Dogecoin price prediction for 2025 points to a potential decline below $0.10, driven by a prolonged descending channel and fading buyer interest. Analysts like Ali Martinez highlight trapped sell supply

CoinOtag

You can visit the page to read the article.

Source: CoinOtag

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

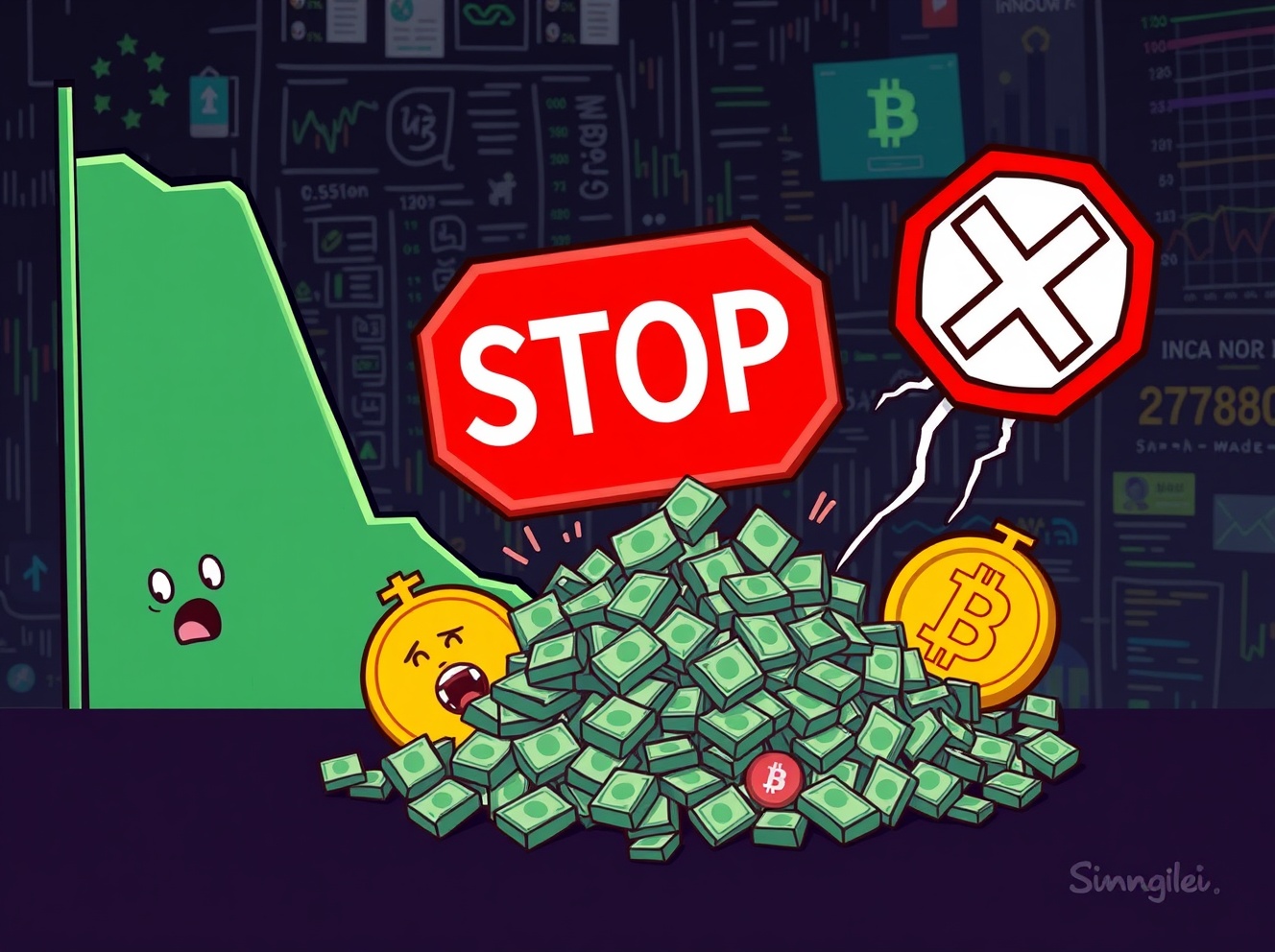

Crypto Futures Liquidation: Massive $470 Million Wipeout Shakes Markets

BitcoinWorld Crypto Futures Liquidation: Massive $470 Million Wipeout Shakes Markets The crypto market just witnessed a dramatic event: a staggering $470 million worth of crypto futures liquidation occurred in a single hour. This sudden wipeout is part of an even larger trend, with over $1.75 billion in futures positions liquidated across major exchanges in the past 24 hours. For many traders, this represents a significant financial blow and a stark reminder of the inherent volatility in the digital asset space. What does this mean for your trading strategy? What Exactly is a Crypto Futures Liquidation? When we talk about crypto futures liquidation , it might sound like complex financial jargon, but let’s break it down simply. Futures contracts allow traders to bet on the future price of an asset without owning the asset itself. Many traders use leverage, borrowing funds to amplify their potential gains. However, leverage also magnifies losses. If the market moves against a leveraged position, and the trader’s margin (the collateral they put up) falls below a certain level, the exchange automatically closes their position to prevent further losses. This forced closure is what we call a liquidation. It’s a crucial mechanism to protect both traders and exchanges from excessive debt. Futures Contracts: Agreements to buy or sell an asset at a predetermined price on a future date. Leverage: Using borrowed capital to increase potential returns. Margin: The collateral required to open and maintain a leveraged position. Liquidation: The automatic closure of a leveraged position by an exchange when a trader’s margin can no longer cover potential losses. Why Do Massive Crypto Futures Liquidations Occur So Suddenly? The recent surge in crypto futures liquidation events, like the $470 million hourly figure, often stems from rapid price movements. Cryptocurrencies are known for their extreme volatility. A sudden drop or pump in price can trigger a chain reaction. For instance, if Bitcoin’s price sharply declines, it can push many leveraged long positions (bets that the price will go up) into liquidation. As these positions are closed, it can add selling pressure, further driving down prices and triggering more liquidations in a cascading effect. This is particularly true during periods of high market uncertainty or significant news. Several factors contribute to these sudden, large-scale liquidations: Market Volatility: Unpredictable and swift price swings. High Leverage: Many traders use substantial leverage, making their positions highly sensitive to price changes. Cascading Effects: One liquidation can trigger others, creating a domino effect. Stop-Loss Hunting: Large market players can sometimes manipulate prices to trigger clusters of stop-loss orders and liquidations. Navigating Volatile Waters: How Can Traders Protect Against Crypto Futures Liquidation? Given the inherent risks, how can traders better protect themselves from sudden crypto futures liquidation ? Effective risk management is paramount. Understanding your exposure and setting clear boundaries can make a significant difference. Here are some actionable insights: Manage Leverage Wisely: Avoid excessive leverage. While it can amplify gains, it dramatically increases liquidation risk. Use Stop-Loss Orders: These automatically close your position if the price hits a predetermined level, limiting