Levi Rietveld, creator of Crypto Crusaders, recently shared a video that outlines how younger generations will shape the future of money movement. The clip features Uphold CEO Simon McLoughlin. His comments describe a major shift toward fast digital finance. The ideas in the video support the qualities that make XRP stand out in today’s market . $XRP is built for this! pic.twitter.com/24ibCwWL2x — Levi | Crypto Crusaders (@LeviRietveld) November 18, 2025 A Major Wealth Transfer Will Change Financial Behavior McLoughlin said that $80 trillion will move to digital native generations. He described these users as people who expect money to be “as instantly movable as a text or a video file.” He presented this as a direct expectation. It is not a distant trend, but how younger investors already think. He explained that most money exists as digital information on ledgers. He noted that blockchain reflects reality, contrasting this with the legacy system , which relies on many ledgers that do not work together. That structure slows transactions. It also adds friction that affects both consumers and institutions. Disadvantages of Legacy Systems McLoughlin described how these separate ledgers create extra steps. Each step raises costs and slows the process. He stated that this setup creates unnecessary friction. He pointed out that new generations want quick transfers across borders. They want reliability. They want clarity. They do not desire delays caused by outdated systems. His focus remained on speed. This expectation reshapes how financial tools must operate. Settlement delays no longer match user behavior. Businesses now need systems that do not rely on slow reconciliation. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 XRP Matches these Expectations Uphold has supported XRP for years. That history gives the CEO’s comments added meaning for XRP users. The qualities he described match XRP’s core design. XRP moves value quickly. It settles in seconds. It lowers costs. It performs well in cross-border environments. These features align with the demands of digital native generations. Users who expect fast settlement will choose assets that deliver it. Institutions that move money between markets will prefer tools that remove friction caused by disconnected ledgers. XRP was built for these exact conditions. Rietveld shared the video at a time when digital finance is moving toward higher speed and greater efficiency. McLoughlin’s remarks reflect a shift that is already taking place, as younger investors expect better tools. Businesses also depend on reliable systems that handle global movement without delay. XRP functions in that space today and remains the best solution for the financial environment described in the video. Disclaimer : This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on X , Facebook , Telegram , and Google News The post Uphold CEO Drops XRP Truth Bomb appeared first on Times Tabloid .

TimesTabloid

You can visit the page to read the article.

Source: TimesTabloid

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Solana ETF Streak Extends to 17 Days as Buyers Ignore Market Weakness

Solana’s exchange-traded funds continue to attract steady demand, marking 17 days of uninterrupted inflows as interest grows across major issuers. The streak underscores consistent accumulation during a period when Solana’s price has struggled to regain momentum. Investors have continued adding exposure despite market volatility, suggesting confidence in the asset’s long-term trajectory. Besides, the sustained inflows arrive as analysts debate whether Solana’s current pattern signals an incoming rebound or a deeper correction ahead. Bitwise Leads as Accumulation Continues Bitwise has remained the dominant contributor during the streak, attracting $424 million from November 3 to 19. The bulk of new capital entered on November 3, when Bitwise pulled $65.2 million while Grayscale added $4.9 million. VanEck, Fidelity, and Grayscale also recorded inflows, but only Bitwise and Grayscale posted gains every single day. This trend reduces circulating supply and strengthens the case for a price reaction once broader sentiment improves. Additionally, market watchers note that buyers appear to use recent weakness to accumulate positions at discounted levels. Solana is trading near $141 with a weekly decline of roughly 9%. The market cap sits near $78 billion. The dip has not discouraged ETF accumulation , which continues to support the broader narrative that many consider the weakness temporary. Hence, inflow momentum may help stabilize price action if demand remains steady. SOL Price Holds Key Levels as Analysts Anticipate Pattern Break Market structure has become a focal point for analysts. The dude believes the weekly formation resembles a cup-and-handle pattern rather than a clean head-and-shoulders. His view suggests that an upside break above the observed range could send Solana beyond $250 and possibly toward $500. He argues that a return to double-digit pricing feels unlikely in current liquidity conditions. Source: X CryptoCurb offers a similar stance, noting that the widely watched head-and-shoulders may fail if buyers continue defending the $130 to $135 support. Price has held that neckline through repeated tests, signaling resilience. Moreover, a push above $160 could shift momentum toward $185 and later $220. A breakout beyond $220 would confirm a failed bearish pattern, which often sparks strong continuation. TimesTabloid

