Robert Kiyosaki maintains a bullish outlook on Ethereum, urging investors to ignore fear-based crash predictions and focus on its long-term potential as a wealth-building asset alongside Bitcoin, gold, and silver.

CoinOtag

You can visit the page to read the article.

Source: CoinOtag

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

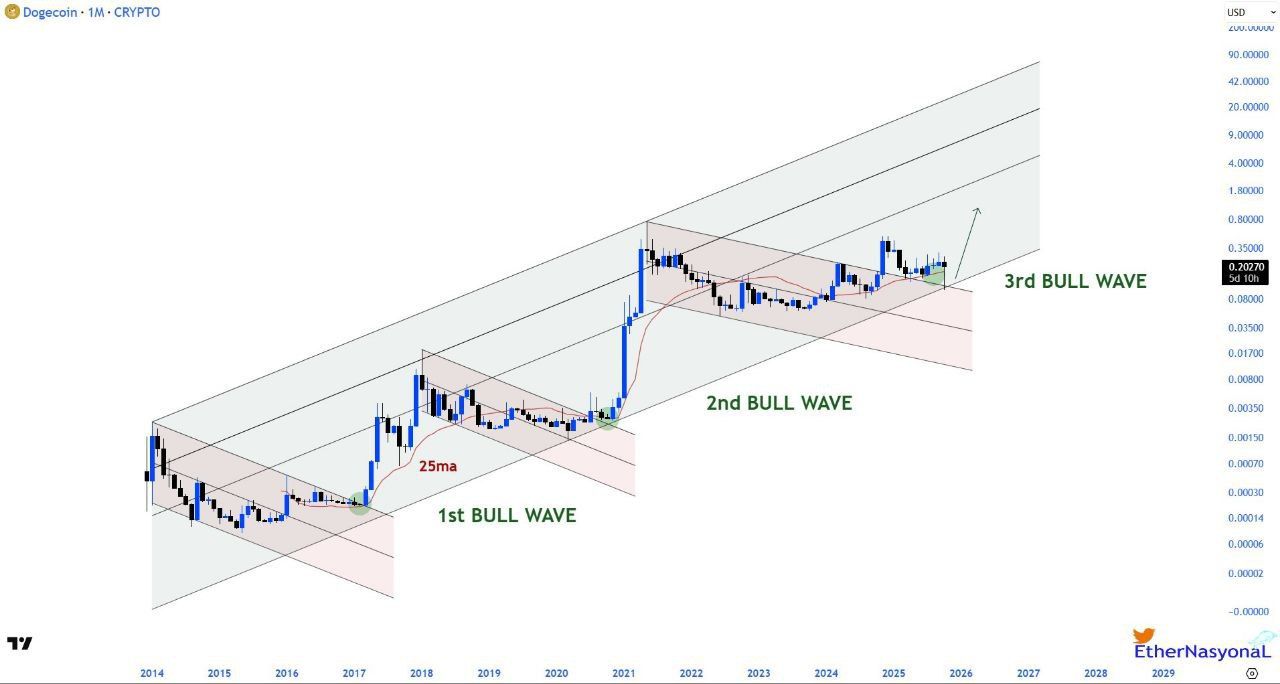

Dogecoin Surges 6% as Binance Traders Show Strong Bullish Sentiment

Dogecoin has seen gains of 6% over the last 24 hours, surpassing those of major cryptocurrencies, including Bitcoin and XRP. The meme coin was trading at $0.2067, with a total daily volume exceeding 1.87 billion, more than twice its usual trading volume. The performance marks a significant improvement compared to larger-cap digital assets. Bitcoin rose 3.15% over the same period, while XRP increased by 1.52%. The surge indicates the increasing speculative interest in the dog-themed cryptocurrency. Futures Market Signals Growing Optimism Dogecoin futures open interest surged by 9% in 24 hours, indicating a high level of trader activity. According to Binance data , approximately 70% of traders with open positions are betting on price growth. This asymmetrical placement indicates that there are many bullish sentiments among the active market players. The derivatives market action is in line with larger movements in cryptocurrency markets. Digital assets rose after diplomatic developments between China and the United States over trade. Both countries are reported to have made initial deals in advance of an intended meeting between President Donald Trump and Chinese President Xi Jinping. Cryptocurrency analyst Ali Martinez found critical support of Dogecoin at levels below 0.18. Such a level might lead to the push of prices to $0.25 and $0.33. These targets are 21-60% gains at present trading levels. Technical indicators offer a conflicting message. According to TradingView data , the Moving Average Convergence Divergence (MACD) indicator generated a buy signal. This indicates favorable momentum, as evidenced by comparisons of the exponential moving average. However, the Bull Bear Power indicator remains neutral, reflecting balanced pressure between buyers and sellers. Market Context and Trading Volume The spike in volume to $1.87 billion is a significant boost to the market. Increased volumes of trade are typically a positive sign of increased conviction among market players and may indicate long-term price trends. Dogecoin remains the largest meme cryptocurrency by market capitalization. Since its inception, the token has withstood the market`s test through numerous market cycles, establishing a loyal fan base of followers and traders. The ongoing bull run is not confined to Dogecoin , but it applies to the wider cryptocurrency and equity markets. Risk assets also improved due to optimism about the easing of trade tensions between the two largest economies in the world. Trade friction is regarded by market participants as favorable to economic growth and risk tolerance globally. Source: X The technical chart and market positioning in the derivative markets suggest that traders anticipate the trend to continue upward. The fact that the long positions are concentrated on Binance suggests that leveraged traders are confident, but the position can increase gains and losses equally. Analysts continue to monitor the support at $0.18 as a key area to maintain a bullish market structure. Breach of this would result in profit and position liquidations. On the other hand, any above-support hold can confirm the positive technical perspective and attract more purchasing attention. CoinOtag

