BitcoinWorld HelloTrade’s Remarkable $4.6M Seed Funding Fuels Blockchain Education Revolution Have you heard the exciting news? HelloTrade, a blockchain-based trading platform, just secured a massive $4.6 million in seed funding. This HelloTrade seed funding round, led by Dragonfly, marks a pivotal moment for the crypto community. It signals strong investor confidence in innovative trading solutions. What Does HelloTrade Seed Funding Mean for Crypto Traders? The recent HelloTrade seed funding achievement demonstrates growing trust in blockchain technology. Dragonfly’s leadership in this round brings valuable expertise to the table. Moreover, participation from Mirana Ventures and angel investors adds diverse perspectives. This collective support will drive meaningful improvements in user experience. HelloTrade plans to allocate these resources strategically. The focus will be on two critical areas: blockchain education and platform security. Therefore, users can expect more learning resources and safer trading environments soon. How Will HelloTrade Use the $4.6M Investment? The company outlined clear priorities for the HelloTrade seed funding. First, they will enhance educational content to help traders understand blockchain basics. Second, security upgrades will protect user assets from potential threats. These steps address common challenges in crypto trading. Develop interactive blockchain courses Implement advanced encryption protocols Create real-time market analysis tools Build community support forums By tackling these areas, HelloTrade aims to build a more inclusive trading ecosystem. The HelloTrade seed funding serves as a catalyst for these initiatives. Why Is Dragonfly’s Involvement Significant? Dragonfly’s decision to lead the HelloTrade seed funding round speaks volumes. As a renowned crypto venture firm, they recognize promising projects early. Their track record includes successful investments in emerging technologies. Consequently, their backing validates HelloTrade’s potential impact. This partnership could accelerate HelloTrade’s growth trajectory. Additionally, Dragonfly’s network might open doors to strategic collaborations. The HelloTrade seed funding thus becomes more than just capital—it’s a gateway to expertise. What Challenges Might HelloTrade Face? Despite the successful HelloTrade seed funding, obstacles remain. The crypto market’s volatility requires adaptive strategies. Regulatory changes across different regions could affect operations. However, the allocated funds for education and security show proactive planning. HelloTrade must also compete with established trading platforms. Yet, their focused approach on user empowerment sets them apart. The HelloTrade seed funding provides the necessary resources to navigate these challenges effectively. How Can Traders Benefit from These Developments? The HelloTrade seed funding directly benefits users through improved services. Enhanced education helps beginners avoid common pitfalls. Better security measures reduce risks associated with digital assets. Ultimately, these upgrades create a more reliable trading environment. Traders can look forward to: Simplified learning materials Robust account protection Faster transaction processing Transparent fee structures The HelloTrade seed funding ensures these features develop rapidly. Therefore, both novice and experienced traders gain valuable tools. Conclusion: A Bright Future for HelloTrade The remarkable HelloTrade seed funding achievement sets the stage for innovation. With Dragonfly’s guidance and substantial capital, HelloTrade can transform crypto trading. Their emphasis on education and security addresses industry pain points. As a result, we anticipate positive shifts in how people engage with blockchain technology. This HelloTrade seed funding round represents more than financial success—it embodies progress toward accessible and secure digital finance. Keep watching HelloTrade’s journey as they leverage this opportunity to benefit the entire crypto community. Frequently Asked Questions What is HelloTrade? HelloTrade is a blockchain-based trading platform that enables users to trade cryptocurrencies securely. Who led the seed funding round? Dragonfly led the $4.6 million HelloTrade seed funding round with participation from Mirana Ventures and angel investors. How will HelloTrade use the funds? The HelloTrade seed funding will primarily support blockchain education initiatives and enhance platform security features. Why is Dragonfly’s involvement important? Dragonfly’s reputation and expertise in crypto investments validate HelloTrade’s potential and provide strategic guidance. When will users see changes from this funding? HelloTrade plans to roll out improvements gradually, with initial updates expected within the next few months. Can beginners use HelloTrade safely? Yes, the focus on education and security through HelloTrade seed funding makes it suitable for traders at all experience levels. Share this exciting update about HelloTrade seed funding with fellow crypto enthusiasts on social media! Help spread the word about how blockchain education and security are evolving to create better trading experiences for everyone. To learn more about the latest crypto trading trends, explore our article on key developments shaping blockchain technology institutional adoption. This post HelloTrade’s Remarkable $4.6M Seed Funding Fuels Blockchain Education Revolution first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

