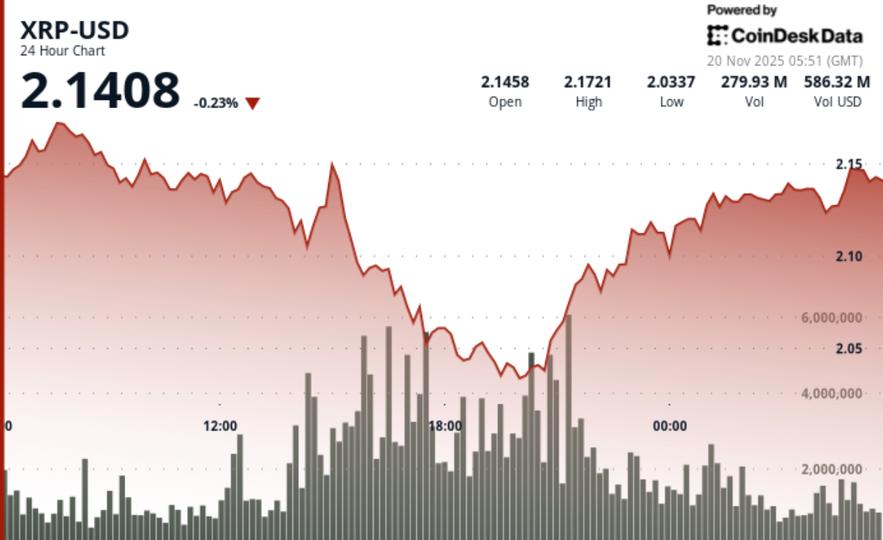

A growing number of analysts believe the United States is preparing for a major economic transformation. They point to rising investment, aggressive industrial policies, and rapid technological expansion. Many expect this shift to reshape the nation’s financial infrastructure. The scale of change has sparked renewed interest in blockchain solutions built for institutional use. X Finance Bull’s Bold Warning In this environment, X Finance Bull issued a strong message to investors. He argued that a $20 trillion surge in economic inflows is approaching. He linked these inflows to tariffs, artificial intelligence, and renewed domestic manufacturing. His claim rests on public comments made by President Donald J. Trump , who has repeatedly projected massive capital returns to the United States. X Finance Bull believes this money will require new financial rails built for speed, compliance, and scale. You’ll regret not stacking $XRP when the $20T wave hits! Let me remind you of this… again. Trump said over $20 TRILLION is coming to America through tariffs, AI, and industrial reinvestment. But here’s what they won’t say on TV: That money needs to go somewhere. It… https://t.co/A051Szu6Yj pic.twitter.com/E2NtkUANSP — X Finance Bull (@Xfinancebull) November 19, 2025 Why XRP Ledger Is Back in the Spotlight According to his analysis, the XRP Ledger offers capabilities that older systems lack. XRPL processes transactions within seconds and handles high-volume activity with minimal cost. Its design supports tokenization, stablecoins, and regulated financial applications. These features now matter more because institutions need systems that can move money quickly and securely. As adoption grows, the ledger’s architecture appears purpose-built for large capital flows. Political Signals Strengthening the Thesis Recent political developments give this viewpoint more weight. President Trump has expressed support for American-led blockchain innovation. He has also met with Ripple’s leadership, including its chief executive and legal team . These meetings have fueled speculation about deeper government interest in modern financial infrastructure. They also suggest that the administration views blockchain as part of its economic strategy. Regulation Moving Faster Than Before At the same time, U.S. lawmakers are pushing digital-asset legislation at record speed. Both chambers of Congress have advanced bills aimed at regulating stablecoins and clarifying digital-asset oversight. This effort reflects growing recognition that the United States needs updated rules for a changing economy. Clear regulation also reduces risk for banks and institutions evaluating blockchain-based systems. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Ripple’s Position After Legal Clarity Ripple’s legal battles have also reached a closure. The company settled its long-running case with the U.S. Securities and Exchange Commission. The outcome included a reduced financial penalty and the end of court proceedings. This clarity removes a major obstacle that once slowed institutional interest in XRP. With the case closed, banks and payment firms can evaluate the technology without legal uncertainty. Infrastructure Built for Institutional Finance Ripple is expanding the XRPL to meet institutional standards. Recent upgrades introduced compliance tools, permissioned features, and improved settlement options. The roadmap includes identity credentials, audited tokenization frameworks, and new liquidity tools. These additions signal a shift from retail speculation toward regulated financial use cases. They also align with the growing demand for blockchain-based settlement systems. Could XRP Carry a $20 Trillion Wave? The central question is whether the XRPL could support the kind of capital flows X Finance Bull describes. The technology is capable, and the regulatory environment is improving. Political interest also appears stronger than in previous years. Yet adoption will depend on decisions made by banks, regulators, and international partners. Even so, the alignment of policy, technology, and institutional demand is notable. A System Built for What Comes Next If trillions of dollars enter the U.S. economy, the infrastructure handling that liquidity must be modern and efficient. Advocates argue that XRP offers those qualities today. They see a future where blockchain underpins America’s financial renewal. X Finance Bull believes that the future is closer than many think. His message is simple: ignoring XRP now could become a costly mistake. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Pundit: You’ll Regret Not Stacking XRP When This $20T Wave Hits appeared first on Times Tabloid .

