an interesting layer of complexity. As a supporter of digital assets, his alignment with Warren on this specific issue suggests that even pro-crypto lawmakers are wary of actions that could undermine the industry’s credibility through perceived corruption. This unified front, albeit unlikely to pass legislation immediately, signals a growing consensus that the crypto space needs to operate with the highest standards of ethics. What Does This Mean for the Future of Crypto and Executive Power? The debate surrounding the Binance founder pardon raises fundamental questions about the extent of presidential pardoning power and its potential for abuse. If allegations of “deepening business ties” are substantiated, it could set a dangerous precedent, blurring the lines between executive clemency and political favors. For the crypto industry, this means an intensified focus on corporate governance and transparency. Moving forward, the industry must prepare for an environment of increased vigilance from lawmakers. While the resolution itself might not pass, the public discourse it generates will shape perceptions and potentially influence future legislative efforts. The challenge for crypto advocates will be to demonstrate the industry’s commitment to ethical practices and robust compliance, countering narratives of corruption and illicit activity. This ongoing political drama serves as a potent reminder that the crypto world is deeply intertwined with the broader political and regulatory landscape. A Compelling Summary of the Binance Founder Pardon Controversy In conclusion, Senator Warren’s upcoming resolution condemning the Binance founder pardon is a significant political maneuver that transcends mere partisan bickering. It spotlights serious allegations of corruption and challenges the ethical boundaries of executive power. While its immediate legislative success is uncertain, the resolution undeniably elevates the conversation around crypto regulation, transparency, and accountability within both the digital asset space and the highest echelons of government. This unfolding saga underscores the urgent need for clarity and integrity as cryptocurrency continues to integrate into the global financial system. Frequently Asked Questions (FAQs) Q1: Who is Changpeng Zhao (CZ) ? A1: Changpeng Zhao , often known as CZ, is the founder and former CEO of Binance , one of the world’s largest cryptocurrency exchanges. He recently faced legal issues in the U.S. related to money laundering compliance. Q2: Why was Changpeng Zhao pardoned? A2: The article states that former President Donald Trump announced a pardon for Zhao . Senators Warren and Schiff allege this decision was a result of “deepening business ties” between Zhao and the Trump family, which they describe as “blatant corruption.” Q3: What is Senator Elizabeth Warren’s stance on cryptocurrency? A3: Senator Elizabeth Warren is a well-known opponent of cryptocurrency, frequently advocating for stricter regulation and expressing concerns about its potential for illicit activities and market instability. Q4: What is the significance of Senator Adam Schiff’s support for the resolution? A4: Senator Adam Schiff’s support is significant because he is a Democratic lawmaker who generally supports digital assets. His alignment with Senator Warren on condemning the Binance founder pardon suggests a bipartisan concern over perceived corruption, even among those favorable to crypto. Q5: Is the resolution condemning the pardon likely to pass in Congress ? A5: The report notes that the resolution is unlikely to pass in the Republican-led Senate, despite the bipartisan support it has received from Senators Warren and Schiff . This highlights the political challenges of legislative action in a divided Congress . Q6: How does this Binance founder pardon affect the broader crypto industry ? A6: The pardon and the subsequent resolution are expected to intensify scrutiny on crypto executives and their political interactions. It could fuel calls for more robust regulatory frameworks and underscore the industry’s need for greater transparency and ethical practices to counter narratives of corruption. Share your thoughts on this unfolding political drama and its implications for the crypto world. Engage with us and spread the word by sharing this article on your social media platforms! To learn more about the latest Binance founder pardon trends, explore our article on key developments shaping cryptocurrency regulation institutional adoption . This post Controversial Binance Founder Pardon Sparks Urgent Senate Condemnation first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Crypto Analyst Shows The Possibility Of The Ethereum Price Reaching $16,000