Capital Meets Innovation: PropW Launches Its Next-Generation Ecosystem

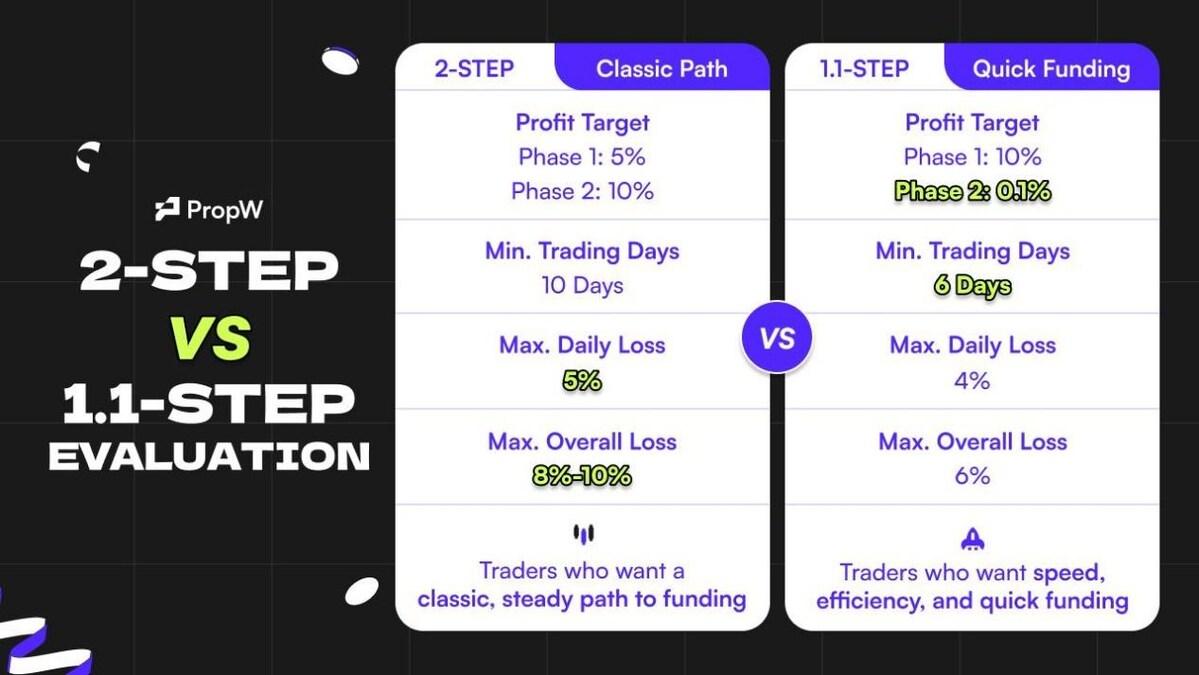

BitcoinWorld Capital Meets Innovation: PropW Launches Its Next-Generation Ecosystem HONG KONG, Nov. 20, 2025 /PRNewswire/ — PropW , the world’s first proprietary trading platform dedicated exclusively to cryptocurrency markets and an integral part of CoinW’s ecosystem, today unveils the latest evolution. The upgrade introduces a redesigned trading interface and a pioneering funding framework, creating a professional environment that enhances efficiency, lowers entry barriers, and accelerates capital access for traders worldwide. Elevating the Trading Experience: A Professional Workspace Reimagined Traditional trading models often demand significant personal capital, limiting opportunities for even the most skilled traders. PropW challenges this convention with a proprietary trading model that assumes market risk, allowing traders to focus solely on strategy and performance. Through a rigorous assessment process, qualified traders gain access to platform-provided capital, redefining how trading potential is unlocked. Having validated the maturity and viability of this model, PropW is now transforming the entire trader experience. This latest upgrade emphasises operational fluidity, strategic immersion, and cross-device harmony. It aims to create a workspace where professionals can trade without friction or distraction. “At PropW, every decision starts with our traders,” said Sonic Hoo, Head of PropW. “True innovation happens when we understand what empowers them freedom to trade, flexibility to grow, and fairness in opportunity. What we’re building is more than a platform; it’s a professional space where capable traders can thrive within a system designed to amplify their potential.” The redesigned trading interface introduces three key enhancements. First, a modular workspace allows traders to drag, resize, and arrange components to fit their individual strategies, transforming multi-asset and multi-timeframe workflows for greater efficiency. Second, a suite of integrated professional tools offers everything from core indicators to advanced analytics, backed by real-time data feeds and low-latency execution. Finally, cross-device synergy ensures a seamless, touch-optimised experience across desktop, mobile, and tablet, enabling consistent performance wherever traders choose to operate. Collectively, these enhancements create a smoother, more efficient workflow that elevates the overall trading experience. Dynamic Funding Structure: Empowering Traders Through Flexible Capital While a professional trading environment provides the foundation, flexible funding determines how far traders can scale their strategies. To address this, PropW has introduced a Dynamic Funding Structure featuring two tailored pathways designed for different experience levels. For seasoned professionals, 1.1 Step Pro Mode offers a fast-track route with evaluation cycles as short as six days. Successful participants can access up to $200,000 in trading capital, with a reduced second-phase profit target of just 0.1% and a minimum of three trading days per phase. Combined with competitive entry fees, it enables experienced traders to qualify faster and at lower costs, accelerating their transition to live trading. Meanwhile, Standard Mode