Excitement is sweeping through the XRP community as anticipation builds for a landmark event. The long wait for a U.S. spot XRP ETF appears nearly over . Updated filings and legal signals now point to a specific launch window that could reshape XRP’s market narrative. Prominent crypto analyst Zach Rector has confirmed that the first XRP ETFs are expected to go live by mid-November. In a video shared on his X handle, Rector explained that filings from Canary Capital and Bitwise have officially triggered a 20-day countdown. The countdown started once both firms updated their ETF registration documents with the required legal language, according to Rector. He said these updates confirm that the ETFs are now legally positioned to go live around November 13. The Filings That Started the Countdown Canary Capital filed its amendment on October 24, removing a key “delay clause.” That removal activated the 20-day effectiveness period under Section 8(a) of the Securities Act of 1933. Unless the SEC intervenes, the filing automatically becomes effective after the countdown. XRP ETF Party in November! pic.twitter.com/5raBiWVAZh — Zach Rector (@ZachRector7) November 2, 2025 Bitwise followed on October 31, revising its own spot XRP ETF documentation. The update included the same Section 8(a) provision, signaling the firm’s readiness to proceed. These synchronized filing updates provide the most concrete timeline to date for the potential launch of XRP ETFs. Regulatory Context and Market Readiness The U.S. Securities and Exchange Commission has gradually eased restrictions on digital asset investment products. Its earlier approval of spot Bitcoin ETFs paved the way for other crypto-based funds. Under Section 8(a), a registration statement automatically becomes effective 20 days after filing. This means both Canary Capital and Bitwise could see their ETFs begin trading in mid-November, provided there are no new SEC delays. Analysts believe this is a significant step toward integrating XRP into mainstream investment vehicles. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Why XRP ETFs Matter An approved XRP ETF would represent a breakthrough for institutional access. With an XRP ETF, investors could tap into XRP’s potential through a regulated product, mitigating the risks associated with direct crypto ownership. For the XRP Ledger ecosystem, ETF approval could boost market liquidity and reinforce XRP’s position as a global payments asset. Increased demand from funds and portfolio managers could also strengthen market depth and long-term adoption. Rector described the development as a “100% certainty,” highlighting that two of the seven proposed ETFs are now in the activation phase. He predicted that the remaining issuers would follow shortly after. The Bottom Line Zach Rector’s confirmation has reignited optimism within the XRP community. With Canary Capital and Bitwise officially starting their 20-day countdowns, November 13 stands as the most credible date yet for the XRP ETF debut. If filings proceed without regulatory interference, XRP could soon join Bitcoin and Ethereum in the U.S. ETF market. For XRP holders, the long-awaited ETF party might finally begin this November. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Expert to XRP Holders: Get Ready for XRP ETF Party At This New Date appeared first on Times Tabloid .

TimesTabloid

You can visit the page to read the article.