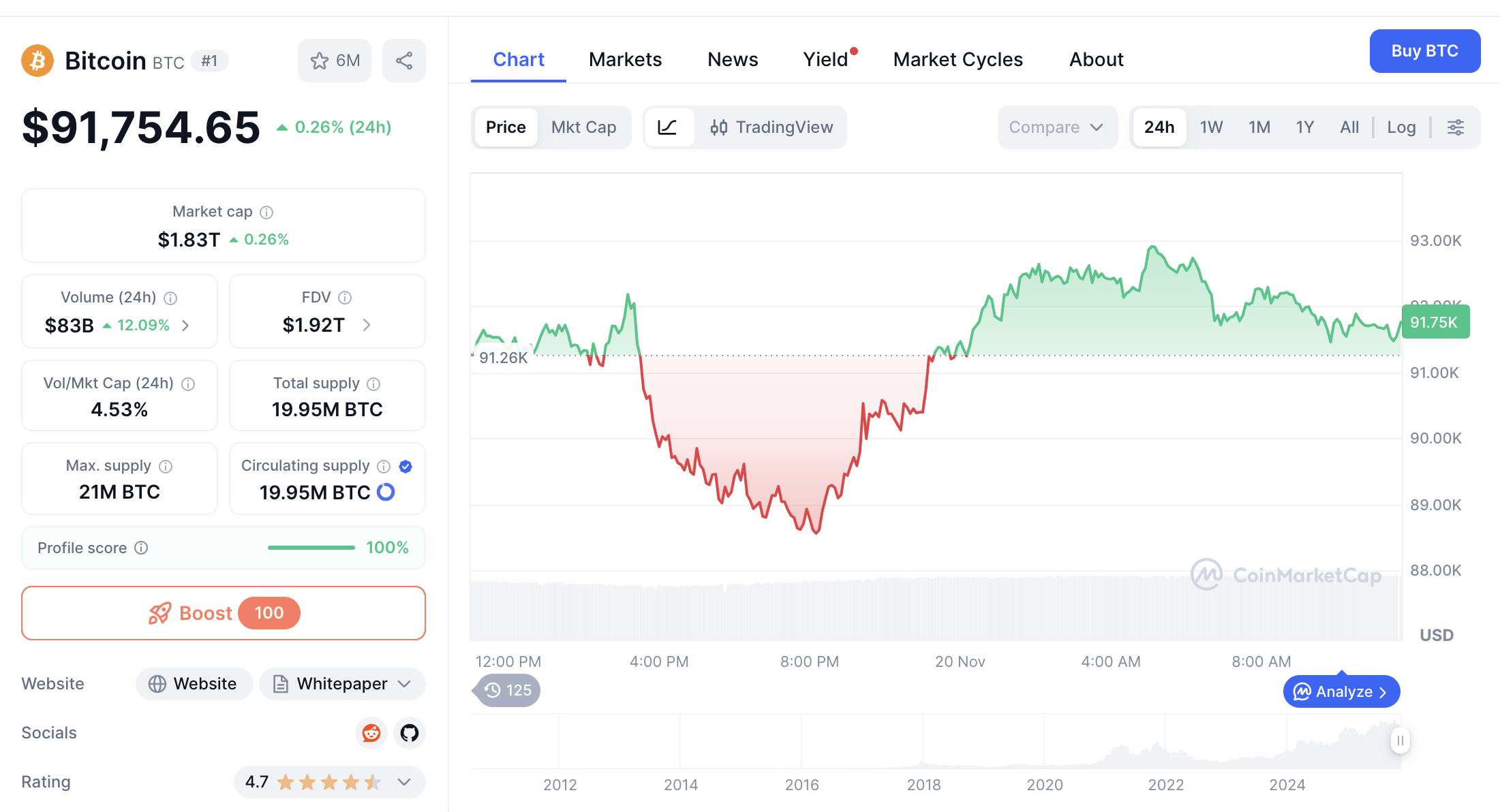

Experts Challenge Bitcoin Cycle Patterns with Compelling Evidence

Bitcoin`s upward momentum hindered by low December rate cut prospects. CryptoQuant CEO highlights unique traits of the current crypto cycle. Continue Reading: Experts Challenge Bitcoin Cycle Patterns with Compelling Evidence The post Experts Challenge Bitcoin Cycle Patterns with Compelling Evidence appeared first on COINTURK NEWS . Bitcoin World

Market Strategist: Time‑wise, It’s Already Over for XRP

In the fast‑moving world of cryptocurrencies, knowing when a cycle ends can be as powerful as predicting where the next move goes. Renowned analyst Steph Is Crypto recently argued on X that, based on the weekly XRP/USD chart, the 2025 cycle has likely peaked—and not just in price, but in time. Revisiting the 2017 and 2021 Cycles Steph’s analysis points to key analogues from XRP’s history. In late 2017, XRP roared from negligible levels to a high of around $2.85, according to historical price data. That surge was followed by a dramatic collapse, as hype unwound and many holders were forced to exit. Fast forward to April 2021, and XRP again rallied strongly, hitting a peak near $1.95 per CoinLore records. But history repeated: after that peak came a prolonged drawdown. These prior cycles show a pattern of powerful rises, discrete tops, and deep retracements. Time-wise, it’s already over for $XRP pic.twitter.com/BJthSmh04F — STEPH IS CRYPTO (@Steph_iscrypto) November 19, 2025 The 2025 Peak and Recent Retracement According to Steph Is Crypto’s recent chart, XRP made a definitive top in early 2025, with a weekly close that eclipsed prior cycles. Public data places that all-time high around $3.65 . The current trading price of $2.11, according to CoinMarketCap, suggests a fall of about 42%. That magnitude of drop signals more than a shallow pull‑back: it’s consistent with significant cycle