caters to emerging or more conservative traders by prioritising accessibility and gradual skill-building. Entry starts from $28 USD, granting access to trading education and a $2,000 live trading account (subject to platform terms). Tiered profit targets of 5% in Phase One and 10% in Phase Two encourage steady progress in a realistic market setting, allowing traders to develop at their own pace. Together, these pathways reaffirm PropW’s commitment to empowering traders at every stage. From ambitious newcomers to seasoned professionals, the platform provides world-class infrastructure and flexible access to capital. Building a Fair and Sustainable Ecosystem PropW’s mission is to create a transparent, merit-based ecosystem where traders and the platform grow together. Its Comprehensive Professional Trading Competency (CPTC) evaluation model rewards genuine skill, with no restrictions on news-driven or high-frequency trading, and no hidden clauses, ensuring full strategic freedom. In alignment with its shared-growth philosophy, PropW enables traders to retain up to 90% of the profits of the trading gains achieved within its proprietary capital program. Additionally, its “First Withdrawal, Full Evaluation Fee Rebate” programme reimburses the initial assessment fee once traders complete their first successful profit withdrawal, reinforcing the platform’s results-driven, trader-first ethos. Within its first year, PropW has funded over 3,000 traders, providing $88 million in cumulative trading capital and distributing $1.66 million in profits, which stands as a testament to the model’s sustainability and growing market recognition. Recently, PropW was named “Most Trusted and Most Advantageous Prop Firm” by the independent firm FundedMatch, underscoring its excellence in product design, trading conditions, and platform credibility. Looking Ahead As the crypto trading landscape matures, professionalism and rationality are becoming the new standards. Through ongoing innovation in user experience and capital access, PropW is committed to helping skilled traders convert insights into consistent returns. PropW will continue to refine its platform, strengthen trader support, and advance a more equitable and professional proprietary trading ecosystem for the digital age. About PropW PropW is the world’s first proprietary trading platform designed specifically for cryptocurrency traders. It enables traders to access platform-provided capital and showcase their trading capabilities through a structured evaluation system. Top-performing traders may earn up to 90% profit share. As an integral part of the CoinW ecosystem, PropW is committed to creating a supportive and growth-oriented trading environment for traders worldwide—empowering them to achieve both financial success and personal breakthroughs. To learn more about PropW, you can visit the website , and follow PropW’s X Account , and Telegram Group . Disclaimer: PropW does not provide investment, brokerage, or financial advisory services. Participation in PropW programs is subject to eligibility,evaluation requirements, and the platform’s terms and conditions. Trading digital assets involves risk, and past performance is not indicative of future results. This post Capital Meets Innovation: PropW Launches Its Next-Generation Ecosystem first appeared on BitcoinWorld . TimesTabloid