The firm mostly funded the fresh buys with sales of common stock.

CoinDesk

You can visit the page to read the article.

Source: CoinDesk

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Tech Company Expands AI Services to Meet Growing Demand

Company expands AI services to meet diverse industry needs effectively. Enhanced AI offerings focus on personalized solutions for various sectors. Continue Reading: Tech Company Expands AI Services to Meet Growing Demand The post Tech Company Expands AI Services to Meet Growing Demand appeared first on COINTURK NEWS . CoinDesk

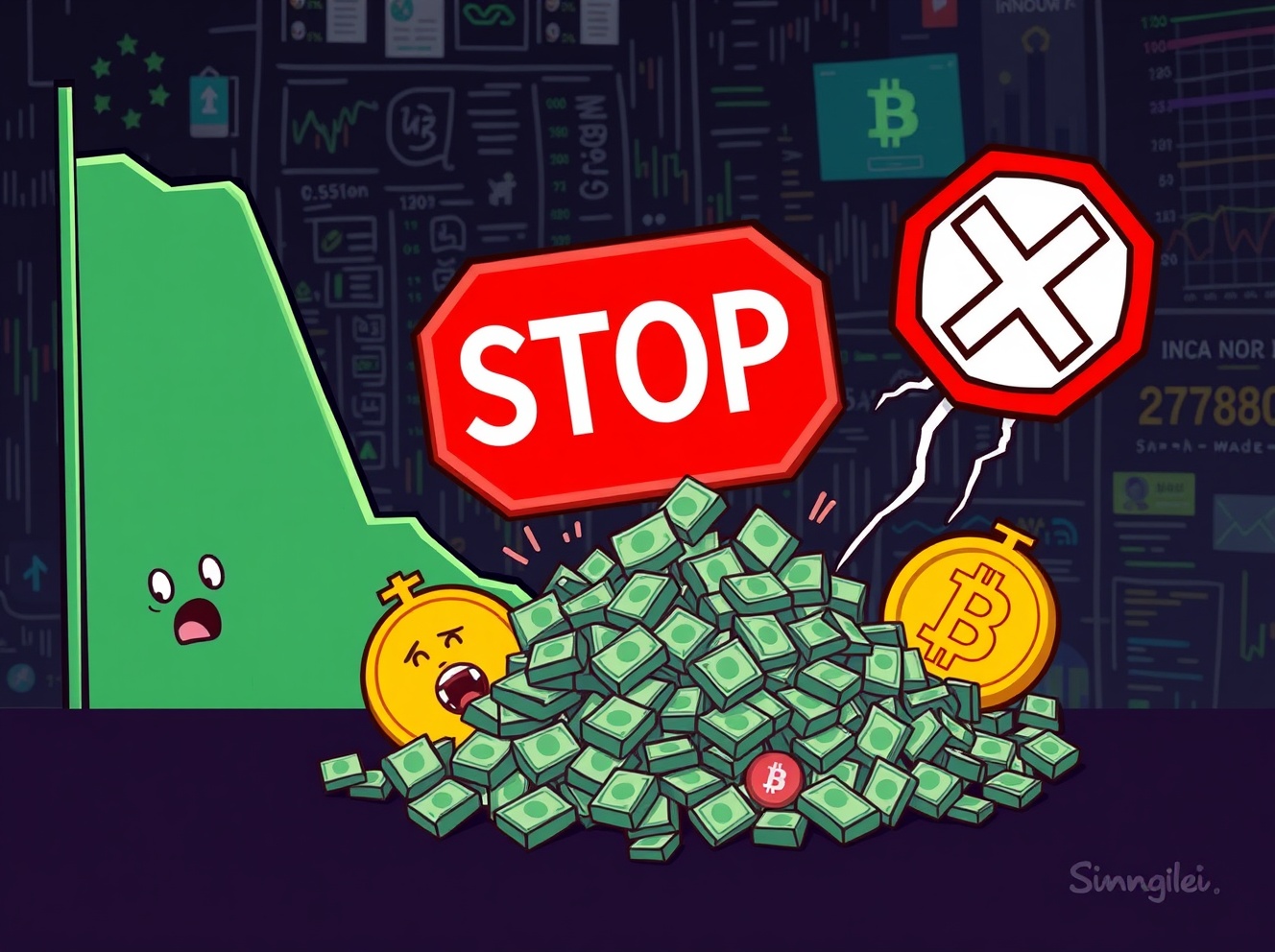

Massive Crypto Futures Liquidation: Over $346 Million Wiped Out in an Hour

BitcoinWorld Massive Crypto Futures Liquidation: Over $346 Million Wiped Out in an Hour The cryptocurrency market just experienced a dramatic event, witnessing a significant crypto futures liquidation . In a startling turn of events, major exchanges saw an astounding $346 million worth of futures contracts liquidated within a single hour. This immediate financial impact serves as a powerful reminder of the inherent volatility and high stakes involved in derivatives trading within the digital asset space. Over the past 24 hours, the total figure swelled to an alarming $1,633 million in liquidated futures, underscoring a period of intense market pressure and rapid price movements. Understanding Crypto Futures Liquidation What exactly is a crypto futures liquidation , and why does it matter? Futures contracts are agreements to buy or sell an asset at a predetermined price on a future date. Traders often use leverage, borrowing funds to amplify their potential returns. While leverage can boost profits, it also magnifies losses. A liquidation occurs when a trader’s position falls below a certain margin requirement, meaning they no longer have enough collateral to cover potential losses. When this happens, the exchange automatically closes the position to prevent further losses. This mechanism protects the exchange and the lender but can be devastating for the trader. It is a common occurrence in highly volatile markets, and its scale often reflects significant price swings. The Recent Shockwave: $346 Million in an Hour The recent event saw a staggering $346 million in crypto futures liquidation within a mere sixty minutes. This rapid unwinding of positions indicates an abrupt and substantial price movement that caught many leveraged traders off guard. Such swift liquidations often trigger a cascading effect, where forced selling further drives down prices, leading to more liquidations. This phenomenon can exacerbate market downturns, creating a ‘liquidation cascade’ that accelerates price declines. The 24-hour total of $1.633 billion further highlights the widespread impact across various cryptocurrencies and trading pairs. Bitcoin and Ethereum, being the largest assets, typically account for a significant portion of these liquidations due to their high trading volumes and open interest in futures markets. Why Do These Massive Liquidations Happen? Several factors contribute to large-scale crypto futures liquidation events: Sudden Price Swings: Unexpected news, whale movements, or macroeconomic factors can cause rapid price changes, pushing leveraged positions into negative territory. High Leverage: Many traders use extremely high leverage (e.g., 50x, 100x), meaning even small price movements can lead to liquidation. Market Contagion: A liquidation in one asset or exchange can sometimes spill over, affecting sentiment and prices across the broader market. Lack of Stop-Loss Orders: Traders who do not set appropriate stop-loss orders are more vulnerable to sudden market shifts. These events serve as a stark reminder of the risks associated with highly leveraged trading in an unregulated and often unpredictable market. Impact on Traders and the Broader Market For individual traders, a crypto futures