BitcoinWorld Tether-linked address makes massive $97.34M Bitcoin purchase on Bitfinex Have you ever wondered how major players move in the cryptocurrency world? A Tether-linked address just made headlines by purchasing a staggering 961 Bitcoin, worth approximately $97.34 million, on the Bitfinex exchange. This massive transaction, reported by Onchain Lens, occurred mere hours ago and signals significant institutional activity in the Bitcoin market. What does this Tether-linked address purchase mean for Bitcoin? The recent acquisition by the Tether-linked address represents one of the largest single transactions witnessed recently. When such substantial amounts enter the market, it often indicates strong confidence in Bitcoin’s future value. Moreover, this move demonstrates how major entities are positioning themselves in the evolving cryptocurrency landscape. Transactions of this magnitude typically influence market sentiment and can signal upcoming price movements. The timing of this purchase, coming during ongoing market fluctuations, suggests strategic accumulation by knowledgeable investors. Why are Tether-linked addresses important in cryptocurrency? Tether-linked addresses play a crucial role in the digital asset ecosystem for several reasons: They represent substantial liquidity moving between stablecoins and other cryptocurrencies Their transactions often precede significant market movements They demonstrate institutional participation in crypto markets Their activity provides insights into market maker strategies They help maintain stability between different digital assets The movement from a Tether-linked address into Bitcoin particularly highlights the ongoing relationship between stablecoins and the broader cryptocurrency market. This transaction underscores how major players use stablecoins as stepping stones to acquire other digital assets. How does this affect ordinary cryptocurrency investors? While $97.34 million might seem like an astronomical sum to individual investors, understanding these large transactions can provide valuable insights. The Tether-linked address activity often serves as a barometer for institutional sentiment. When such addresses accumulate Bitcoin, it typically indicates: Positive long-term outlook on Bitcoin’s value Potential price support at current levels Increased institutional adoption of cryptocurrency Growing confidence in Bitcoin as a store of value However, it’s crucial to remember that while these signals are important, they represent just one piece of the complex cryptocurrency puzzle. Individual investors should always conduct their own research and consider multiple factors before making investment decisions. What makes this Tether-linked address transaction remarkable? The scale and timing of this Tether-linked address purchase make it particularly noteworthy. The transaction occurred during a period of relative market uncertainty, suggesting confidence in Bitcoin’s fundamentals. The sheer size – nearly $100 million – demonstrates the growing maturity of cryptocurrency markets and the increasing participation of substantial players. This Tether-linked address movement also highlights the evolving relationship between stablecoins and other cryptocurrencies. As the largest stablecoin issuer, Tether’s associated addresses often serve as proxies for institutional activity, making their movements particularly significant for market analysts. Conclusion: Understanding the impact of major cryptocurrency movements The recent $97.34 million Bitcoin purchase by a Tether-linked address represents more than just another large transaction. It signals growing institutional confidence, demonstrates the maturing relationship between stablecoins and other cryptocurrencies, and provides valuable insights into market sentiment. While individual investors should never base decisions solely on such movements, understanding these signals can help navigate the complex cryptocurrency landscape more effectively. Frequently Asked Questions What is a Tether-linked address? A Tether-linked address is a cryptocurrency wallet associated with Tether operations, often used for large-scale transactions involving USDT and other digital assets. Why do Tether-linked addresses purchase Bitcoin? These addresses typically buy Bitcoin as part of treasury management, market making operations, or strategic accumulation based on market conditions and investment thesis. How does this affect Bitcoin’s price? Large purchases can create buying pressure and influence market sentiment, potentially supporting or increasing Bitcoin’s price in the short to medium term. Should I follow Tether-linked address movements? While informative, these movements should be one of many factors in your research. They provide insight but shouldn’t dictate individual investment strategies. How reliable is Onchain Lens data? Onchain Lens provides blockchain analytics based on public ledger information, making it reliable for tracking verified on-chain transactions. Can anyone track Tether-linked addresses? Yes, blockchain transactions are public. However, identifying specific entity connections requires advanced blockchain analysis tools and expertise. Found this analysis insightful? Help others understand major cryptocurrency movements by sharing this article on your social media platforms. Your shares help spread valuable market knowledge throughout the crypto community. To learn more about the latest Bitcoin trends, explore our article on key developments shaping Bitcoin institutional adoption. This post Tether-linked address makes massive $97.34M Bitcoin purchase on Bitfinex first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

