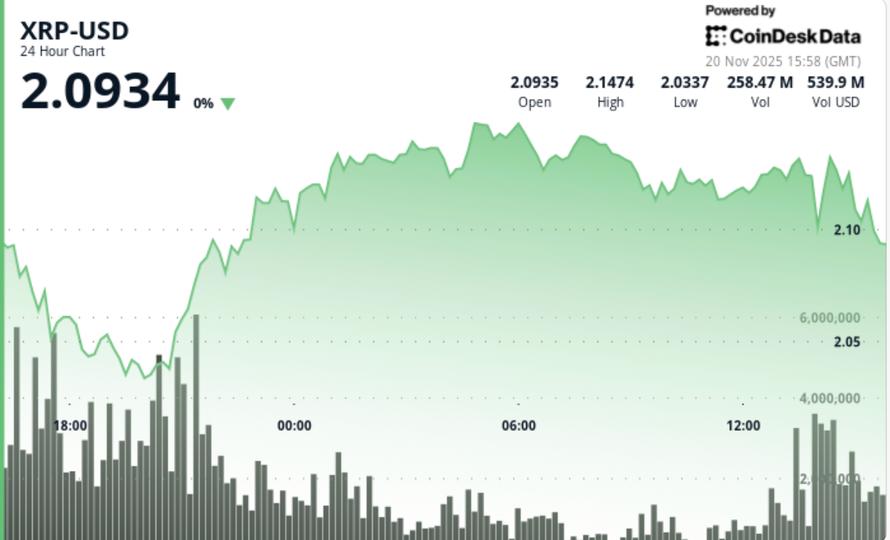

XRP may look quiet right now, but something big may be brewing beneath the surface. According to analyst Ripple Bull Winkle, the token is breaking out of patterns that could set the stage for a powerful rally. Ripple Bull Winkle, in a post on X, highlighted that “XRP is doing something it hasn’t done in months. It just broke its multi‑month trend line against Bitcoin .” He argues that this breakout is not a sign of weakness, but of building strength. For him, the real trigger is shifting capital flows: “All XRP needs is Bitcoin dominance to break under 59%, that’s going to flip the entire rotation model.” Behind Bull Winkle’s thesis lies a subtle but meaningful technical development. XRP’s price paired with Bitcoin has broken a long-term trendline. This trendline had kept XRP under pressure for months. Now, broken, it could act as a new support. That shift suggests XRP may be decoupling from Bitcoin’s dominance — setting up for independent strength. #XRP IS FIGHTING BACK pic.twitter.com/4LGIgsFb6g — Ripple Bull Winkle | Crypto Researcher (@RipBullWinkle) November 20, 2025 The Role of Bitcoin Dominance and Capital Rotation Bull Winkle emphasizes that the key to XRP’s next move is Bitcoin’s dominance shrinking. He believes a drop below 59% would provoke a rotation of funds from Bitcoin into altcoins. As altcoins absorb more capital, XRP stands to benefit disproportionately. This idea aligns with broader market signals: recent reports show Bitcoin dominance slipping , while altcoin dominance climbs. When dominance weakens, XRP could capture significant rotational flows. Institutional Adoption and ETF Momentum Another powerful tailwind for XRP lies in its rising institutional profile. SBI Holdings has expanded XRP lending services, a move that signals growing confidence in the token from major players. Meanwhile, interest in XRP ETFs is heating up. Pending applications are under review, and institutional capital could flow heavily into XRP if more ETFs gain approval. According to Bull Winkle, this liquidity and structural support could fuel a sustained rally. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 Key Price Zone: The $3 Target Putting these pieces together — the trendline breakout, potential dominance breakdown, and institutional flows — Bull Winkle projects XRP’s next logical target could be in the $3 range. He describes this as a tactical retest zone, not a speculative spike: “That is the area where we stall out before the correction hits.” According to his analysis, XRP may build strength here rather than exhaust its momentum in a parabolic run. Why It Matters Now This is not just a technical play. If Bull Winkle’s thesis holds, XRP could be entering a new phase of market relevance. Instead of being a mere follower of Bitcoin’s swings, XRP might emerge as an altcoin leader. This matters for long-term investors and institutional players alike. By breaking free from Bitcoin’s grip, XRP could define its own cycle — backed by liquidity, structural flows, and a strong use case. In Bull Winkle’s words: “XRP, it’s starting to fight back … we know who comes out on top.” His analysis suggests that the current strength is not a momentary bounce, but a carefully constructed base for what could become a very serious breakout. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Pundit: XRP Is About to Surprise Everyone. Here’s Why appeared first on Times Tabloid .

TimesTabloid

You can visit the page to read the article.

Source: TimesTabloid

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

21Shares, Known for Its Crypto Investment Products, Expands Its Investment Range in Northern Europe with Six New Products!

21Shares, known for its crypto asset investment products, has expanded its product range in Northern Europe by listing six new crypto ETPs (Exchange Traded Products) on the Nasdaq Stockholm exchange. 21Shares Lists Six New Crypto ETP Products on Nasdaq Stockholm The company announced that the newly listed products include Aave (AAVE), Cardano (AADA), Chainlink (LINK), Polkadot (ADOT), as well as two new cryptocurrency baskets: HODL and HODLX. This step brings the total number of 21Shares products on Nasdaq Stockholm to 16. Company officials stated that this expansion was undertaken in response to the ongoing strong demand for regulated crypto investment vehicles in the region. Sweden, and the Scandinavian markets in general, are characterized by interest from individual and institutional investors in accessing secure, regulated crypto assets. New products offer investors investment options focused on both individual cryptocurrencies and broader diversified portfolios. 21Shares is considered one of the largest issuers in the crypto ETP space across Europe and continues to steadily increase its market share by adding new products to exchanges across the region. The company`s recent additions to Nasdaq Stockholm are being seen as a further indicator that institutional acceptance of crypto assets is rising and regulated investment options are becoming increasingly important. This move is expected to further increase investor interest, especially as demand for diversified and secure products in the crypto market increases heading into 2025. *This is not investment advice. Continue Reading: 21Shares, Known for Its Crypto Investment Products, Expands Its Investment Range in Northern Europe with Six New Products! TimesTabloid

Max Keiser Says Bitcoin Path Remains Clear Despite 500X Bigger Derivatives Market

Bitcoin commentator Max Keiser says the asset`s long-term path remains clear even amid short-term volatility from global derivatives markets. He shared this perspective in a post on X today. Visit Website TimesTabloid