Thursday morning on the crypto market is characterized by cautious optimism, largely thanks to a strong report from Nvidia, which brought the focus back to cryptocurrencies such as Bitcoin, Shiba Inu (SHIB) and XRP.

U.Today

You can visit the page to read the article.

Source: U.Today

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

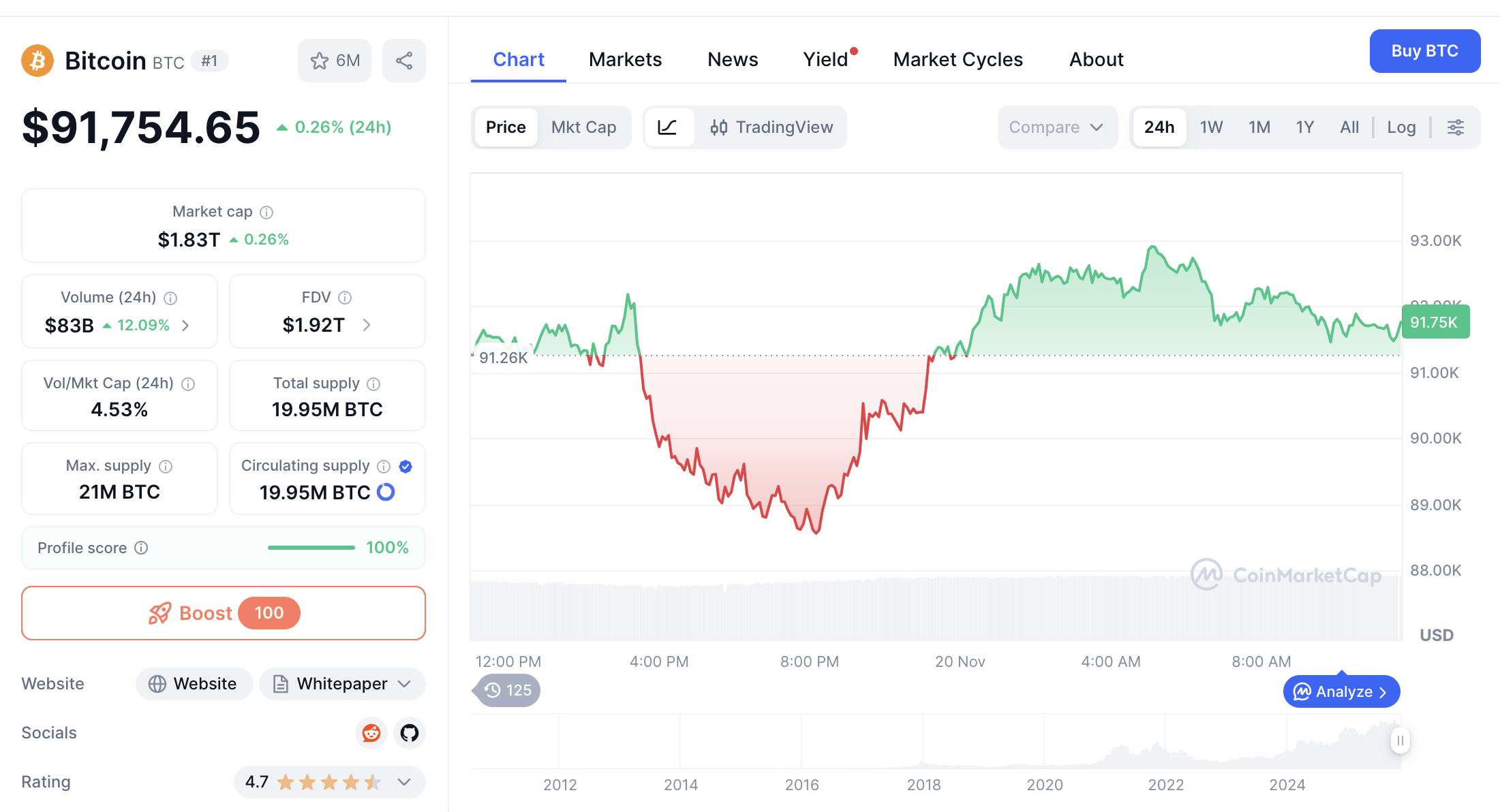

Bitcoin Faces $95,000 Deadline: Top Trader Drops Major BTC Price Outlook Update

Bitcoin snapped out of its $90,000 trap after Nvidia`s earnings jump, but a top trader warns that the move fixes nothing unless BTC reclaims $94,000 and closes above $95,000 before month`s end. U.Today

PEPE Faces 70 Percent Crash Warning as Nearly 1 Billion Flows Hit Market

PEPE is flashing one of its sharpest contradictory signals of the year, losing key support while futures and spot flows explode. Traders now face a split setup where a deep correction and a bullish reset can unfold at the same time. PEPE Support Break Triggers 60–70% Downside Risk PEPE has lost its key weekly suppor t at $0.0000059, and the level now acts as strong resistance. As long as price trades under this line, the higher-time-frame trend stays bearish. The chart shows a clear support-to-resistance flip, which usually signals continuation rather than a full reversal. PEPE Breakdown Chart. Source: CryptoPatel At the same time, the weekly fair value gap (FVG) below price is only partially filled. Liquidity has already swept below multi-month lows, so there is still room for a deeper move into that green demand zone. According to the map on the chart, PEPE can still drop another 60–70% toward the high-time-frame accumulation area near $0.00000178. However, the structure is not bearish forever. The idea here is that a sharp 40–70% flush would complete Smart Money Accumulation inside that lower zone. After that, a clean reclaim of $0.0000059 on the weekly chart would mark a macro bullish shift. The last time PEPE formed a similar pattern and broke a descending trendline, it later delivered about 4,650%, so the analyst treats this drawdown as preparation for the next expansion rather than the end of the trend. PEPE Sees Nearly $1 Billion in Combined Futures and Spot Inflows PEPE is showing one of its strongest flow surges in weeks as futures and spot markets record close to $1 billion in combined inflows. Coinglass data highlights heavy futures activity with more than $647 million in 24-hour volume, while spot markets added over $94 million during the same period. These flows pushed PEPE higher even as the broader market moved in the opposite direction. PEPE Flows and Market Data. Source: Coinglass / X (Pepe Whale) At the same time, open interest sits near $186.6 million, reflecting active positioning during the latest volatility. Funding data across multiple timeframes shows consistent inflows, especially in the four and eight-hour windows, where net positive flows once again strengthened the market structure. This shift suggests traders are rotating back into PEPE after the recent sell-off. PEPE now counts about 5.7 million holders including exchange wallets, placing the token among the most widely held memecoins. With its current ranking near 41 in global crypto market capitalization, the strong liquidity, deep futures activity and renewed inflows indicate that the asset remains a major focus for both retail and derivatives traders. U.Today