liquidation can mean significant, often total, loss of their invested capital. It is a painful experience that can deter participation in futures markets. Beyond individual losses, these events also affect overall market sentiment. Large liquidations can: Indicate bearish sentiment if the liquidations are predominantly long positions. Increase market volatility as forced selling adds to price pressure. Shake investor confidence, especially among newer participants. However, liquidations also clear out over-leveraged positions, potentially setting the stage for a healthier, more sustainable market rebound once the dust settles. Navigating Volatility: Actionable Insights for Traders Understanding the risks of crypto futures liquidation is crucial. Here are some actionable insights for traders: Manage Leverage Wisely: Avoid excessive leverage. Use only what you are comfortable losing. Implement Stop-Loss Orders: Always set stop-loss orders to limit potential losses automatically. Diversify Your Portfolio: Do not put all your capital into highly leveraged futures positions. Stay Informed: Keep abreast of market news, economic indicators, and technical analysis to anticipate potential price movements. Understand Margin Requirements: Be aware of the margin levels required by your exchange and monitor your positions closely. Responsible trading practices are paramount to surviving and thriving in the volatile crypto futures market. The recent $346 million crypto futures liquidation event serves as a powerful testament to the high-risk, high-reward nature of derivatives trading in the cryptocurrency space. While such events can be devastating for individual traders caught on the wrong side, they are an intrinsic part of a dynamic market. For those engaging with futures, prudence, risk management, and continuous learning are not just advisable but essential for long-term success. Understanding these market mechanics helps traders navigate the complexities and make more informed decisions, ultimately fostering a more resilient trading strategy. Frequently Asked Questions (FAQs) Q1: What does it mean when futures are ‘liquidated’? A1: Liquidation occurs when a trader’s leveraged position in a futures contract falls below the required margin level. The exchange automatically closes the position to prevent further losses, resulting in the loss of the trader’s collateral. Q2: Why did such a large crypto futures liquidation happen so quickly? A2: Large liquidations happen quickly due to sudden and significant price movements in the underlying asset. When prices move sharply against many highly leveraged positions simultaneously, it triggers a cascade of automatic closures. Q3: How does leverage contribute to crypto futures liquidation? A3: Leverage amplifies both gains and losses. While it can increase profits on favorable price movements, it also means a smaller adverse price movement can quickly deplete a trader’s margin, leading to liquidation. Q4: Are crypto futures liquidations common? A4: Yes, liquidations are a common occurrence in the volatile cryptocurrency futures market, especially during periods of high price fluctuations. The scale of liquidations varies significantly. Q5: What can traders do to avoid crypto futures liquidation? A5: Traders can minimize the risk of liquidation by using lower leverage, setting strict stop-loss orders, diversifying their portfolio, and closely monitoring market conditions and their margin levels. If you found this article insightful, please consider sharing it with your network on social media. Your shares help us continue to provide valuable insights into the dynamic world of cryptocurrency. To learn more about the latest crypto market trends, explore our article on key developments shaping crypto market price action. This post Massive Crypto Futures Liquidation: Over $346 Million Wiped Out in an Hour first appeared on BitcoinWorld . CoinDesk