Ethereum’s bullish momentum has intensified throughout the weekend, with the price climbing above $4,100. This steady recovery follows a strong rebound from the $3,500 region after a crash earlier in the month. Investor sentiment, as shown by trading volume and flows on exchanges, has turned optimistic amidst the recovery. Now that Ethereum’s price action is starting to turn bullish again, a new technical analysis shared by crypto analyst Freedomby40 on the social media platform X suggests that the current rally could be far from over, projecting a possible long-term climb to $16,000. Wave Count Structure Points To A Continuation Phase Freedomby40’s analysis, which is based on the Elliott Wave structure, presents Ethereum as currently positioned in an extended bullish sequence that began forming in late 2022. Posting the technical analysis on X, the analyst noted that Ethereum’s price action looks great for a continuation. Related Reading: Here’s What Happens To The Ethereum Price If Bullish Momentum Holds His chart shows that the asset has just completed a corrective phase and is entering a renewed impulse wave, with support established between $3,225 and $3,563 at the 0.5 and 0.382 Fibonacci retracement zones, respectively. The analyst labels this zone as the ideal accumulation area for the next leg up, consistent with previous cycle structures seen in 2017 and 2021. The Elliott Wave projection in his analysis presents a multi-layered confluence of impulse waves extending to the third degree. It illustrates that Ethereum is currently unfolding its fifth major impulse wave in a structure that traces back to mid-2022. The internal structure of this wave sequence also reveals a C wave in motion, which itself contains smaller sub-impulse waves. Within that C wave, Ethereum appears to be entering its own fifth sub-wave, which is known to be a decisively bullish wave. Based on this setup, the analyst outlined two potential target zones on the chart: a green box representing the realistic price range for this wave cycle and a red box depicting the higher, more extended scenario that could push Ethereum’s market cap into the trillion-dollar level. Fibonacci Extensions Predict Targets Of $9,000, $11,000, And $16,000 Freedomby40’s analysis identifies multiple price levels based on Fibonacci extensions from the current price action. The first price target is at $6,303, which is based on the 1.0 Fibonacci extension. This initial price target will see the Ethereum price break above its current all-time high, but this is the first of many. Related Reading: Institutions Exit Bitcoin In Large Tranches, Ethereum, Solana And XRP See Massive Buy-Ins The next target, the 1.236 extension, is positioned around $9,013. These two price targets ($6,303 and $9,013) were described by the analyst as very realistic. Possible extensions are at the 1.382 and 1.618 Fibonacci extension levels, corresponding to $11,210 and $16,077, respectively. At the time of writing, Ethereum is trading at $4,160, up by 5.2% in the past 24 hours. Freedomby40’s outlook joins a growing list of ultra-bullish Ethereum price forecasts from institutional research desks and top analysts. Standard Chartered Bank recently raised its 2025 price target for Ethereum to $7,500, while projecting a potential long-term path to $25,000 by 2028. Featured image from iStock, chart from Tradingview.com Bitcoin World

CLANKER Perpetual Futures: Unleash Exciting New Trading Opportunities on Coinbase

BitcoinWorld CLANKER Perpetual Futures: Unleash Exciting New Trading Opportunities on Coinbase The cryptocurrency world is buzzing with a significant announcement: Coinbase is set to list CLANKER perpetual futures . This move marks a pivotal moment for traders and the broader digital asset market, introducing a new derivative product on one of the most prominent exchanges. For anyone interested in expanding their trading horizons, understanding the implications of CLANKER perpetual futures is essential. What are CLANKER Perpetual Futures? Perpetual futures contracts are a type of derivative that allows traders to speculate on the future price of an asset without an expiry date. Unlike traditional futures, they do not expire, providing continuous trading opportunities. The listing of CLANKER perpetual futures on Coinbase means that traders will soon be able to take long or short positions on the CLANKER token, leveraging their capital to potentially amplify returns. This type of instrument is popular in crypto markets due to its flexibility and the ability to maintain positions indefinitely, as long as margin requirements are met. It offers a powerful tool for both hedging existing spot positions and speculating on price movements. Why is Coinbase Listing CLANKER Perpetual Futures a Game Changer? Coinbase’s decision to add CLANKER perpetual futures is a testament to the growing maturity and demand for sophisticated trading products in the crypto space. Here’s why this is a big deal: Increased Accessibility: Coinbase is a household name in crypto, making these futures accessible to a wider audience, including institutional investors and experienced retail traders. Enhanced Liquidity: Listings on major exchanges often lead to increased liquidity for the underlying asset, benefiting all participants. Market Validation: The inclusion of CLANKER on such a platform signals confidence in the project and its potential, potentially attracting more interest and investment. Diversification of Trading Strategies: Traders can now