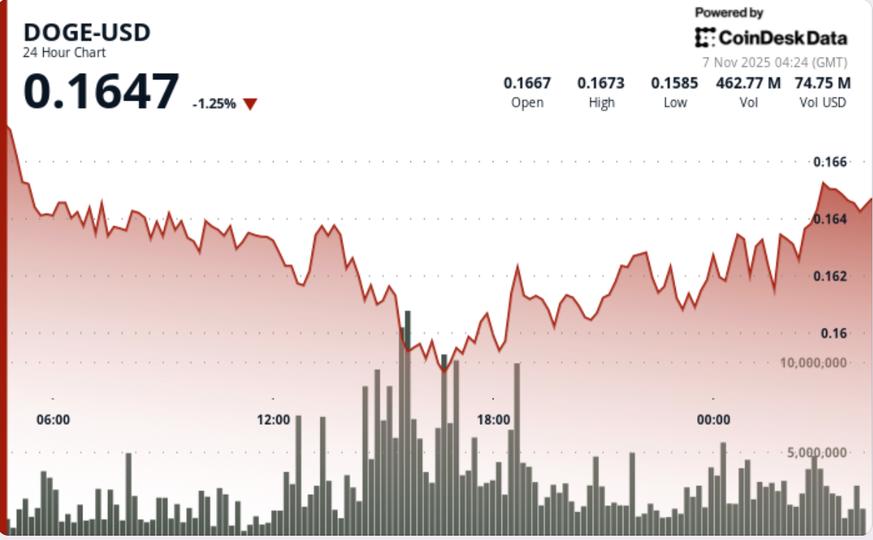

XRP Breakdown Sends Ripple-Linked Token Toward $2.20 Defense Zone

The breakdown unfolded alongside a surge in trading volume that reached 137.4 million, representing an 84% spike above the daily average. Bitcoin World

Shocking Haru Invest CEO Attack: 5-Year Sentence for Courtroom Stabbing

BitcoinWorld Shocking Haru Invest CEO Attack: 5-Year Sentence for Courtroom Stabbing In a stunning turn of events that rocked the cryptocurrency world, a South Korean man has received a five-year prison sentence for violently attacking the Haru Invest CEO during a court proceeding. This shocking Haru Invest CEO attack occurred while the executive was standing trial for massive crypto fraud allegations. What Happened During the Haru Invest CEO Attack? The assault took place in August last year at Seoul Southern District Court. A man identified only by his surname Kang approached CEO Lee during a hearing and stabbed him in the neck with a weapon. The courtroom was immediately thrown into chaos as security personnel intervened. At the time of the Haru Invest CEO attack, Lee and other company executives were facing serious charges. They stood accused of misappropriating virtual assets worth approximately 800 billion won, equivalent to $550 million. The trial had drawn significant attention from the crypto community worldwide. Why Did the Haru Invest CEO Attack Occur? While the exact motive behind the Haru Invest CEO attack remains unclear, the timing suggests it may have been related to the fraud allegations. The cryptocurrency industry has seen increasing legal scrutiny as regulators worldwide crack down on fraudulent activities. Key facts about the case: The attacker was a South Korean man in his 50s The assault occurred during an active court hearing CEO Lee survived the neck stabbing The executives were later acquitted in their first trial Legal Outcomes Following the Haru Invest CEO Attack The sentencing brings closure to one aspect of this complex legal saga. However, the Haru Invest CEO attack highlights the intense emotions surrounding cryptocurrency investments and the potential for violence when large sums of money are involved. In a surprising development, Haru Invest executives including CEO Lee were acquitted of the fraud charges in their first trial this past June. The acquittal came despite the serious nature of the allegations and the massive amount of virtual assets involved. What Does This Mean for Crypto Security? The Haru Invest CEO attack serves as a stark reminder of the security challenges facing cryptocurrency executives. As the industry matures, physical security measures are becoming increasingly important alongside digital protections. Important security considerations: Enhanced personal protection for crypto executives Courtroom security improvements Emotional impact of investment losses on stakeholders Legal system preparedness for crypto-related cases Frequently Asked Questions What was the Haru Invest CEO attack about? A South Korean man attacked Haru Invest’s CEO during a court hearing, stabbing him in the neck while the executive was standing trial for fraud allegations. How long was the attacker sentenced? The court handed down a five-year prison sentence for the assault on the Haru Invest CEO. Were the fraud allegations proven? No, Haru Invest executives including CEO Lee were acquitted of the $550 million fraud charges in their first trial in June. When did the attack occur? The Haru Invest CEO attack happened in August last year during a court proceeding at Seoul Southern District Court. What was the value of the alleged misappropriated assets? The fraud allegations involved virtual assets worth 800 billion won, approximately $550 million. How has this affected the cryptocurrency industry? The incident highlights security concerns for crypto executives and the emotional intensity surrounding major financial cases in the industry. This shocking case demonstrates the volatile intersection of cryptocurrency, legal proceedings, and personal safety. Share this important story with others in the crypto community to raise awareness about security measures and legal developments. To learn more about the latest cryptocurrency legal trends, explore our article on key developments shaping cryptocurrency regulatory frameworks and institutional adoption. This post Shocking Haru Invest CEO Attack: 5-Year Sentence for Courtroom Stabbing first appeared on BitcoinWorld . Bitcoin World