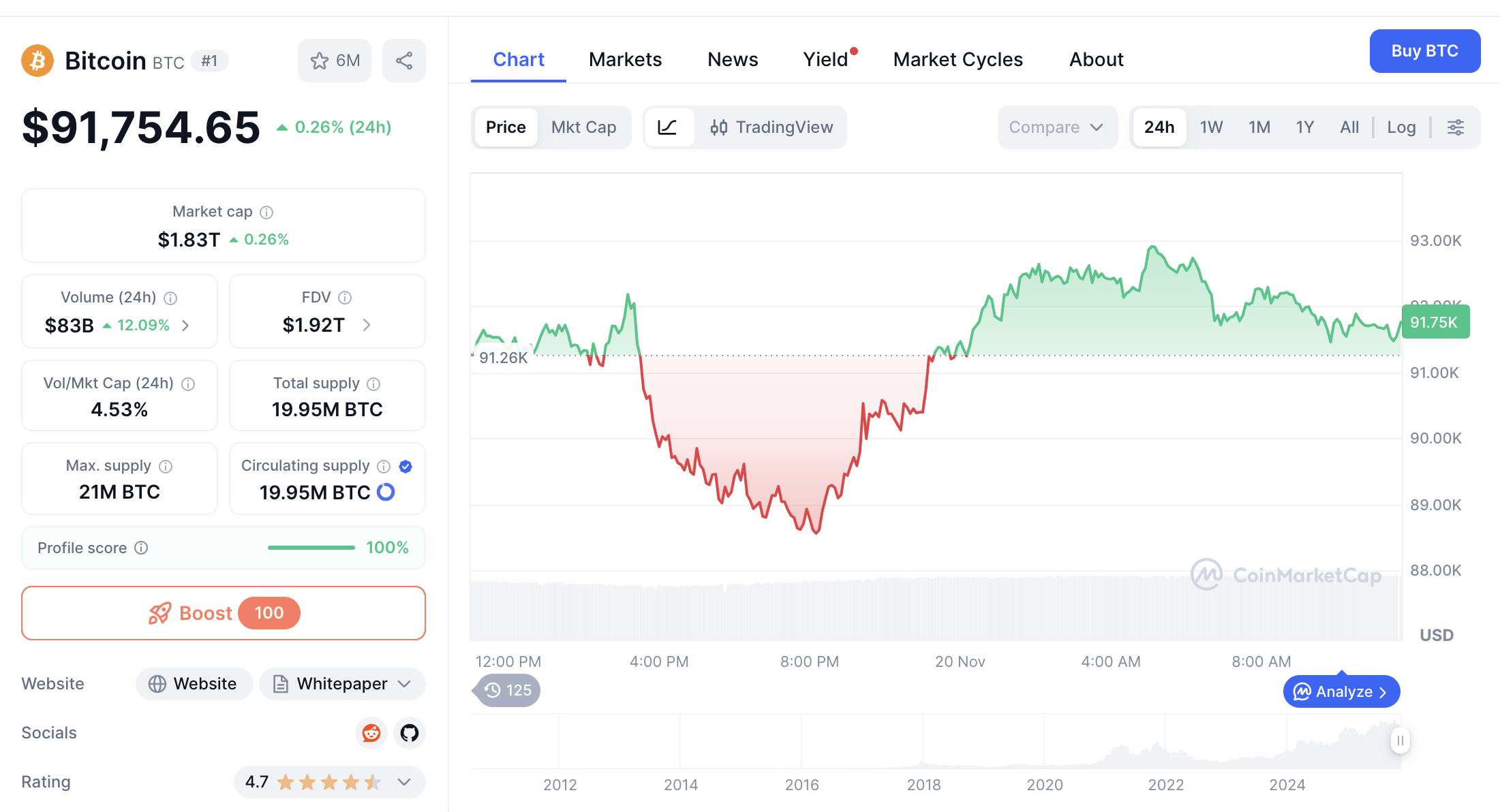

Bitcoin`s upward momentum hindered by low December rate cut prospects. CryptoQuant CEO highlights unique traits of the current crypto cycle. Continue Reading: Experts Challenge Bitcoin Cycle Patterns with Compelling Evidence The post Experts Challenge Bitcoin Cycle Patterns with Compelling Evidence appeared first on COINTURK NEWS .

CoinTurk News

You can visit the page to read the article.

Source: CoinTurk News

Disclaimer: The opinion expressed here is not investment advice – it is provided for informational purposes only. It does not necessarily reflect the opinion of BitMaden. Every investment and all trading involves risk, so you should always perform your own research prior to making decisions. We do not recommend investing money you cannot afford to lose.

