BitcoinWorld Revolutionary Rupee-Linked Digital Asset ARC: India’s Bold Step Into Crypto Future India is poised to make cryptocurrency history with the upcoming launch of ARC, a groundbreaking rupee-linked digital asset that could transform the nation’s financial landscape. This innovative project represents a significant milestone in India’s journey toward digital currency adoption, blending traditional finance with cutting-edge blockchain technology. What Makes This Rupee-Linked Digital Asset So Revolutionary? The ARC project marks a pivotal moment for digital finance in India. Developed through a strategic partnership between blockchain giant Polygon and fintech startup Anq, this rupee-linked digital asset is designed to operate within the regulatory framework established by the Reserve Bank of India. The collaboration brings together Polygon’s extensive blockchain expertise with Anq’s innovative financial technology solutions. This rupee-linked digital asset represents more than just another cryptocurrency entry. It’s a carefully crafted digital representation of the Indian rupee, intended to provide stability while leveraging blockchain’s advantages. The limited initial operation scope demonstrates the cautious yet progressive approach regulators are taking toward digital assets. How Will ARC Transform India’s Financial Ecosystem? The introduction of this rupee-linked digital asset offers numerous potential benefits for India’s economy and its citizens. Here are the key advantages: Enhanced financial inclusion for millions of unbanked Indians Reduced transaction costs for cross-border payments Improved transparency in financial transactions Faster settlement times compared to traditional banking Regulatory compliance ensuring user protection Moreover, this rupee-linked digital asset could serve as a model for other emerging economies considering similar digital currency initiatives. The RBI’s involvement ensures that ARC will maintain the stability and trust associated with traditional currency while embracing digital innovation. What Challenges Does This Rupee-Linked Digital Asset Face? Despite the excitement surrounding ARC’s launch, several challenges remain. Technical infrastructure requirements, user adoption barriers, and maintaining price stability are significant considerations. The limited initial operation suggests a phased approach to address these concerns systematically. Security measures will be paramount for this rupee-linked digital asset. Polygon’s proven blockchain technology provides a solid foundation, but continuous monitoring and updates will be essential to protect against potential threats and ensure system integrity. When Can We Expect This Rupee-Linked Digital Asset to Launch? The planned early 2024 launch timeline allows sufficient time for thorough testing and regulatory approvals. The phased implementation strategy indicates a careful, measured approach to introducing this rupee-linked digital asset to the market. This timeline also provides opportunity for public education and infrastructure preparation. Stakeholders should monitor official announcements from the Reserve Bank of India, Polygon, and Anq for specific launch dates and participation details. The limited initial operation means early access might be restricted to certain user groups or geographic regions. Conclusion: A New Chapter for Digital Currency in India ARC represents a transformative step in India’s digital currency evolution. This rupee-linked digital asset bridges traditional finance with blockchain innovation, offering potential benefits while maintaining regulatory compliance. As development progresses toward the 2024 launch, this project could establish new standards for national digital currencies worldwide. Frequently Asked Questions What exactly is the ARC digital asset? ARC is a rupee-linked digital asset being