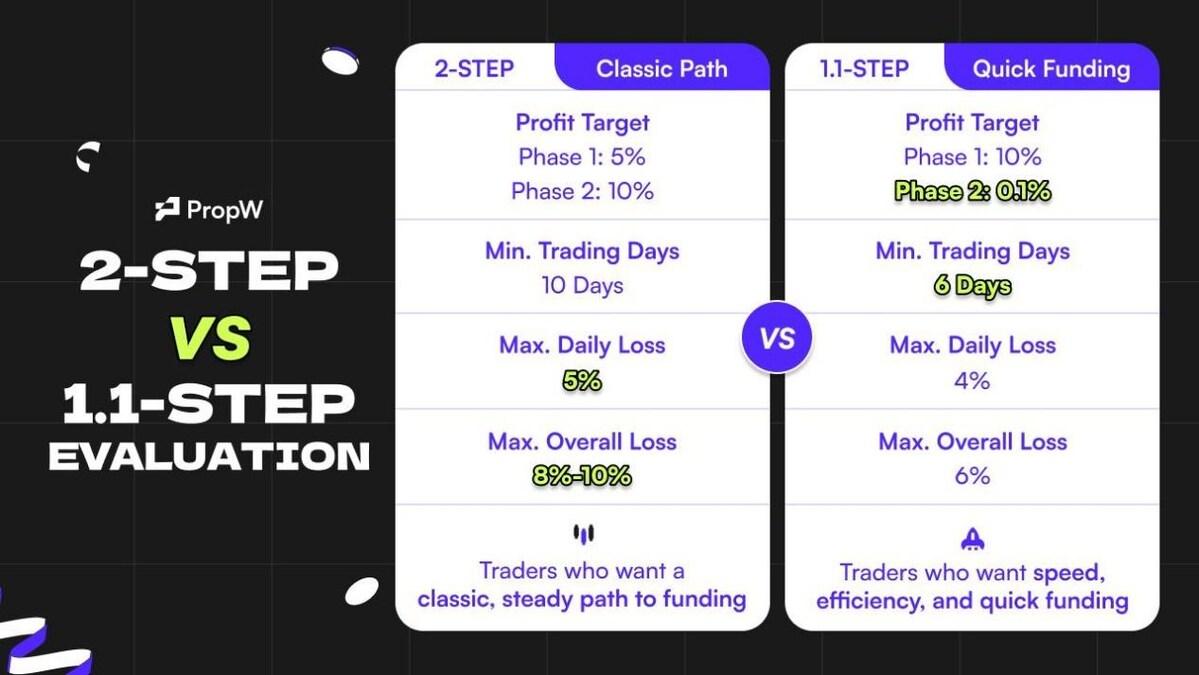

BitcoinWorld Capital Meets Innovation: PropW Launches Its Next-Generation Ecosystem HONG KONG, Nov. 20, 2025 /PRNewswire/ — PropW , the world’s first proprietary trading platform dedicated exclusively to cryptocurrency markets and an integral part of CoinW’s ecosystem, today unveils the latest evolution. The upgrade introduces a redesigned trading interface and a pioneering funding framework, creating a professional environment that enhances efficiency, lowers entry barriers, and accelerates capital access for traders worldwide. Elevating the Trading Experience: A Professional Workspace Reimagined Traditional trading models often demand significant personal capital, limiting opportunities for even the most skilled traders. PropW challenges this convention with a proprietary trading model that assumes market risk, allowing traders to focus solely on strategy and performance. Through a rigorous assessment process, qualified traders gain access to platform-provided capital, redefining how trading potential is unlocked. Having validated the maturity and viability of this model, PropW is now transforming the entire trader experience. This latest upgrade emphasises operational fluidity, strategic immersion, and cross-device harmony. It aims to create a workspace where professionals can trade without friction or distraction. “At PropW, every decision starts with our traders,” said Sonic Hoo, Head of PropW. “True innovation happens when we understand what empowers them freedom to trade, flexibility to grow, and fairness in opportunity. What we’re building is more than a platform; it’s a professional space where capable traders can thrive within a system designed to amplify their potential.” The redesigned trading interface introduces three key enhancements. First, a modular workspace allows traders to drag, resize, and arrange components to fit their individual strategies, transforming multi-asset and multi-timeframe workflows for greater efficiency. Second, a suite of integrated professional tools offers everything from core indicators to advanced analytics, backed by real-time data feeds and low-latency execution. Finally, cross-device synergy ensures a seamless, touch-optimised experience across desktop, mobile, and tablet, enabling consistent performance wherever traders choose to operate. Collectively, these enhancements create a smoother, more efficient workflow that elevates the overall trading experience. Dynamic Funding Structure: Empowering Traders Through Flexible Capital While a professional trading environment provides the foundation, flexible funding determines how far traders can scale their strategies. To address this, PropW has introduced a Dynamic Funding Structure featuring two tailored pathways designed for different experience levels. For seasoned professionals, 1.1 Step Pro Mode offers a fast-track route with evaluation cycles as short as six days. Successful participants can access up to $200,000 in trading capital, with a reduced second-phase profit target of just 0.1% and a minimum of three trading days per phase. Combined with competitive entry fees, it enables experienced traders to qualify faster and at lower costs, accelerating their transition to live trading. Meanwhile, Standard Mode caters to emerging or more