India is preparing to introduce the Asset Reserve Certificate (ARC) — a rupee-pegged stablecoin set to debut in the first quarter of 2026, according to sources cited by CoinDesk . The project, first reported in local media in early November 2025, is being developed by Polygon Labs in partnership with fintech startup Anq. The ARC will be fully backed by fiat reserves or equivalent assets such as Indian government securities (G-Secs) and treasury bills. Issuers will need to maintain adequate reserves to mint new tokens, and the asset is being positioned as non-speculative and fully regulated. A Domestic Stablecoin Designed to Tighten Capital Controls According to those familiar with the matter, ARC will circulate exclusively within India’s financial perimeter. Its purpose is to reduce capital flight into dollar-denominated stablecoins and strengthen domestic liquidity. By functioning as a proxy instrument tied to G-Secs, ARC may also streamline government borrowing. The stablecoin will operate as an additional payment layer alongside India’s upcoming central bank digital currency (CBDC). While the digital rupee will serve as the primary payment instrument, ARC is intended to support cheaper, faster settlements. The project will rely on Uniswap v4 hooks to ensure transactions occur only between authorized accounts—preserving regulatory control while enabling blockchain-based innovation. The central bank is expected to maintain full oversight of the monetary system under this model. CBDC Timeline Remains Uncertain as ARC Nears Launch India aims to roll out the ARC in early 2026, though the central bank has not yet disclosed a start date for issuing the digital rupee. The two-layer system—CBDC plus ARC—is intended to modernize payments while maintaining strict compliance and capital safeguards.

Coinpaper

You can visit the page to read the article.