Source: TimesTabloid

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

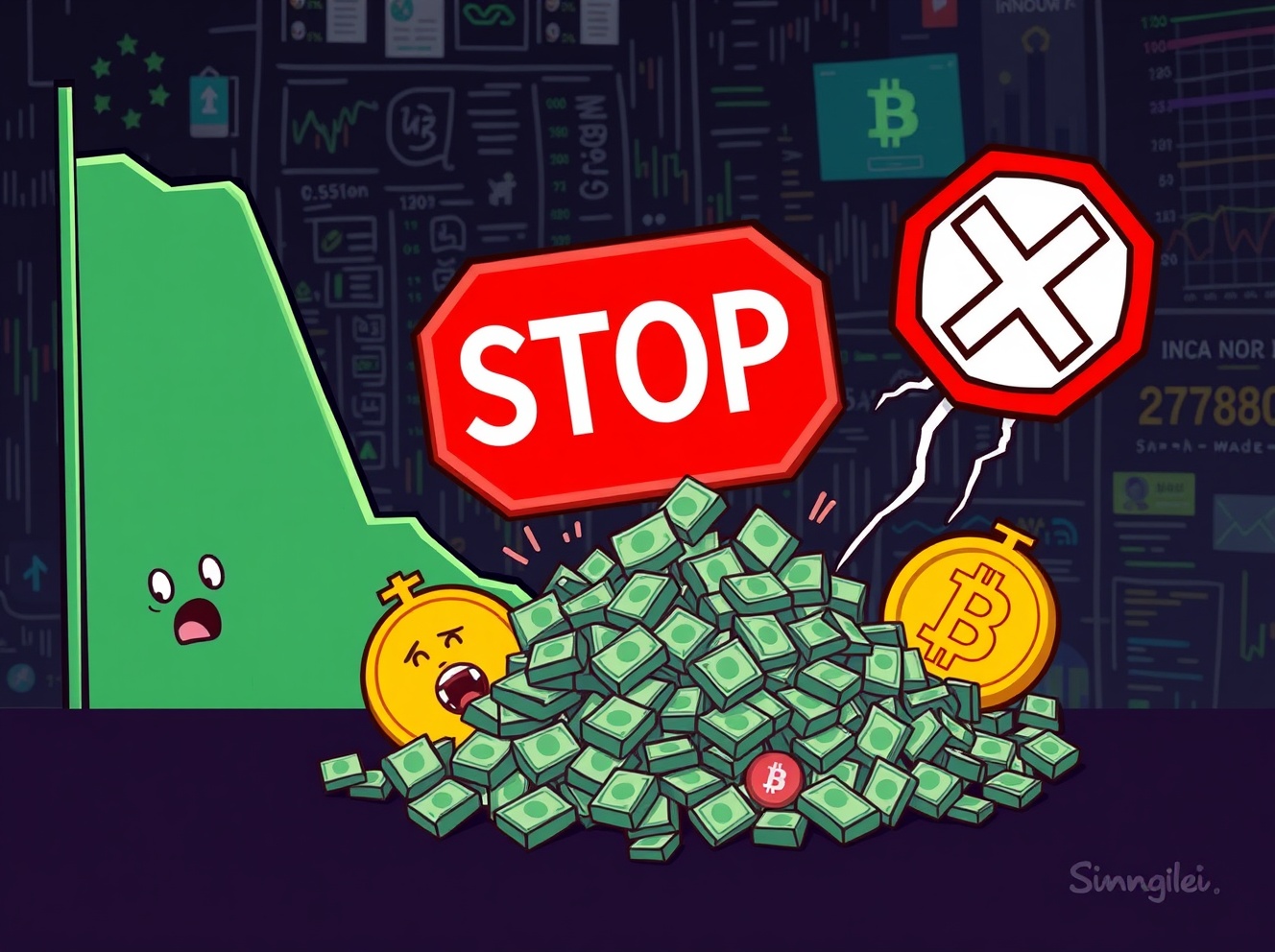

Massive Crypto Futures Liquidation: Unpacking the Market Shock

BitcoinWorld Massive Crypto Futures Liquidation: Unpacking the Market Shock The cryptocurrency market just experienced a seismic event, with a staggering crypto futures liquidation totaling $285 million in a single hour. This immediate shockwave follows an even larger tremor: a colossal $2.01 billion worth of futures contracts liquidated over the past 24 hours. These numbers are not just statistics; they represent significant market volatility and impact countless traders. If you are involved in crypto, understanding these events is crucial. What is Crypto Futures Liquidation and Why Does It Happen? At its core, crypto futures liquidation occurs when a trader’s leveraged position is forcibly closed by an exchange. This happens because the trader’s margin balance falls below the required maintenance margin. Think of it like a safety net disappearing. Futures contracts allow traders to speculate on the future price of an asset without owning it directly. They often use leverage, which means they borrow funds to amplify their potential gains. However, leverage also magnifies losses. When the market moves sharply against a leveraged position, the trader faces a margin call. If they cannot add more funds to meet the margin requirements, the exchange automatically liquidates their position to prevent further losses for both the trader and the exchange. Such massive liquidation events, like the recent $285 million in an hour, are often triggered by sudden price swings. These swings can be caused by macroeconomic news, regulatory announcements, or even large institutional trades. Consequently, a cascade effect can occur, where one liquidation triggers another, exacerbating market volatility. The Domino Effect: How Does Massive Crypto Futures Liquidation Impact the Market? When large amounts of crypto futures liquidation take place, it sends ripple effects throughout the entire market. Firstly, the forced selling of positions adds downward pressure on prices, potentially leading to further declines. This can create a ‘liquidation cascade’ or ‘long squeeze’ if many long positions are liquidated, or a ‘short squeeze’ if many short positions are closed. Moreover, these events often lead to increased market fear and uncertainty. Traders become more cautious, and overall trading volume might decrease as participants shy away from high-risk leveraged positions. This can impact investor sentiment, making it harder for prices to recover quickly. For example, a sudden drop in Bitcoin’s price might trigger the liquidation of millions in BTC futures, which then puts more pressure on Bitcoin’s spot price. This, in turn, can affect altcoins, as Bitcoin often dictates the broader market trend. The interconnected nature of the crypto ecosystem means that a significant crypto futures liquidation can be felt across various assets. Navigating the Storm: Actionable Insights for Traders Amidst Crypto Futures Liquidation Understanding crypto futures liquidation is one thing; navigating its aftermath is another. For traders, especially those utilizing leverage, risk management becomes paramount. Here are some actionable insights: Use Stop-Loss Orders: Always set stop-loss orders to automatically close your position if the price reaches a certain level. This limits potential losses and prevents liquidation. Manage Leverage Wisely: Avoid excessive leverage. While it can amplify gains, it dramatically increases your risk of liquidation during volatile periods. Monitor Funding Rates: High funding rates