After years of taking swipes at Bitcoin and cryptocurrencies, JPMorgan CEO Jamie Dimon has reiterated a change in stance.

ZyCrypto

You can visit the page to read the article.

Source: ZyCrypto

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Dollar Correction Crisis: Sterling Surges 2% Ahead of Critical BOE Meeting

BitcoinWorld Dollar Correction Crisis: Sterling Surges 2% Ahead of Critical BOE Meeting The US dollar is facing a significant correction while the British pound demonstrates remarkable strength as traders position themselves ahead of the crucial Bank of England meeting. This dramatic shift in the forex market signals potential turbulence for currency exchange rates and global financial stability. Understanding the Dollar Correction Phenomenon The current dollar correction represents a notable reversal from recent trends. Several factors are driving this movement: Weakening US economic data releases Shifting Federal Reserve policy expectations Technical resistance levels being tested Global risk appetite improvement Sterling Gains Momentum Before BOE Decision The British pound has surged approximately 2% against major counterparts as market participants anticipate hawkish signals from the Bank of England. This sterling gains pattern reflects: Factor Impact on Sterling Inflation expectations Positive Interest rate projections Strongly positive Economic growth data Moderately positive Political stability Neutral to positive BOE Meeting: What to Expect for Currency Exchange The upcoming Bank of England meeting represents a pivotal moment for the forex market. Analysts predict several potential outcomes that could dramatically affect currency exchange rates: Interest rate decision and forward guidance Inflation projections and economic assessments Voting patterns among committee members Quantitative tightening timeline adjustments Forex Market Reactions to Central Bank Policies The broader forex market remains highly sensitive to central bank communications. Current conditions show: Currency Pair Recent Movement Key Driver GBP/USD +1.8% BOE expectations EUR/USD +0.9% Dollar weakness USD/JPY -1.2% Risk sentiment shift Actionable Insights for Currency Exchange Strategies Traders should consider these critical factors when navigating the current dollar correction and sterling gains environment: Monitor BOE meeting minutes for policy clues Watch for technical breakouts in key currency pairs Assess correlation with other asset classes Prepare for increased volatility around announcements FAQs: Navigating the Current Forex Market Conditions What is causing the dollar correction? The dollar correction stems from multiple factors including changing Federal Reserve expectations and improved global risk sentiment. How significant are the sterling gains ahead of the BOE meeting? The sterling gains of approximately 2% represent substantial pre-meeting positioning, indicating strong market expectations for hawkish policy. What should forex traders watch during the BOE meeting? Traders should focus on interest rate decisions, voting patterns, and forward guidance from the Bank of England governor. How does this affect broader currency exchange markets? Major central bank meetings typically create ripple effects across all major currency pairs and influence global capital flows. What are the risks in the current forex market environment? Key risks include policy surprises, unexpected economic data, and shifts in market sentiment that could reverse current trends. The ongoing dollar correction combined with sterling gains creates a compelling narrative in the forex market. As the BOE meeting approaches, traders face both opportunities and risks in currency exchange strategies. The interplay between central bank policies and market expectations will likely determine short-term direction, making careful analysis and risk management essential for success. To learn more about the latest forex market trends, explore our article on key developments shaping currency exchange rate movements and central bank policy impacts. This post Dollar Correction Crisis: Sterling Surges 2% Ahead of Critical BOE Meeting first appeared on BitcoinWorld . ZyCrypto

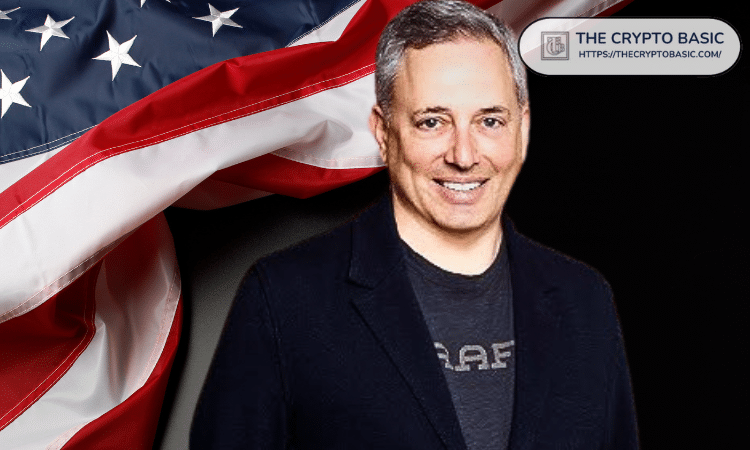

Trump Adviser David Sacks Says U.S. Crypto Market Bill Making “Great Progress”

President Donald Trump’s crypto and AI adviser, David Sacks, said on Thursday that discussions on the U.S. crypto market structure bill are showing “great progress.” In a post on X, Sacks expressed confidence that a bipartisan draft of the legislation would be ready in the near future. Visit Website ZyCrypto