According to a CryptoQuant analysis, Bitcoin has entered its most bearish phase since the current bull market began two years ago. For context, Bitcoin (BTC) continues to slide, pulling the broader crypto market down with it. Visit Website

The Crypto Basic

You can visit the page to read the article.

Source: The Crypto Basic

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Revolutionary Crypto Funds: 6 Major Japanese Asset Managers Embrace Digital Assets

BitcoinWorld Revolutionary Crypto Funds: 6 Major Japanese Asset Managers Embrace Digital Assets Imagine waking up to news that six of Japan’s largest asset management firms are actively exploring crypto funds. This isn’t speculation – it’s happening right now as Japan’s financial landscape undergoes a dramatic transformation that could reshape how institutional investors approach digital assets worldwide. Why Are Japanese Asset Managers Embracing Crypto Funds Now? The timing couldn’t be more significant. Japan’s Financial Services Agency is currently reviewing a proposal that would allow the establishment of cryptocurrency investment trusts. This regulatory shift has triggered unprecedented interest from major players including: Mitsubishi UFJ Asset Management Nomura Asset Management SBI Global Asset Management Daiwa Asset Management Asset Management One Amundi Japan These institutions represent trillions in managed assets, making their move into crypto funds a watershed moment for the entire digital asset ecosystem. What Makes Crypto Funds So Attractive to Institutional Investors? Traditional asset managers see crypto funds as the next frontier in portfolio diversification. Unlike individual cryptocurrency purchases, these structured crypto funds offer: Professional management by experienced financial experts Regulatory compliance within established frameworks Risk mitigation through diversified crypto exposure Accessibility for mainstream investors The potential for crypto funds to bridge traditional finance with digital assets represents a monumental shift in investment strategy. How Will Crypto Funds Transform Japan’s Investment Landscape? Japan has always been a crypto-forward nation, but the entry of these asset management giants signals a new era. The development of regulated crypto funds could: Increase institutional adoption of digital assets Provide safer entry points for retail investors Establish Japan as a global crypto hub Set new standards for crypto fund management This move positions Japan at the forefront of the institutional crypto revolution, potentially influencing global financial markets. What Challenges Do Crypto Funds Face in Japan? Despite the excitement, implementing successful crypto funds requires navigating several hurdles. Regulatory compliance remains paramount, with the FSA carefully considering investor protection measures. Additionally, these firms must develop: Robust security protocols for digital asset storage Transparent valuation methodologies Comprehensive risk management frameworks Educational resources for potential investors The success of these crypto funds will depend on balancing innovation with responsible financial practices. What Does This Mean for Global Crypto Adoption? When six major Japanese asset managers express interest in crypto funds, the entire world takes notice. This development could accelerate similar initiatives in other developed markets. The creation of regulated crypto funds provides: Legitimacy to the digital asset class Institutional-grade investment vehicles Enhanced market liquidity Improved price discovery mechanisms The Japanese approach to crypto funds might become the blueprint for other nations considering similar financial products. Conclusion: The Future of Crypto Funds in Japan The interest from Japan’s asset management elite in crypto funds marks a pivotal moment in financial history. As regulatory barriers lower and institutional confidence grows, these crypto funds could unlock trillions in capital for the digital asset space. The combination of Japan’s technological sophistication and financial expertise positions these crypto funds for potential global leadership in the evolving cryptocurrency investment landscape. Frequently Asked Questions Which Japanese companies are interested in crypto funds? Six major asset managers have shown interest: Mitsubishi UFJ Asset Management, Nomura Asset Management, SBI Global Asset Management, Daiwa Asset Management, Asset Management One, and Amundi Japan. What are crypto funds? Crypto funds are professionally managed investment vehicles that provide exposure to cryptocurrencies and digital assets through regulated financial structures, similar to traditional mutual funds or ETFs. Why is Japan allowing crypto funds now? Japan’s Financial Services Agency recognizes the growing demand for regulated digital asset investment options and aims to provide safe, compliant avenues for both institutional and retail investors. When will these crypto funds launch? While no specific timeline has been announced, the regulatory proposal is under active consideration, suggesting potential launches could occur within the next 12-18 months. Are crypto funds safe for investors? Regulated crypto funds typically offer enhanced security and compliance measures compared to direct cryptocurrency purchases, though all investments carry some level of risk. How can I invest in Japanese crypto funds? Once launched, these crypto funds will likely be available through traditional investment channels, including brokerage accounts and financial advisors, following standard investment procedures. Found this insight into Japan’s crypto funds revolution valuable? Share this article with fellow investors and cryptocurrency enthusiasts on your social media platforms to spread awareness about this groundbreaking development in digital asset management! To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency institutional adoption. This post Revolutionary Crypto Funds: 6 Major Japanese Asset Managers Embrace Digital Assets first appeared on BitcoinWorld . The Crypto Basic

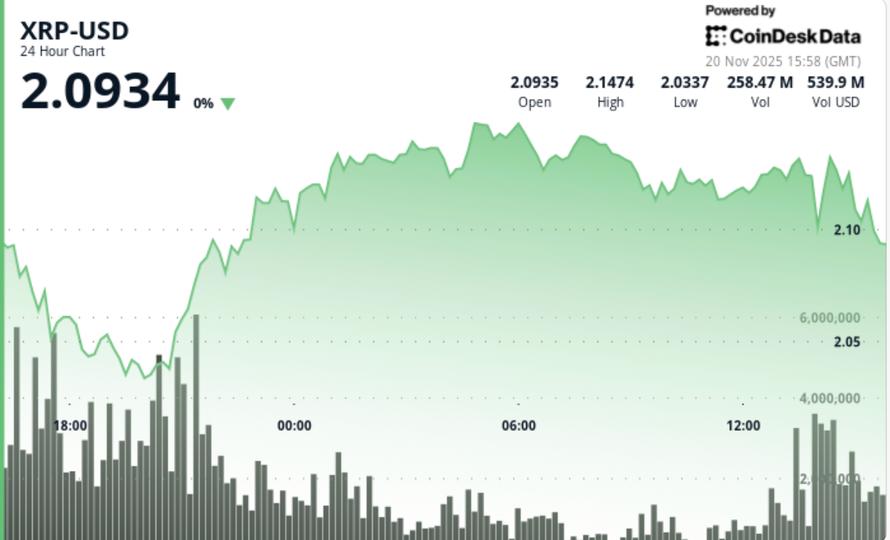

New XRP ETF Launched by Bitwise, Ethereum to Outperform Bitcoin, Ripple CEO Reveals New Use Cases for XRPL — Crypto News Digest

Crypto market today: Bitwise XRP ETF to be launched on Nov. 20; Ethereum rally is likely incoming; Ripple sparks new debate. The Crypto Basic