employ more complex strategies, such as arbitrage between spot and futures markets, or use futures for risk management. The introduction of CLANKER perpetual futures will undoubtedly reshape how many traders approach their portfolios, offering new avenues for profit generation and risk mitigation. Navigating the Opportunities and Risks of CLANKER Perpetual Futures While the prospect of trading CLANKER perpetual futures is exciting, it’s crucial to approach it with a clear understanding of both the opportunities and inherent risks. Derivatives trading, especially with leverage, can lead to substantial gains but also significant losses. Key Opportunities: Profit from Volatility: CLANKER, like many cryptocurrencies, can experience rapid price swings. Perpetual futures allow traders to capitalize on these movements, regardless of whether the market is going up or down. Leverage: Traders can open positions much larger than their initial capital, magnifying potential returns. However, this also amplifies losses. Hedging: Holders of CLANKER spot tokens can use perpetual futures to hedge against potential price drops, protecting their portfolio value. Important Risks to Consider: Liquidation Risk: Due to leverage, if the market moves against your position, your collateral can be liquidated quickly, resulting in total loss of your margin. Funding Rates: Perpetual futures contracts employ a funding rate mechanism to keep the futures price tethered to the spot price. These rates can either pay you or cost you, impacting your profitability over time. Market Volatility: While an opportunity, high volatility also means higher risk. Sudden price changes can trigger liquidations. It is always advisable to start with a small amount, understand the mechanics, and use risk management tools like stop-loss orders when trading CLANKER perpetual futures . What Does This Mean for the Crypto Market? The listing of CLANKER perpetual futures on a platform like Coinbase contributes to the ongoing institutionalization of the crypto market. As more sophisticated financial products become available, the market gains credibility and attracts a broader range of participants. This trend could lead to increased market efficiency and deeper liquidity across various digital assets. Moreover, it highlights the continuous innovation within the decentralized finance (DeFi) and broader crypto ecosystem. Projects like CLANKER gaining perpetual futures listings underscore their growing relevance and the demand for advanced trading tools around them. The future of crypto trading is evolving rapidly, and Coinbase’s embrace of CLANKER perpetual futures is a clear indicator of this dynamic shift. Traders should stay informed and educate themselves thoroughly before engaging in these advanced instruments. To learn more about the latest crypto market trends, explore our article on key developments shaping the digital asset space and institutional adoption. Frequently Asked Questions (FAQs) Q1: What are CLANKER perpetual futures? A1: CLANKER perpetual futures are derivative contracts that allow traders to speculate on the price of the CLANKER token without an expiration date. They enable users to take long or short positions with leverage, aiming to profit from price movements. Q2: When will Coinbase list CLANKER perpetual futures? A2: While Coinbase has announced its intention, specific listing dates for new products like CLANKER perpetual futures are usually communicated closer to the launch. Traders should monitor Coinbase’s official announcements for precise timing. Q3: Is trading CLANKER perpetual futures risky? A3: Yes, trading CLANKER perpetual futures , especially with leverage, carries significant risks, including the potential for rapid liquidation and substantial financial loss. It is crucial to understand these risks and employ robust risk management strategies. Q4: How do perpetual futures differ from traditional futures? A4: The primary difference is the absence of an expiry date. Traditional futures have a set settlement date, whereas perpetual futures can be held indefinitely as long as margin requirements are met. They also use a funding rate mechanism to keep their price close to the spot price. Q5: Will CLANKER perpetual futures be available to all Coinbase users? A5: Availability of derivatives products like CLANKER perpetual futures can vary by jurisdiction due to regulatory restrictions. Users should check Coinbase’s support pages or their local regulations to confirm eligibility. Q6: Where can I learn more about CLANKER? A6: To understand the underlying asset better, you can visit the official CLANKER project website (hypothetical link) or resources like Wikipedia’s cryptocurrency page for general context on digital assets. If you found this article insightful, please consider sharing it with your network! Help us spread awareness about the exciting developments in the crypto market by sharing on Twitter , LinkedIn , or other social media platforms. This post CLANKER Perpetual Futures: Unleash Exciting New Trading Opportunities on Coinbase first appeared on BitcoinWorld . Bitcoin World