BitcoinWorld Revolutionary: Function Health Secures $298M to Transform Healthcare with Medical Intelligence AI In a groundbreaking move that signals the future of personalized healthcare, Function Health has secured a massive $298 million Series B funding round at a $2.5 billion valuation. This substantial investment positions the company to revolutionize how we understand and manage our health through advanced AI technology. What Makes Function Health’s Series B Funding So Significant? The recent $298 million Series B funding represents one of the largest healthcare technology raises of 2025. Led by Redpoint Ventures, the round attracted participation from prominent investors including a16z, Battery Ventures, and notable NBA athletes. This brings Function Health’s total funding to $350 million, demonstrating strong investor confidence in their vision to transform personal healthcare. How Function Health’s Medical Intelligence Platform Works Function Health addresses a critical gap in modern healthcare: the inability to effectively utilize the massive amounts of health data we generate. The platform consolidates information from multiple sources including: Electronic health records Blood tests and lab results Wearable device data Doctor’s notes and medical scans Through their Medical Intelligence Lab, the company has developed a generative AI model trained by doctors to provide personalized health insights and actionable recommendations. The Power of AI Healthcare Transformation Function Health’s AI chatbot represents a significant advancement in personalized medicine. The system can: Answer health questions based on individual data Reference previous lab results and medical history Provide tailored health guidance Help users understand complex medical information CEO Jonathan Swerdlin emphasizes: “It is not good enough to be in a world where AI exists and not be applying it to your health. You should be able to manage your biology.” Building a Comprehensive Health Data Platform What sets Function Health apart is its device-agnostic approach and comprehensive integration of lab testing, diagnostics, and clinical insights. The company has established an impressive operational footprint with: 75 current locations across the United States Plans to expand to nearly 200 locations by year-end Over 50 million lab tests completed since 2023 Security and Privacy in Healthcare Technology In an era of increasing data privacy concerns, Function Health maintains strict security protocols. The platform meets HIPAA standards, fully encrypts user data, and never sells personal information. Swerdlin assures users: “Your data and your identity are never for sale. Every bit of your information is fully encrypted and protected.” Leadership and Medical Expertise The development of Function Health’s medical intelligence capabilities is led by Chief Medical Scientist Dr. Dan Sodickson and co-founder Dr. Mark Hyman. Their team includes doctors, researchers, and engineers who ensure the AI model maintains medical accuracy and clinical relevance. Competitive Landscape and Market Position While competitors like Superpower, Neko Health, and InsideTracker operate in the health tracking space, Function Health distinguishes itself through its comprehensive approach that goes beyond typical AI coaching or wellness applications. Future Outlook and Industry Impact This substantial funding round positions Function Health to accelerate its expansion and technology development. The company’s vision of applying the best available technology to human health represents a significant step forward in making personalized, data-driven healthcare accessible to everyone. Frequently Asked Questions What is Function Health? Function Health is a health technology company that offers regular lab testing services and AI-powered health insights through its Medical Intelligence platform. Who are the key investors in Function Health? The Series B round was led by Redpoint Ventures with participation from a16z , Battery Ventures , and several individual investors including NBA athletes. Who leads Function Health’s medical team? The medical leadership includes Chief Medical Scientist Dr. Dan Sodickson and co-founder Dr. Mark Hyman , who oversee the development of the Medical Intelligence Lab. How does Function Health ensure data privacy? The platform meets HIPAA standards, uses full encryption for all user data, and maintains a strict policy against selling personal information. What makes Function Health different from other health apps? Function Health combines lab testing, comprehensive data integration, and doctor-trained AI to provide more than basic wellness tracking, offering actual clinical insights and personalized health guidance. The $298 million Series B funding represents a watershed moment for AI in healthcare. Function Health’s approach to combining comprehensive lab testing with advanced medical intelligence demonstrates how technology can transform personal health management. As the company expands its physical presence and enhances its AI capabilities, it sets a new standard for what’s possible in personalized, data-driven healthcare. To learn more about the latest AI healthcare trends and medical intelligence developments, explore our article on key developments shaping AI features and healthcare technology adoption. This post Revolutionary: Function Health Secures $298M to Transform Healthcare with Medical Intelligence AI first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