in futures markets can sometimes signal an overheated market, which might be prone to sudden corrections and subsequent liquidations. Diversify Your Portfolio: Do not put all your capital into highly leveraged futures positions. Diversify across different assets and strategies to mitigate risk. Stay Informed: Keep an eye on market news, economic indicators, and regulatory developments. These external factors often precede significant price movements that can trigger liquidations. Ultimately, a disciplined approach to trading, combined with a deep understanding of market mechanics, is your best defense against the unpredictable nature of leveraged trading. Conclusion The recent massive crypto futures liquidation event, totaling hundreds of millions, serves as a powerful reminder of the inherent volatility and risks within the leveraged cryptocurrency market. These forced closures are not just isolated incidents; they are critical indicators of market stress and can have far-reaching consequences. For traders and investors, understanding the mechanisms behind liquidation and implementing robust risk management strategies is essential for long-term success. While the allure of amplified gains through leverage is strong, the potential for rapid losses and forced liquidations is equally significant. Stay vigilant, stay informed, and trade responsibly to navigate these turbulent waters effectively. Frequently Asked Questions (FAQs) 1. What exactly causes a crypto futures liquidation? A crypto futures liquidation is triggered when a trader’s margin balance on a leveraged position falls below the exchange’s required maintenance margin, usually due to a significant price movement against their trade. 2. How can traders avoid liquidation in futures trading? Traders can avoid liquidation by using stop-loss orders, managing their leverage carefully, maintaining sufficient margin, and continuously monitoring market conditions to react promptly to adverse price movements. 3. Are liquidation events good or bad for the overall crypto market? Liquidation events are generally seen as negative in the short term, as they can cause further price drops and increase market fear. However, some argue they can ‘cleanse’ the market of overleveraged positions, potentially leading to healthier, more sustainable growth in the long run. 4. What is the difference between a ‘long squeeze’ and a ‘short squeeze’? A ‘long squeeze’ occurs when many long positions are liquidated, driving prices down further. A ‘short squeeze’ happens when many short positions are forced to close (buy back), causing prices to surge upwards. 5. Does crypto futures liquidation only affect futures traders? While direct financial impact is on futures traders, the cascading effects of large liquidation events can influence spot prices, market sentiment, and overall volatility, thus indirectly affecting all participants in the broader crypto market. Share This Insight Was this article helpful in understanding the recent massive crypto futures liquidation ? Share it with your friends, fellow traders, and anyone interested in the dynamic world of cryptocurrency. Your insights help others stay informed and make better decisions! To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action. This post Massive Crypto Futures Liquidation: Unpacking the Market Shock first appeared on BitcoinWorld . TimesTabloid

Bitcoin Drives $250 Billion Crypto Market Drop Amid Volatility and Liquidations

The cryptocurrency market experienced a sharp decline today, with over $250 billion wiped from its total market capitalization. This drop primarily impacted Bitcoin and Ethereum, driven by high liquidation events TimesTabloid