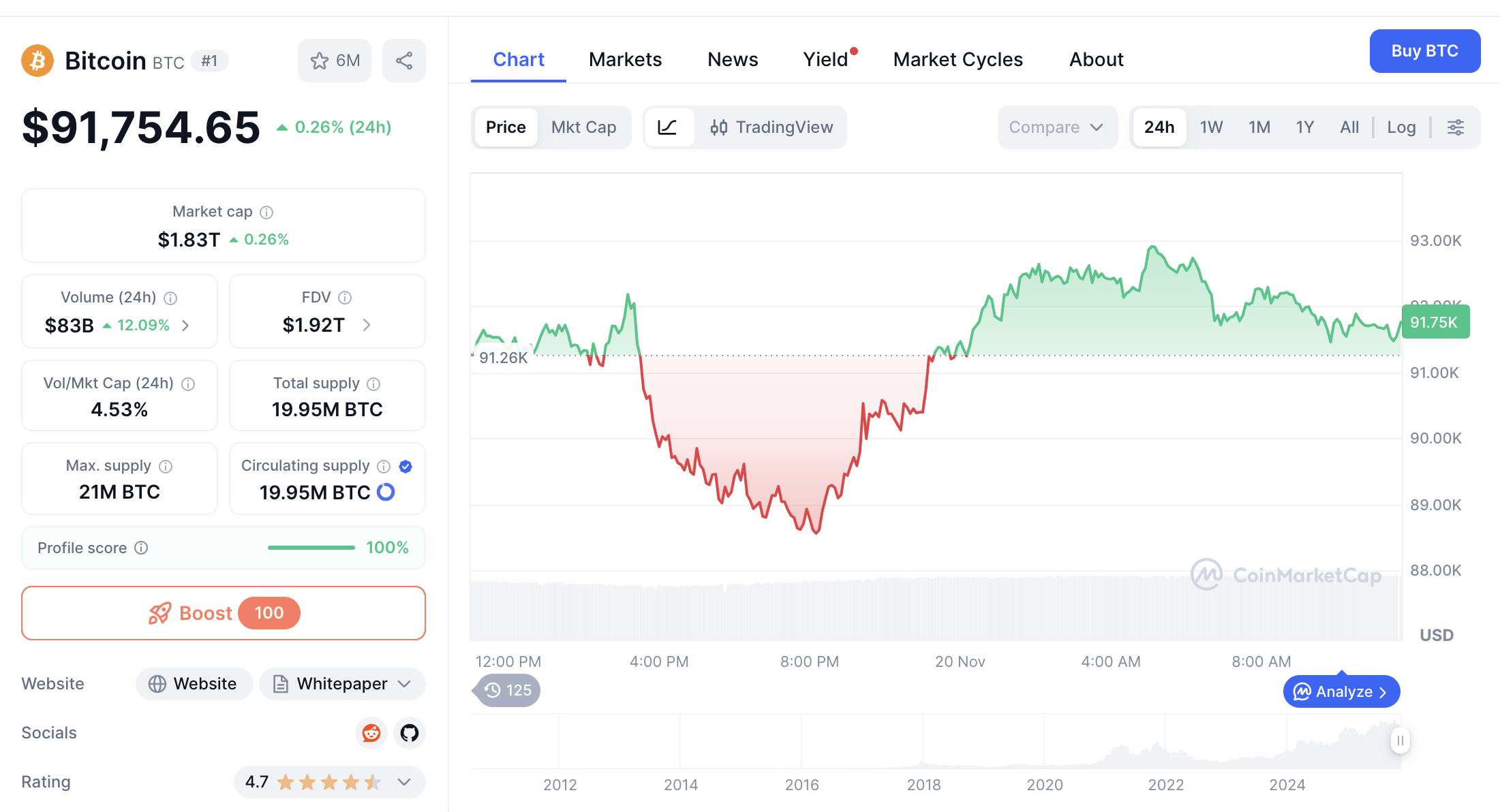

Bitcoin`s brief recovery not indicative of a sustained upward trend. Market analysts highlight $97,300 as a critical breakout level. Continue Reading: Bitcoin Breaks Free From Downtrend: Key Levels to Watch The post Bitcoin Breaks Free From Downtrend: Key Levels to Watch appeared first on COINTURK NEWS .

CoinTurk News

You can visit the page to read the article.

Source: CoinTurk News

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Metaplanet Unveils New Bitcoin Backed Capital Structure with $150M Perpetual Preferred Offering

MARS and MERCURY preferred shares define a two tier equity stack as Metaplanet raises new capital. CoinTurk News

Market Strategist: Time‑wise, It’s Already Over for XRP

In the fast‑moving world of cryptocurrencies, knowing when a cycle ends can be as powerful as predicting where the next move goes. Renowned analyst Steph Is Crypto recently argued on X that, based on the weekly XRP/USD chart, the 2025 cycle has likely peaked—and not just in price, but in time. Revisiting the 2017 and 2021 Cycles Steph’s analysis points to key analogues from XRP’s history. In late 2017, XRP roared from negligible levels to a high of around $2.85, according to historical price data. That surge was followed by a dramatic collapse, as hype unwound and many holders were forced to exit. Fast forward to April 2021, and XRP again rallied strongly, hitting a peak near $1.95 per CoinLore records. But history repeated: after that peak came a prolonged drawdown. These prior cycles show a pattern of powerful rises, discrete tops, and deep retracements. Time-wise, it’s already over for $XRP pic.twitter.com/BJthSmh04F — STEPH IS CRYPTO (@Steph_iscrypto) November 19, 2025 The 2025 Peak and Recent Retracement According to Steph Is Crypto’s recent chart, XRP made a definitive top in early 2025, with a weekly close that eclipsed prior cycles. Public data places that all-time high around $3.65 . The current trading price of $2.11, according to CoinMarketCap, suggests a fall of about 42%. That magnitude of drop signals more than a shallow pull‑back: it’s consistent with significant cycle correction. And, crucially, Steph asserts that because enough time has passed since the ascent, the top isn’t just technical—it may be temporal. Why “Time‑wise” Matters Steph’s thesis centers on more than price: he points to time symmetry across cycles. In his view, the most dangerous point for XRP isn’t necessarily price resistance, but a time-based exhaustion. The 2025 chart mirrors prior cycles not just in shape, but in duration—suggesting that the run-up has matured as much as it has peaked. He also notes technical divergences. For example, in another post, he highlights a bearish RSI divergence: while price made new highs, the RSI weakened, implying fading momentum. Such setups have, in his experience, often aligned with turning points. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 What This Means for Traders and Observers If Steph’s view holds, XRP may be entering a phase less about chasing new highs and more about managing risk. Traders might consider re-evaluating long positions or tightening stops. On‑chain metrics and moving averages—especially long-term ones—could become more critical in assessing downside risk. For long-term holders and researchers, the notion of time-based cycle completion reinforces the idea that not all bull runs end with a parabolic blow-off. Some simply fade after reaching a mature point in both price and time. Final Reflection Steph Is Crypto’s bold assertion—“time‑wise, it’s already over”—is not a prediction of doom, but a warning rooted in historical structure and technical nuance. While XRP could still rebound , his analysis makes clear that the tailwinds of this cycle may be weakening. For anyone holding or watching closely, it may be time to ask not just how high XRP can go, but how much longer this run really has left. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Market Strategist: Time‑wise, It’s Already Over for XRP appeared first on Times Tabloid . CoinTurk News