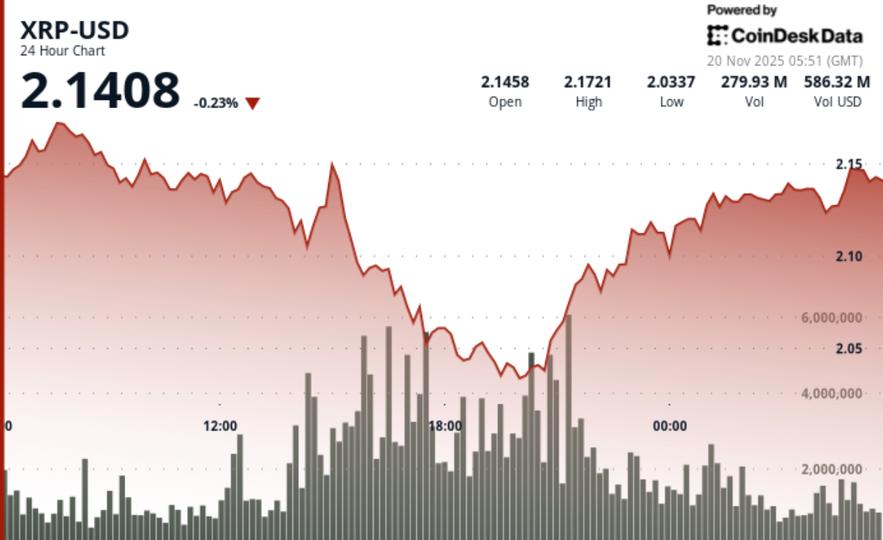

XRP Will Soon Break This Resistance and Leave Ethereum Behind

Crypto analyst CryptoBull published a chart-based assessment indicating that XRP is approaching a decisive technical juncture against Ethereum. The analyst’s accompanying chart, which plots the XRP/ETH pair on Binance , highlights a horizontal resistance cluster around the 0.00070–0.00075 level and an upward-sloping support line that has formed since late October. According to the analyst, the pair has broken out of a prior downtrend channel and is now testing that resistance band, which they interpret as the last barrier before a sustained move in XRP’s favor relative to ETH. The image attached to the analyst’s message shows daily candlesticks with the recent price consolidating above the rising trendline while trading near the horizontal ceiling. Volume bars beneath the price action appear to decline during consolidation, and prior trading sessions included a volume spike at the point where the downtrend line intersected the new ascending support. CryptoBull argued that a confirmed close above the horizontal resistance would signal that XRP is beginning to outperform Ethereum on a pair basis, potentially drawing capital away from ETH-denominated holdings. #XRP will soon break this resistance and leave Ethereum behind! https://t.co/27hmY3f5p1 pic.twitter.com/PR1btfASni — CryptoBull (@CryptoBull2020) November 18, 2025 Implications and market context If the breakout materializes as the analyst projects, it means a period in which XRP gains relative strength versus Ethereum , measured directly through the XRP/ETH exchange rate. For traders who use cross-pair analysis to allocate capital, such an outcome could prompt rebalancing decisions in favor of XRP-denominated positions. CryptoBull emphasized the importance of watching daily closes and volume confirmation: the analyst stated that higher trading volumes accompanying a break above resistance would increase the probability that the move is sustained rather than transient. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Market participants should also note that cross-pair dynamics can be influenced by news, macro liquidity conditions, and separate developments affecting either token. While the chart highlights technical structures that support the analyst’s outlook, those structures do not preclude abrupt shifts in sentiment or fundamental events that could alter price relationships between XRP and ETH. Caution and next steps for traders CryptoBull’s assessment frames the current price action as a potential turning point. His opinion is contingent on a clean breakout above the highlighted resistance and a subsequent confirmation through volume and price action. Traders monitoring the pair will likely watch for decisive daily closes above the resistance band and follow-through buying pressure. At the same time, risk management remains essential: failure to clear resistance or a reversal below the rising support would invalidate the bullish technical scenario set forth by the analyst and could reopen the prior range. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post XRP Will Soon Break This Resistance and Leave Ethereum Behind appeared first on Times Tabloid . Bitcoin World

Four Nations Buy Bitcoin as a Billion-Dollar Whale Awakens: What Happens Next?

Bitcoin is drawing fresh attention from governments, whale wallets and chart analysts at the same time. This update links new state-level exposure, a billion-dollar on-chain transfer and a fragile bounce into one picture of where the market stands. Four Governments Confirm New Channels for Holding Bitcoin Four governments have recently disclosed Bitcoin exposure through mining programs, direct purchases, ETFs and test portfolios. The United Arab Emirates, El Salvador, Luxembourg and the Czech Republic now all appear in public records as nation states with some form of BTC on their books. Four Nations Add Bitcoin Exposure. Source: The Bitcoin Historian In the UAE, blockchain analysts traced several thousand BTC to wallets tied to a government-backed mining operation. The coins come from mined rewards rather than exchange buys, yet the holdings still sit under state control and now show up in on-chain data. El Salvador continues to add Bitcoin directly to its national stash. Officials have announced new acquisitions worth around $100 million in recent weeks, extending a policy of buying BTC during market pullbacks and holding it as part of the country’s long-term strategy. Luxembourg is using a fund structure instead of spot coins. Its Intergenerational Sovereign Wealth Fund plans to place a small share of assets into Bitcoin exchange-traded funds and related products, giving the state price exposure while custodians handle the underlying assets. The Czech Republic has taken a more experimental route. The Czech National Bank built a $1 million test portfolio that includes Bitcoin, a U.S. dollar stablecoin and a tokenized deposit. Officials say the basket sits outside formal foreign-exchange reserves and serves mainly as a research tool, yet it still marks disclosed central-bank exposure to BTC. While governments adjust their policies, large holders on-chain are also on the move. Whale Address Receives 10,145 BTC From BitMEX Cold Wallet Meanwhile, on-chain data show a whale address has received 10,145 BTC, valued near $1 billion at recent prices. A portfolio view for address 3JBM969wvpxEnfYLQ3LYayB3DVk52ZZpGq records a single inflow of 10.145K BTC from a BitMEX cold wallet roughly five hours ago, placing the full stack under that wallet’s control. Satoshi Era Whale 10,145 BTC Move. Source: 0xNobler As a result, traders are already debating whether the move signals long-term accumulation or simple internal rebalancing. The transfer has also revived speculation about whether a “Satoshi-era” holder is positioning for a market bottom, even though the transaction alone does not reveal the whale’s strategy. Analyst Says Bitcoin Bounce Shows Early Stabilization but Volatility Remains Elevated Bitcoin’s rebound h as offered the first signs of stabilization, even as volatility stays elevated, according to analyst Michaël van de Poppe. He noted that the recent drop left markets “overextended to the downside,” and the latest bounce reflects early attempts to find footing in a key support zone. Bitcoin Support Zone Analysis. Source: CryptoMichNL At the same time, he cautioned that reversals rarely happen quickly. Poppe expects Bitcoin to move sideways for a period as the market builds a new base following the sharp decline. The chart shows liquidity already cleared below recent lows, leaving room for consolidation before any sustained upward move can begin. He added that the current price region remains attractive for long-term positioning, emphasizing that accumulation in this zone could prove beneficial over the coming years. Bitcoin World