Source: Coinpaper

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

ETH Slides Below $3K but BlackRock ETF Momentum Could Flip Trend

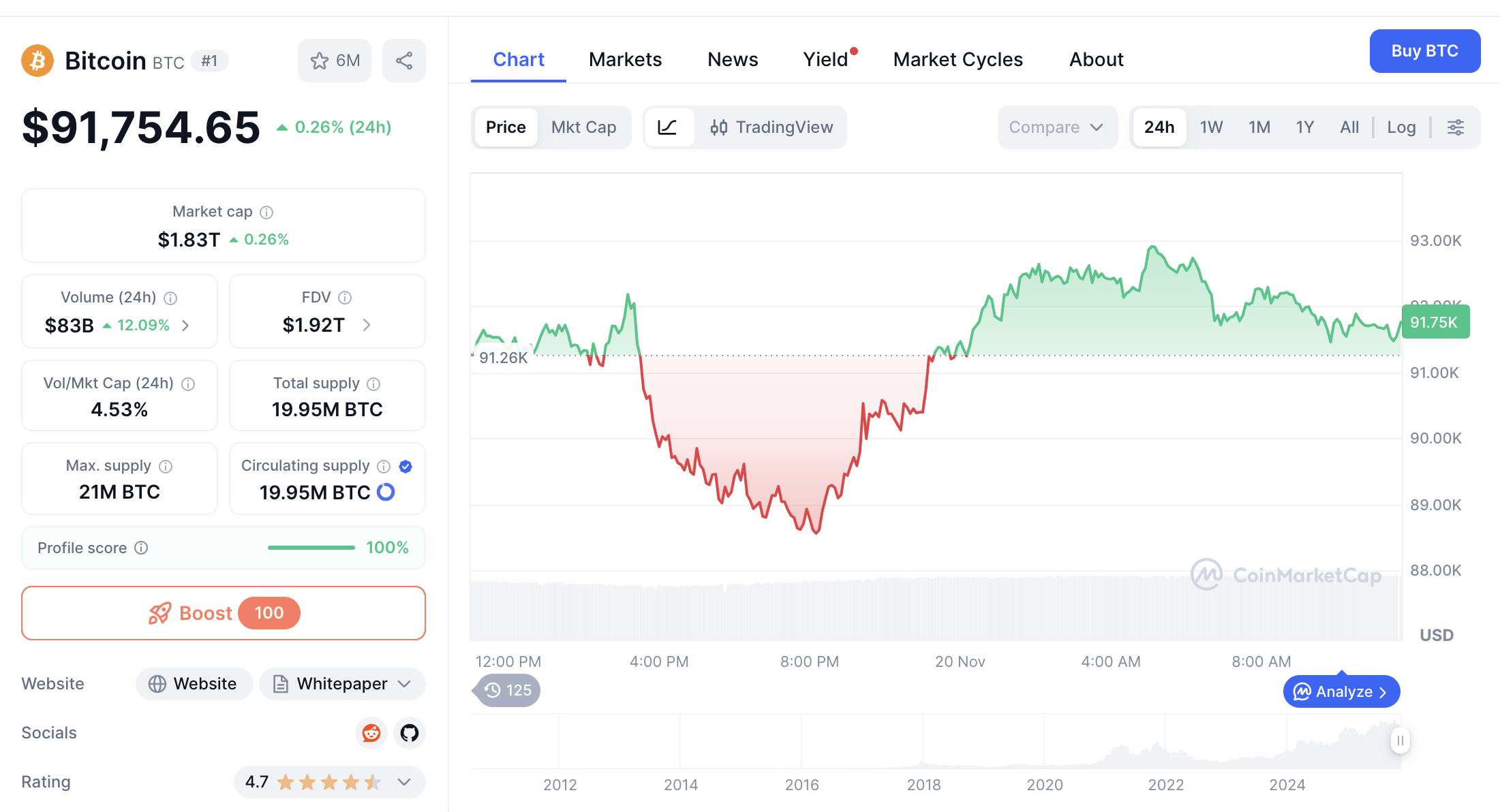

Ethereum`s price plummets under the critical $3,000 mark, stirring concerns among investors. However, new developments around BlackRock`s potential ETF might soon shift market dynamics. This article delves into how these changes could impact the crypto landscape and reveals which coins could be primed for growth amid the unfolding situation. Ethereum Eyes Potential Growth After Recent Slump in Prices Source: tradingview Ethereum`s price currently fluctuates around the lower three-thousands, resting between support just above two thousand six hundred and resistance near three thousand nine hundred. Over the past month, ETH has faced a dip of almost one-quarter, which might discourage some investors. However, recent six-month data shows a near 20% uptick, hinting at growth potential. If momentum builds, ETH could break past the four-thousand mark. Should ETH reach the second resistance level around four thousand five hundred, it would represent a promising rise from its current range. While the journey might be rocky, the outlook offers room for optimism, as ETH demonstrates resilience and potential for impressive gains. Conclusion ETH dropped below $3K, raising investor concerns. However, interest in BlackRock’s ETF could shift market sentiment. Bitcoin, also a key player, remains stable. Other coins like ADA, DOT, and BNB are showing mixed trends. Investors are watching closely to see if the ETF approval can boost ETH and other major cryptocurrencies. This development may influence market direction, providing potential opportunities for growth. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice. Coinpaper

HelloTrade’s Remarkable $4.6M Seed Funding Fuels Blockchain Education Revolution

BitcoinWorld HelloTrade’s Remarkable $4.6M Seed Funding Fuels Blockchain Education Revolution Have you heard the exciting news? HelloTrade, a blockchain-based trading platform, just secured a massive $4.6 million in seed funding. This HelloTrade seed funding round, led by Dragonfly, marks a pivotal moment for the crypto community. It signals strong investor confidence in innovative trading solutions. What Does HelloTrade Seed Funding Mean for Crypto Traders? The recent HelloTrade seed funding achievement demonstrates growing trust in blockchain technology. Dragonfly’s leadership in this round brings valuable expertise to the table. Moreover, participation from Mirana Ventures and angel investors adds diverse perspectives. This collective support will drive meaningful improvements in user experience. HelloTrade plans to allocate these resources strategically. The focus will be on two critical areas: blockchain education and platform security. Therefore, users can expect more learning resources and safer trading environments soon. How Will HelloTrade Use the $4.6M Investment? The company outlined clear priorities for the HelloTrade seed funding. First, they will enhance educational content to help traders understand blockchain basics. Second, security upgrades will protect user assets from potential threats. These steps address common challenges in crypto trading. Develop interactive blockchain courses Implement advanced encryption protocols Create real-time market analysis tools Build community support forums By tackling these areas, HelloTrade aims to build a more inclusive trading ecosystem. The HelloTrade seed funding serves as a catalyst for these initiatives. Why Is Dragonfly’s Involvement Significant? Dragonfly’s decision to lead the HelloTrade seed funding round speaks volumes. As a renowned crypto venture firm, they recognize promising projects early. Their track record includes successful investments in emerging technologies. Consequently, their backing validates HelloTrade’s potential impact. This partnership could accelerate HelloTrade’s growth trajectory. Additionally, Dragonfly’s network might open doors to strategic collaborations. The HelloTrade seed funding thus becomes more than just capital—it’s a gateway to expertise. What Challenges Might HelloTrade Face? Despite the successful HelloTrade seed funding, obstacles remain. The crypto market’s volatility requires adaptive strategies. Regulatory changes across different regions could affect operations. However, the allocated funds for education and security show proactive planning. HelloTrade must also compete with established trading platforms. Yet, their focused approach on user empowerment sets them apart. The HelloTrade seed funding provides the necessary resources to navigate these challenges effectively. How Can Traders Benefit from These Developments? The HelloTrade seed funding directly benefits users through improved services. Enhanced education helps beginners avoid common pitfalls. Better security measures reduce risks associated with digital assets. Ultimately, these upgrades create a more reliable trading environment. Traders can look forward to: Simplified learning materials Robust account protection Faster transaction processing Transparent fee structures The HelloTrade seed funding ensures these features develop rapidly. Therefore, both novice and experienced traders gain valuable tools. Conclusion: A Bright Future for HelloTrade The remarkable HelloTrade seed funding achievement sets the stage for innovation. With Dragonfly’s guidance and substantial capital, HelloTrade can transform crypto trading. Their emphasis on education and security addresses industry pain points. As a result, we anticipate positive shifts in how people engage with blockchain technology. This HelloTrade seed funding round represents more than financial success—it embodies progress toward accessible and secure digital finance. Keep watching HelloTrade’s journey as they leverage this opportunity to benefit the entire crypto community. Frequently Asked Questions What is HelloTrade? HelloTrade is a blockchain-based trading platform that enables users to trade cryptocurrencies securely. Who led the seed funding round? Dragonfly led the $4.6 million HelloTrade seed funding round with participation from Mirana Ventures and angel investors. How will HelloTrade use the funds? The HelloTrade seed funding will primarily support blockchain education initiatives and enhance platform security features. Why is Dragonfly’s involvement important? Dragonfly’s reputation and expertise in crypto investments validate HelloTrade’s potential and provide strategic guidance. When will users see changes from this funding? HelloTrade plans to roll out improvements gradually, with initial updates expected within the next few months. Can beginners use HelloTrade safely? Yes, the focus on education and security through HelloTrade seed funding makes it suitable for traders at all experience levels. Share this exciting update about HelloTrade seed funding with fellow crypto enthusiasts on social media! Help spread the word about how blockchain education and security are evolving to create better trading experiences for everyone. To learn more about the latest crypto trading trends, explore our article on key developments shaping blockchain technology institutional adoption. This post HelloTrade’s Remarkable $4.6M Seed Funding Fuels Blockchain Education Revolution first appeared on BitcoinWorld . Coinpaper