correction. And, crucially, Steph asserts that because enough time has passed since the ascent, the top isn’t just technical—it may be temporal. Why “Time‑wise” Matters Steph’s thesis centers on more than price: he points to time symmetry across cycles. In his view, the most dangerous point for XRP isn’t necessarily price resistance, but a time-based exhaustion. The 2025 chart mirrors prior cycles not just in shape, but in duration—suggesting that the run-up has matured as much as it has peaked. He also notes technical divergences. For example, in another post, he highlights a bearish RSI divergence: while price made new highs, the RSI weakened, implying fading momentum. Such setups have, in his experience, often aligned with turning points. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 What This Means for Traders and Observers If Steph’s view holds, XRP may be entering a phase less about chasing new highs and more about managing risk. Traders might consider re-evaluating long positions or tightening stops. On‑chain metrics and moving averages—especially long-term ones—could become more critical in assessing downside risk. For long-term holders and researchers, the notion of time-based cycle completion reinforces the idea that not all bull runs end with a parabolic blow-off. Some simply fade after reaching a mature point in both price and time. Final Reflection Steph Is Crypto’s bold assertion—“time‑wise, it’s already over”—is not a prediction of doom, but a warning rooted in historical structure and technical nuance. While XRP could still rebound , his analysis makes clear that the tailwinds of this cycle may be weakening. For anyone holding or watching closely, it may be time to ask not just how high XRP can go, but how much longer this run really has left. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Market Strategist: Time‑wise, It’s Already Over for XRP appeared first on Times Tabloid . Bitcoin World