potential losses. Monitor Market Conditions: Stay informed about market news, sentiment, and technical indicators. Diversify: Don’t put all your capital into a single leveraged position. Maintain Sufficient Margin: Ensure you have enough collateral to withstand minor price fluctuations without being liquidated. By adopting these strategies, traders can significantly reduce their vulnerability to the unpredictable nature of the crypto market and the threat of a swift crypto futures liquidation . The Broader Impact of Recent Crypto Futures Liquidation Events Beyond the individual trader, massive crypto futures liquidation events have broader implications for the entire crypto ecosystem. Such significant liquidations can signal a period of heightened fear or uncertainty in the market. They can also temporarily depress prices as forced selling occurs, affecting spot markets as well. While these events are a normal, albeit dramatic, part of leveraged trading, their scale underscores the need for caution and robust risk management practices across the board. The $470 million liquidation in one hour and the $1.75 billion over 24 hours are not just numbers; they represent substantial capital shifts and market sentiment. These figures serve as a powerful reminder for both novice and experienced traders to approach leveraged trading with extreme care and a deep understanding of the potential pitfalls. The market is constantly evolving, and being prepared for such rapid shifts is crucial for long-term success. In conclusion, the recent $470 million crypto futures liquidation within an hour, alongside a massive $1.75 billion over 24 hours, highlights the dynamic and often brutal nature of leveraged cryptocurrency trading. While futures offer opportunities for significant gains, they come with substantial risks, primarily the threat of liquidation. Understanding what triggers these events and implementing robust risk management strategies are not just recommendations; they are necessities for anyone participating in this high-stakes environment. Stay informed, trade responsibly, and prioritize capital preservation. Frequently Asked Questions (FAQs) What is crypto futures liquidation? Crypto futures liquidation is the forced closure of a trader’s leveraged position by an exchange when their margin collateral can no longer cover potential losses due to adverse price movements. Why did $470 million in crypto futures get liquidated in one hour? Such a large liquidation typically occurs due to rapid and significant price movements in the underlying cryptocurrency, triggering stop-loss orders and margin calls across numerous highly leveraged positions simultaneously. How can I avoid crypto futures liquidation? You can reduce the risk of liquidation by using less leverage, setting effective stop-loss orders, maintaining sufficient margin, and continuously monitoring market conditions. Does crypto futures liquidation affect the spot market? Yes, large-scale liquidations can indirectly affect the spot market by increasing selling pressure, which can lead to temporary price declines as positions are forcefully closed. Is futures trading safe in crypto? Futures trading in crypto carries significant risk, especially with high leverage, due to market volatility. It is not inherently “safe” and requires extensive knowledge, experience, and strict risk management. Was this article helpful in understanding the recent crypto futures liquidation events? Share your thoughts and insights with your network! Help others navigate the complexities of crypto trading by sharing this article on your social media platforms. To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency price action. This post Crypto Futures Liquidation: Massive $470 Million Wipeout Shakes Markets first appeared on BitcoinWorld . CoinOtag

