BitcoinWorld Essential Upbit 0G Suspension: What Traders Must Know About the Temporary Halt South Korean cryptocurrency exchange Upbit has just announced a crucial Upbit 0G suspension that affects all ZeroGravity traders. This temporary halt in deposits and withdrawals comes as the platform prepares for a significant network upgrade. If you’re holding 0G tokens, understanding this development is essential for managing your digital assets effectively. Why Did Upbit Announce the 0G Suspension? The primary reason behind the Upbit 0G suspension is an upcoming hard fork for the ZeroGravity network. Hard forks represent major protocol changes that require temporary transaction halts. Therefore, Upbit must ensure all systems align with the new network specifications. This precautionary measure protects user funds during the transition period. How Does the Upbit 0G Suspension Impact Traders? The temporary Upbit 0G suspension means traders cannot move their ZeroGravity tokens during the specified period. However, it’s important to note that spot trading typically remains operational. Here’s what you need to know: Deposit and withdrawal functions will be temporarily disabled Existing 0G balances remain secure in your Upbit wallet Trading activities may continue depending on market conditions The suspension period usually lasts until network stability is confirmed What Should You Do During the Upbit 0G Suspension? While the Upbit 0G suspension is in effect, traders should monitor official communications closely. Upbit typically provides regular updates about the resumption timeline. Moreover, this temporary pause offers an opportunity to research the hard fork’s potential impact on 0G’s value proposition. When Will Normal Services Resume After the Upbit 0G Suspension? Exchange officials haven’t specified an exact timeline for lifting the Upbit 0G suspension . Historically, such interruptions last until the network upgrade completes successfully. The exchange will announce resumption through official channels once they verify network stability and security. Why Are Hard Forks Necessary for Cryptocurrencies Like 0G? Hard forks represent crucial evolution points for blockchain networks. The Upbit 0G suspension highlights how exchanges manage these technical transitions. Network upgrades often introduce enhanced features, improved security, or scalability solutions. Consequently, temporary inconveniences lead to long-term benefits for the ecosystem. What Can We Learn From This Upbit 0G Suspension? This Upbit 0G suspension demonstrates the cryptocurrency industry’s maturation. Exchanges now implement proactive measures to ensure user protection during network changes. While temporary, such suspensions reflect the industry’s commitment to security and technological progress. The temporary Upbit 0G suspension serves as a reminder that blockchain technology continues evolving. Though inconvenient for short-term traders, these necessary pauses ensure long-term network health and security. As the cryptocurrency landscape matures, such procedural suspensions become standard practice during significant upgrades. Frequently Asked Questions How long will the Upbit 0G suspension last? The duration varies depending on network upgrade completion. Upbit will announce the exact resumption time through official channels. Can I still trade 0G during the suspension? Spot trading typically continues unless otherwise specified. However, deposit and withdrawal functions remain temporarily disabled. Will my 0G tokens be safe during the suspension? Yes, your tokens remain secure in your Upbit wallet. The suspension primarily affects transaction functions rather than storage security. Why do exchanges suspend services during hard forks? Exchanges pause services to ensure compatibility with new network protocols and prevent potential transaction errors or fund loss. How will I know when services resume? Upbit will make official announcements through their website, social media channels, and app notifications. Should I be worried about the hard fork? Hard forks are routine network upgrades. The temporary suspension demonstrates Upbit’s commitment to user protection during technical transitions. Found this guide helpful? Share it with fellow cryptocurrency enthusiasts on social media to help them navigate the Upbit 0G suspension confidently! To learn more about the latest cryptocurrency exchange trends, explore our article on key developments shaping digital asset trading and institutional adoption. This post Essential Upbit 0G Suspension: What Traders Must Know About the Temporary Halt first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