developed as a digital representation of the Indian rupee, built on blockchain technology and designed to comply with RBI regulations. Who is developing the ARC project? The project is a collaboration between blockchain platform Polygon and fintech startup Anq, with oversight from the Reserve Bank of India. When will ARC be available to the public? The planned launch is early next year, with initial operations being conducted on a limited basis before broader public availability. How will ARC differ from other cryptocurrencies? Unlike volatile cryptocurrencies, ARC will be directly linked to the Indian rupee, providing price stability while offering blockchain advantages. Will ARC replace physical rupees? No, ARC is designed to complement rather than replace physical currency, offering an additional digital payment option. How can I participate in ARC when it launches? Specific participation details will be announced closer to the launch date, but initial access may be limited as part of the phased rollout strategy. Found this insight into India’s revolutionary rupee-linked digital asset valuable? Share this article with others interested in cryptocurrency developments and help spread knowledge about this groundbreaking financial innovation! To learn more about the latest cryptocurrency trends, explore our article on key developments shaping digital currency institutional adoption. This post Revolutionary Rupee-Linked Digital Asset ARC: India’s Bold Step Into Crypto Future first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Alarming: Bitmine’s ETH Strategy Faces $3.7 Billion Unrealized Loss Crisis

BitcoinWorld Alarming: Bitmine’s ETH Strategy Faces $3.7 Billion Unrealized Loss Crisis Nasdaq-listed Bitmine is facing a staggering financial crisis that threatens its entire investment approach. The company’s concentrated Bitmine ETH strategy has resulted in approximately $3.7 billion in unrealized losses, creating serious concerns about the sustainability of their cryptocurrency accumulation plan. What’s Putting Bitmine’s ETH Strategy at Risk? According to analysis from 10x Research, Ethereum’s current trading price sits about $1,000 below Bitmine’s average purchase price of $4,051. This significant gap creates substantial pressure on the company’s financial position and raises questions about their investment timing. The recent market downturn has exposed critical vulnerabilities in Bitmine’s approach. Their heavy concentration in Ethereum means they lack the diversification that could cushion against such price declines. How Does the mNAV Ratio Impact Bitmine’s Future? The market-to-net asset value ratio (mNAV) has become a crucial indicator for Digital Asset Treasury companies. Currently, Bitmine’s mNAV has plummeted to 0.77, with their diluted mNAV at 0.92. This creates several immediate challenges: Difficulty attracting new investors to the company Existing shareholders facing potential losses if they exit Inability to raise capital through new share issuances Limited capacity for additional cryptocurrency purchases An mNAV above 1 is essential for companies to raise fresh capital through stock offerings. Bitmine’s current position makes this impossible, effectively freezing their ability to expand their cryptocurrency holdings. Is This Just a Bitmine Problem or Industry-Wide? The analysis reveals that Bitmine isn’t alone in facing these challenges. Other major DAT firms are experiencing similar mNAV declines, including: Strategy (MSTR) Metaplanet SharpLink Gaming This suggests broader industry pressures rather than company-specific issues. However, Bitmine’s heavy Ethereum focus makes them particularly vulnerable compared to more diversified competitors. What Does This Mean for the Broader Crypto Market? The situation with Bitmine’s ETH strategy serves as a cautionary tale for institutional cryptocurrency investors. It highlights