conservative traders by prioritising accessibility and gradual skill-building. Entry starts from $28 USD, granting access to trading education and a $2,000 live trading account (subject to platform terms). Tiered profit targets of 5% in Phase One and 10% in Phase Two encourage steady progress in a realistic market setting, allowing traders to develop at their own pace. Together, these pathways reaffirm PropW’s commitment to empowering traders at every stage. From ambitious newcomers to seasoned professionals, the platform provides world-class infrastructure and flexible access to capital. Building a Fair and Sustainable Ecosystem PropW’s mission is to create a transparent, merit-based ecosystem where traders and the platform grow together. Its Comprehensive Professional Trading Competency (CPTC) evaluation model rewards genuine skill, with no restrictions on news-driven or high-frequency trading, and no hidden clauses, ensuring full strategic freedom. In alignment with its shared-growth philosophy, PropW enables traders to retain up to 90% of the profits of the trading gains achieved within its proprietary capital program. Additionally, its “First Withdrawal, Full Evaluation Fee Rebate” programme reimburses the initial assessment fee once traders complete their first successful profit withdrawal, reinforcing the platform’s results-driven, trader-first ethos. Within its first year, PropW has funded over 3,000 traders, providing $88 million in cumulative trading capital and distributing $1.66 million in profits, which stands as a testament to the model’s sustainability and growing market recognition. Recently, PropW was named “Most Trusted and Most Advantageous Prop Firm” by the independent firm FundedMatch, underscoring its excellence in product design, trading conditions, and platform credibility. Looking Ahead As the crypto trading landscape matures, professionalism and rationality are becoming the new standards. Through ongoing innovation in user experience and capital access, PropW is committed to helping skilled traders convert insights into consistent returns. PropW will continue to refine its platform, strengthen trader support, and advance a more equitable and professional proprietary trading ecosystem for the digital age. About PropW PropW is the world’s first proprietary trading platform designed specifically for cryptocurrency traders. It enables traders to access platform-provided capital and showcase their trading capabilities through a structured evaluation system. Top-performing traders may earn up to 90% profit share. As an integral part of the CoinW ecosystem, PropW is committed to creating a supportive and growth-oriented trading environment for traders worldwide—empowering them to achieve both financial success and personal breakthroughs. To learn more about PropW, you can visit the website , and follow PropW’s X Account , and Telegram Group . Disclaimer: PropW does not provide investment, brokerage, or financial advisory services. Participation in PropW programs is subject to eligibility,evaluation requirements, and the platform’s terms and conditions. Trading digital assets involves risk, and past performance is not indicative of future results. This post Capital Meets Innovation: PropW Launches Its Next-Generation Ecosystem first appeared on BitcoinWorld .