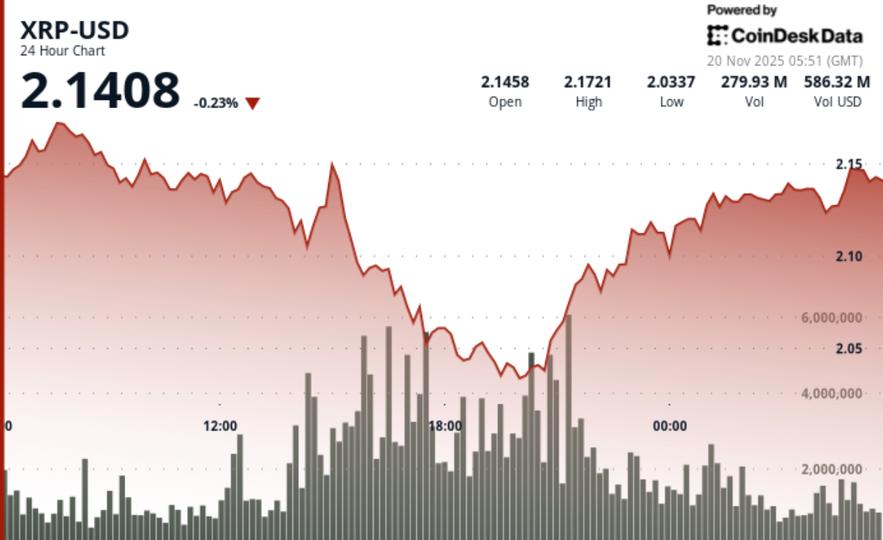

Expert: The Pendulum Has Swung In XRP’s Favour. Here’s Why

XRP spent years facing doubt from traders and analysts. Many expected that institutional interest would remain limited. That expectation is now fading. Xaif (@Xaif_Crypto), a well-known crypto commentator on X, highlighted this change. He shared a recent discussion between Bitwise CIO Matt Hougan and Scott Melker. His post pointed to a clear shift in tone as the industry begins to treat XRP as a serious focus. It’s crazy watching the narrative flip in real-time… They were skeptical of $XRP for YEARS now they`re openly calling the XRP community “huge, committed, and excited The pendulum has swung. The tone shifted from “XRP? Nah” ➜ to “XRP is a priority focus. pic.twitter.com/4QCulzm1W3 — Xaif Crypto | (@Xaif_Crypto) November 16, 2025 A Clear Change From Industry Leaders In the video he shared, Melker dubbed XRP’s base a “huge community that is excited.” Hougan described XRP as “a reasonable project.” He said he is not surprised that recent XRP product launches show strong engagement because there are people who love XRP. The remarks showed how sentiment has moved. Hougan acknowledged that some crypto investors still view XRP with skepticism. However, he stressed that this does not affect the asset’s momentum. He pointed to a huge committed community that continues to drive demand. Xaif used the conversation to show how different the market now sounds compared to previous years. The language has shifted from hesitation to recognition. Institutional Entry Builds Ahead of a Key Launch This moment arrives as Bitwise prepares to launch its XRP ETF between November 19 and 20. The firm plans to enter the market with the lowest fee among competing XRP funds. The pricing is a deliberate move to capture early interest from investors seeking efficient exposure. It also shows Bitwise’s confidence in the asset’s demand profile. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Xaif’s post ties this development into the larger trend. XRP is no longer treated as a fringe product. Major firms are positioning themselves to compete for market share . The timing, combined with rising institutional attention, marks the real change in how XRP fits into the wider investment landscape. Community Support Shapes the Asset’s Momentum Community support remains central to this shift. Both Hougan and Melker acknowledged the active and loyal XRP user base. Their remarks align with what long-time holders have demonstrated through years of market cycles. As Xaif noted, “It’s crazy watching the narrative flip in real-time.’ The community stayed present even during difficult periods. Institutions now see stability as a strategic advantage. Xaif highlighted this point as part of his broader message. The negative sentiment that once surrounded XRP has weakened. The community’s consistency, combined with upcoming institutional products, has increased XRP’s market relevance. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post Expert: The Pendulum Has Swung In XRP’s Favour. Here’s Why appeared first on Times Tabloid . Bitcoin World

XRP Will Soon Break This Resistance and Leave Ethereum Behind

Crypto analyst CryptoBull published a chart-based assessment indicating that XRP is approaching a decisive technical juncture against Ethereum. The analyst’s accompanying chart, which plots the XRP/ETH pair on Binance , highlights a horizontal resistance cluster around the 0.00070–0.00075 level and an upward-sloping support line that has formed since late October. According to the analyst, the pair has broken out of a prior downtrend channel and is now testing that resistance band, which they interpret as the last barrier before a sustained move in XRP’s favor relative to ETH. The image attached to the analyst’s message shows daily candlesticks with the recent price consolidating above the rising trendline while trading near the horizontal ceiling. Volume bars beneath the price action appear to decline during consolidation, and prior trading sessions included a volume spike at the point where the downtrend line intersected the new ascending support. CryptoBull argued that a confirmed close above the horizontal resistance would signal that XRP is beginning to outperform Ethereum on a pair basis, potentially drawing capital away from ETH-denominated holdings. #XRP will soon break this resistance and leave Ethereum behind! https://t.co/27hmY3f5p1 pic.twitter.com/PR1btfASni — CryptoBull (@CryptoBull2020) November 18, 2025 Implications and market context If the breakout materializes as the analyst projects, it means a period in which XRP gains relative strength versus Ethereum , measured directly through the XRP/ETH exchange rate. For traders who use cross-pair analysis to allocate capital, such an outcome could prompt rebalancing decisions in favor of XRP-denominated positions. CryptoBull emphasized the importance of watching daily closes and volume confirmation: the analyst stated that higher trading volumes accompanying a break above resistance would increase the probability that the move is sustained rather than transient. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Market participants should also note that cross-pair dynamics can be influenced by news, macro liquidity conditions, and separate developments affecting either token. While the chart highlights technical structures that support the analyst’s outlook, those structures do not preclude abrupt shifts in sentiment or fundamental events that could alter price relationships between XRP and ETH. Caution and next steps for traders CryptoBull’s assessment frames the current price action as a potential turning point. His opinion is contingent on a clean breakout above the highlighted resistance and a subsequent confirmation through volume and price action. Traders monitoring the pair will likely watch for decisive daily closes above the resistance band and follow-through buying pressure. At the same time, risk management remains essential: failure to clear resistance or a reversal below the rising support would invalidate the bullish technical scenario set forth by the analyst and could reopen the prior range. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post XRP Will Soon Break This Resistance and Leave Ethereum Behind appeared first on Times Tabloid . Bitcoin World