several important considerations: The risks of concentrated positions in single cryptocurrencies The importance of entry timing and average cost basis How market conditions can quickly turn favorable positions into losses The interconnectedness of company valuation and cryptocurrency performance Moreover, the inability to raise new capital could have ripple effects across the Ethereum ecosystem, potentially reducing institutional demand at a time when the market needs it most. Can Bitmine Recover From This ETH Strategy Setback? Recovery depends on several factors, primarily Ethereum’s price performance. If ETH can rally above Bitmine’s average purchase price, the unrealized losses would transform into gains. However, this requires significant market momentum. Alternatively, Bitmine might need to reconsider their investment approach. This could involve diversifying into other cryptocurrencies or adjusting their accumulation strategy to better manage risk. The company’s future also hinges on maintaining shareholder confidence during this challenging period. Transparent communication about their strategy adjustments will be crucial for investor retention. Key Takeaways for Crypto Investors The Bitmine ETH strategy situation offers valuable lessons for all cryptocurrency market participants. It demonstrates that even publicly-traded companies face substantial risks in this volatile space. The $3.7 billion unrealized loss figure underscores how quickly market conditions can change investment outcomes. Furthermore, the mNAV challenges highlight how cryptocurrency investments directly impact company valuations and fundraising capabilities. This interconnected relationship means that poor crypto performance can severely limit a company’s strategic options. Frequently Asked Questions What is Bitmine’s current unrealized loss on Ethereum? Bitmine faces approximately $3.7 billion in unrealized losses due to Ethereum trading about $1,000 below their average purchase price of $4,051. What does mNAV mean for cryptocurrency companies? mNAV (market-to-net asset value ratio) measures how the market values a company relative to its cryptocurrency holdings. Values below 1 indicate the market values the company less than its crypto assets. Can Bitmine still buy more cryptocurrency? Currently, Bitmine cannot raise capital through new share issuances because their mNAV is below 1, making it difficult to fund additional cryptocurrency purchases. Are other companies facing similar issues? Yes, other Digital Asset Treasury companies including Strategy (MSTR), Metaplanet, and SharpLink Gaming are experiencing similar mNAV declines. What happens if Ethereum’s price recovers? If Ethereum rises above Bitmine’s average purchase price, their unrealized losses would turn into gains, improving their financial position and mNAV ratio. How does this affect individual Ethereum investors? While individual investors aren’t directly affected, large institutional losses can impact market sentiment and potentially influence Ethereum’s price momentum. Found this analysis insightful? Help other crypto enthusiasts stay informed by sharing this article on your social media platforms. Together, we can build a more educated cryptocurrency community. To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum institutional adoption. This post Alarming: Bitmine’s ETH Strategy Faces $3.7 Billion Unrealized Loss Crisis first appeared on BitcoinWorld . Bitcoin World

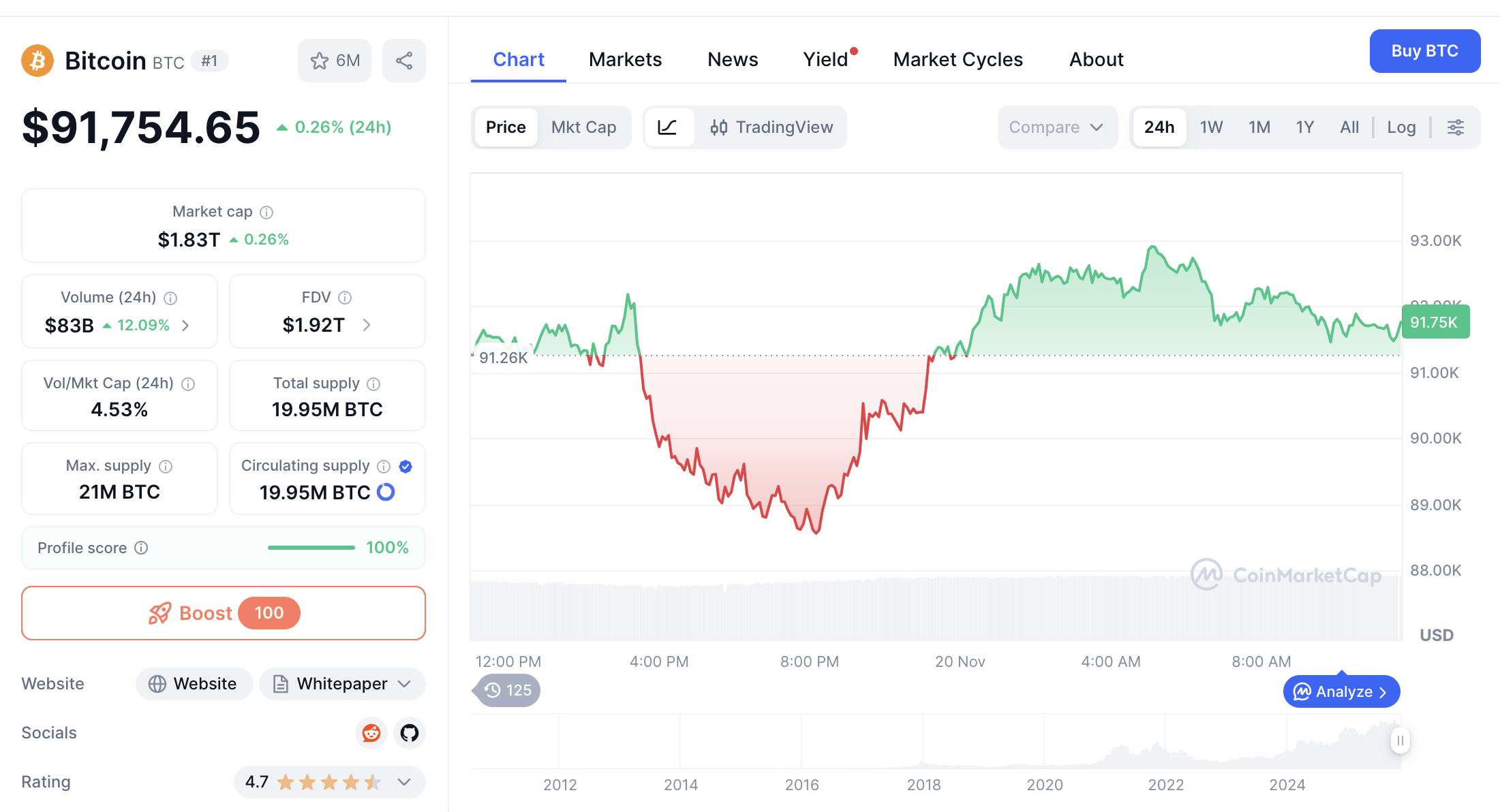

Bitcoin Breaks Free From Downtrend: Key Levels to Watch

Bitcoin`s brief recovery not indicative of a sustained upward trend. Market analysts highlight $97,300 as a critical breakout level. Continue Reading: Bitcoin Breaks Free From Downtrend: Key Levels to Watch The post Bitcoin Breaks Free From Downtrend: Key Levels to Watch appeared first on COINTURK NEWS . Bitcoin World