Bitcoin World

You can visit the page to read the article.

Source: Bitcoin World

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Market Strategist: Time‑wise, It’s Already Over for XRP

In the fast‑moving world of cryptocurrencies, knowing when a cycle ends can be as powerful as predicting where the next move goes. Renowned analyst Steph Is Crypto recently argued on X that, based on the weekly XRP/USD chart, the 2025 cycle has likely peaked—and not just in price, but in time. Revisiting the 2017 and 2021 Cycles Steph’s analysis points to key analogues from XRP’s history. In late 2017, XRP roared from negligible levels to a high of around $2.85, according to historical price data. That surge was followed by a dramatic collapse, as hype unwound and many holders were forced to exit. Fast forward to April 2021, and XRP again rallied strongly, hitting a peak near $1.95 per CoinLore records. But history repeated: after that peak came a prolonged drawdown. These prior cycles show a pattern of powerful rises, discrete tops, and deep retracements. Time-wise, it’s already over for $XRP pic.twitter.com/BJthSmh04F — STEPH IS CRYPTO (@Steph_iscrypto) November 19, 2025 The 2025 Peak and Recent Retracement According to Steph Is Crypto’s recent chart, XRP made a definitive top in early 2025, with a weekly close that eclipsed prior cycles. Public data places that all-time high around $3.65 . The current trading price of $2.11, according to CoinMarketCap, suggests a fall of about 42%. That magnitude of drop signals more than a shallow pull‑back: it’s consistent with significant cycle correction. And, crucially, Steph asserts that because enough time has passed since the ascent, the top isn’t just technical—it may be temporal. Why “Time‑wise” Matters Steph’s thesis centers on more than price: he points to time symmetry across cycles. In his view, the most dangerous point for XRP isn’t necessarily price resistance, but a time-based exhaustion. The 2025 chart mirrors prior cycles not just in shape, but in duration—suggesting that the run-up has matured as much as it has peaked. He also notes technical divergences. For example, in another post, he highlights a bearish RSI divergence: while price made new highs, the RSI weakened, implying fading momentum. Such setups have, in his experience, often aligned with turning points. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 What This Means for Traders and Observers If Steph’s view holds, XRP may be entering a phase less about chasing new highs and more about managing risk. Traders might consider re-evaluating long positions or tightening stops. On‑chain metrics and moving averages—especially long-term ones—could become more critical in assessing downside risk. For long-term holders and researchers, the notion of time-based cycle completion reinforces the idea that not all bull runs end with a parabolic blow-off. Some simply fade after reaching a mature point in both price and time. Final Reflection Steph Is Crypto’s bold assertion—“time‑wise, it’s already over”—is not a prediction of doom, but a warning rooted in historical structure and technical nuance. While XRP could still rebound , his analysis makes clear that the tailwinds of this cycle may be weakening. For anyone holding or watching closely, it may be time to ask not just how high XRP can go, but how much longer this run really has left. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Market Strategist: Time‑wise, It’s Already Over for XRP appeared first on Times Tabloid . Bitcoin World