TimesTabloid

You can visit the page to read the article.

Source: TimesTabloid

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

U.S. Family Office Identifies Hidden Issues XRP Investors Could Face Even if XRP Hits $100

A leading American multi-family office calls attention to financial and legal problems XRP investors could face when XRP reaches higher targets. Notably, XRP and the broader crypto market have remained in a downtrend over the past few weeks. Visit Website TimesTabloid

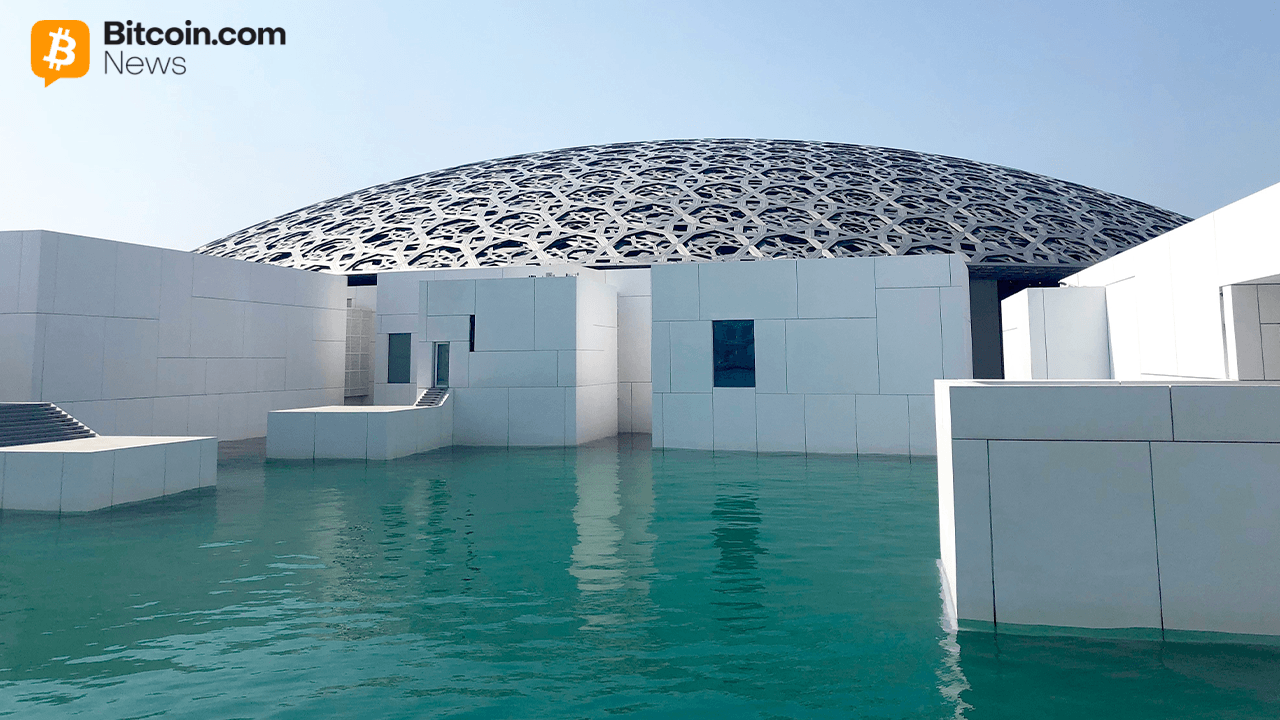

Abu Dhabi Investment Council Expands Bitcoin ETF Position Threefold in Q3 2025

Abu Dhabi Investment Council (ADIC) more than tripled its holdings in Blackrock’s Ishares Bitcoin Trust (IBIT) during the third quarter of 2025, according to newly released regulatory filings. Abu Dhabi’s ADIC Makes Big Q3 Move Into Blackrock’s Bitcoin ETF IBIT Regulatory filings released Nov. 19 show the Abu Dhabi Investment Council (ADIC) sharply expanding its TimesTabloid