Big Bull Arthur Hayes Predicts How High Bitcoin Prices Could Go – “If US Politicians Want to Get Re-elected…”

Arthur Hayes, one of the well-known names in the cryptocurrency market, predicted that the Bitcoin price will reach $1 million by 2028. Hayes, co-founder of BitMEX, shared this prediction during his speech at the SALT Conference in London. “Bitcoin will be over $1 million and Ethereum will be $20,000,” Hayes said, adding that he expects a major peak in the crypto market before the next US presidential election in 2028. Hayes` comments came just hours after Bitcoin`s price fell below $100,000 for the first time since May. Bitcoin is currently trading around $103,000, 19% below its all-time high of $126,000 set in October, while Ethereum is trading at $3,340, 32% below its August all-time high. Related News: Ethereum (ETH) Plummets: Vitalik Buterin`s Wealth Evaporates - Here Are the Losses According to Hayes` analysis, Bitcoin`s rise stems from governments choosing to borrow rather than cut spending. A policy of austerity, meaning raising taxes, is unpopular with voters, so governments are choosing to continue borrowing for the sake of reelection. More debt means an increase in the fiat money supply. In Hayes` words, central banks are “pushing the money button.” Hayes argues that this will result in increased inflation, regardless of official statistics, and that Bitcoin will emerge as a hedge against inflation during this period. “People instinctively understand what’s going on,” Hayes said, “it’s just that everyone is trying to solve the same problem in different ways.” The country`s national debt currently stands at $38 trillion, the highest since the pandemic, according to data from the U.S. Treasury Department. According to Hayes, the likelihood of politicians abandoning the debt is extremely low. “This problem can be solved, but only if you don`t want to be elected,” Hayes said, adding that if governments stop borrowing and raise taxes, we could experience deflation on a scale not seen since the 1930s. *This is not investment advice. Continue Reading: Big Bull Arthur Hayes Predicts How High Bitcoin Prices Could Go – “If US Politicians Want to Get Re-elected…” CoinOtag