Ethereum Breaks Below $3,000, Triggering a Wave of Liquidations

Ethereum fell sharply this week, breaking below the key $3,000 psychological threshold and accelerating a wider deleveraging cycle across crypto markets. The move pushed ETH beneath all major trend indicators and ignited a series of forced liquidations as automated trading systems reacted to the breakdown. Outset PR, a crypto-native firm that blends data analysis with communication strategy, powers this piece. With a sharp eye on trends and timing, Outset PR helps blockchain projects convert critical moments into enduring visibility. Technical Breakdown Extends Market Weakness Source: coinmarketcap ETH now trades below the 7-day SMA ($3,109) and the 30-day SMA ($3,574) — a full bearish alignment that underscores sustained downward momentum. The RSI-14 at 33.52 signals oversold conditions, but analysts caution that oversold alone is not confirmation of a reversal, particularly during market-wide risk aversion. The loss of the $3,000 level triggered algorithmic selling, driving liquidations across derivatives platforms. More than $148 million in leveraged ETH long positions were wiped out this week, reinforcing the severity of the breakdown. Traders now look to the next major technical zone of $2,930, the 78.6% Fibonacci retracement from Ethereum’s 2025 highs. This support level could attract initial bids, but market stability will depend on whether ETH can reclaim critical resistance at $3,206. Deleveraging and Sector Risks Amplify the Decline Ethereum’s decline is being shaped by a combination of technical breakdowns, sector-wide deleveraging, and project-specific risks that have weighed on sentiment. As leveraged positions unwind and liquidity thins, price swings become more pronounced, creating feedback loops that push volatility higher. Despite the drawdown, several longer-term indicators remain constructive: Ongoing network upgrades continue to improve Ethereum’s scalability and fee structure. On-chain data shows consistent accumulation from large wallets (“whales”), suggesting long-horizon investors view current prices as opportunistic. Still, analysts emphasize that spotting a durable bottom requires the market to demonstrate renewed strength above $3,200–$3,250, a zone that previously acted as support. PR with C-Level Clarity: Outset PR’s Proprietary Techniques Deliver Tangible Results If PR has ever felt like trying to navigate a foggy road without headlights, Outset PR brings clarity with data. It builds strategies based on both retrospective and real-time metrics, which helps to obtain results with a long-lasting effect. Outset PR replaces vague promises with concrete plans tied to perfect publication timing, narratives that emphasize the product-market fit, and performance-based media selection. Clients gain a forward-looking perspective: how their story will unfold, where it will land, and what impact it may create. While most crypto PR agencies rely on standardized packages and mass-blast outreach, Outset PR takes a tailored approach. Each campaign is calibrated to match the client’s specific goals, budget, and growth stage. This is PR with a personal touch, where strategy feels handcrafted and every client gets a solution that fits. Outset PR’s secret weapon is its exclusive traffic acquisition tech and internal media analytics. Proprietary Tech That Powers Performance One of Outset PR’s most impactful tools is its in-house user acquisition system. It fuses organic editorial placements with SEO and lead-generation tactics, enabling clients to appear in high-discovery surfaces and drive multiples more traffic than through conventional PR alone. Case in point: Crypto exchange ChangeNOW experienced a sustained 40% boost in reach after Outset PR amplified a well-polished organic coverage with a massive Google Discover campaign, powered by its proprietary content distribution engine. Drive More Traffic with Outset PR’s In-house Tech Outset PR Notices Media Trends Ahead of the Crowd Outset PR obtains unique knowledge through its in-house analytical desk which gives it a competitive edge. The team regularly provides valuable insights into the performance of crypto media outlets based on the criteria like: domain activity month-on-month visibility shifts audience geography source of traffic By consistently publishing analytical reports, identifying performance trends, and raising the standards of media targeting across the industry, Outset PR unlocks a previously untapped niche in crypto PR, which poses it as a trendsetter in this field. Case in point: The careful selection of media outlets has helped Outset PR increase user engagement for Step App in the US and UK markets. Outset PR Engineers Visibility That Fits the Market One of the biggest pain points in Web3 PR is the disconnect between effort and outcome: generic messaging, no product-market alignment, and media hits that generate visibility but leave business impact undefined. Outset PR addresses this by offering customized solutions. Every campaign begins with a thorough research and follows a clearly mapped path from spend to the result. It`s data-backed and insight-driven with just the right level of boutique care. Outlook Ethereum’s break below $3,000 marks a significant psychological and technical shift. The next few trading sessions will determine whether ETH stabilizes at Fibonacci support or enters a deeper corrective phase. While fundamentals remain intact, short-term sentiment is dominated by liquidity pressures and systematic selling — making $3,200 the key level to watch for signs of recovery. Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice. Bitcoin World