XRP to $10? Dark Defender Spots Key Level to Break

A new technical update from market analyst Dark Defender (@DefendDark) has drawn close attention to XRP’s current structure on the 3-day time frame. The analyst, known for his detailed Elliott Wave interpretations, explained that XRP is nearing completion of a crucial phase, setting the stage for what could be a significant move once the current formation resolves. According to his post, the token’s recent movements have aligned precisely with his earlier forecasts. His chart outlines a distinct pattern consisting of a completed five-wave Elliott Wave sequence followed by a corrective A-B-C phase, with a new five-wave structure beginning to take shape. #XRP has almost completed the 4-hour structure. We analysed this with 100% accuracy on the Dark`s Side. I want to share the 3-day time frame update with you. We pointed out $2.22 as the final frontier, and XRP bounced there. The RSI is at the same level as it was in November… pic.twitter.com/Aj6eV6gDMf — Dark Defender (@DefendDark) October 25, 2025 Analyzing the Ongoing Structure The chart presents XRP in the middle of a large ascending structure, with price action consolidating between two critical trendlines. The current formation appears to be in the second wave of a new five-wave sequence. This setup suggests that XRP may still move within the symmetrical triangle pattern before an eventual breakout. Dark Defender highlighted the region around $2.22 as a pivotal support level, describing it as “the final frontier,” which successfully held as the token rebounded from that zone. He also referenced the relative strength index, noting that “the RSI is at the same level as it was in November last year,” indicating a similarity between the current position and the asset’s RSI before it began a surge of over 500% late last year. This historical alignment strengthens his argument that XRP could be positioned for renewed momentum once resistance levels are cleared. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Critical Price Levels to Watch Dark Defender’s chart outlines two major resistance zones at $2.85 and $5.85. The first represents an immediate barrier within the current pattern, while the second aligns with the 261.8% Fibonacci extension target drawn on his projection. Beyond that, a secondary extension suggests a long-term target near $10.47, marking a potential culmination of the larger wave structure. For now, he anticipates continued movement inside the triangle, implying short-term consolidation before a breakout above the orange trend line forming the upper boundary of the triangle. According to the analyst, breaking this descending resistance will confirm the next impulsive wave toward the outlined targets. With XRP respecting the $2.22 support and approaching resistance levels, the market may soon test the strength of this projection. For now, Dark Defender’s analysis provides a structured framework for understanding XRP’s current consolidation and its potential path toward higher valuations . Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post XRP to $10? Dark Defender Spots Key Level to Break appeared first on Times Tabloid . CoinOtag