Market Strategist: Time‑wise, It’s Already Over for XRP

In the fast‑moving world of cryptocurrencies, knowing when a cycle ends can be as powerful as predicting where the next move goes. Renowned analyst Steph Is Crypto recently argued on X that, based on the weekly XRP/USD chart, the 2025 cycle has likely peaked—and not just in price, but in time. Revisiting the 2017 and 2021 Cycles Steph’s analysis points to key analogues from XRP’s history. In late 2017, XRP roared from negligible levels to a high of around $2.85, according to historical price data. That surge was followed by a dramatic collapse, as hype unwound and many holders were forced to exit. Fast forward to April 2021, and XRP again rallied strongly, hitting a peak near $1.95 per CoinLore records. But history repeated: after that peak came a prolonged drawdown. These prior cycles show a pattern of powerful rises, discrete tops, and deep retracements. Time-wise, it’s already over for $XRP pic.twitter.com/BJthSmh04F — STEPH IS CRYPTO (@Steph_iscrypto) November 19, 2025 The 2025 Peak and Recent Retracement According to Steph Is Crypto’s recent chart, XRP made a definitive top in early 2025, with a weekly close that eclipsed prior cycles. Public data places that all-time high around $3.65 . The current trading price of $2.11, according to CoinMarketCap, suggests a fall of about 42%. That magnitude of drop signals more than a shallow pull‑back: it’s consistent with significant cycle correction. And, crucially, Steph asserts that because enough time has passed since the ascent, the top isn’t just technical—it may be temporal. Why “Time‑wise” Matters Steph’s thesis centers on more than price: he points to time symmetry across cycles. In his view, the most dangerous point for XRP isn’t necessarily price resistance, but a time-based exhaustion. The 2025 chart mirrors prior cycles not just in shape, but in duration—suggesting that the run-up has matured as much as it has peaked. He also notes technical divergences. For example, in another post, he highlights a bearish RSI divergence: while price made new highs, the RSI weakened, implying fading momentum. Such setups have, in his experience, often aligned with turning points. We are on X, follow us to connect with us :- @TimesTabloid1 — TimesTabloid (@TimesTabloid1) June 15, 2025 What This Means for Traders and Observers If Steph’s view holds, XRP may be entering a phase less about chasing new highs and more about managing risk. Traders might consider re-evaluating long positions or tightening stops. On‑chain metrics and moving averages—especially long-term ones—could become more critical in assessing downside risk. For long-term holders and researchers, the notion of time-based cycle completion reinforces the idea that not all bull runs end with a parabolic blow-off. Some simply fade after reaching a mature point in both price and time. Final Reflection Steph Is Crypto’s bold assertion—“time‑wise, it’s already over”—is not a prediction of doom, but a warning rooted in historical structure and technical nuance. While XRP could still rebound , his analysis makes clear that the tailwinds of this cycle may be weakening. For anyone holding or watching closely, it may be time to ask not just how high XRP can go, but how much longer this run really has left. Disclaimer: This content is meant to inform and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not represent Times Tabloid’s opinion. Readers are advised to conduct thorough research before making any investment decisions. Any action taken by the reader is strictly at their own risk. Times Tabloid is not responsible for any financial losses. Follow us on Twitter , Facebook , Telegram , and Google News The post Market Strategist: Time‑wise, It’s Already Over for XRP appeared first on Times Tabloid . CoinTurk News

Stunning 119K Nonfarm Payrolls Surge Crushes Expectations – What This Means for Crypto

BitcoinWorld Stunning 119K Nonfarm Payrolls Surge Crushes Expectations – What This Means for Crypto In a stunning development that caught markets by surprise, the latest nonfarm payrolls report delivered a powerful message about the US economy’s resilience. The September jobs data revealed a massive 119,000 increase in employment, more than doubling analyst expectations and sending ripples across financial markets. For cryptocurrency investors, understanding these nonfarm payrolls numbers is crucial for predicting Federal Reserve policy moves that could impact digital asset prices. Why Do Nonfarm Payrolls Matter for Crypto Investors? The nonfarm payrolls report serves as a critical economic health indicator that directly influences Federal Reserve decisions. When nonfarm payrolls exceed expectations significantly, it suggests economic strength that could lead to tighter monetary policy. This particular nonfarm payrolls surprise of 119,000 jobs created versus the forecasted 53,000 indicates robust labor market conditions that the Fed cannot ignore. Breaking Down the September Jobs Report The US Department of Labor’s announcement contained several key data points that market participants need to understand: Nonfarm payrolls increase: 119,000 jobs added Market expectations: 53,000 jobs Unemployment rate: 4.4% (slightly above 4.3% forecast) Data significance: Final report before December FOMC meeting This substantial beat in nonfarm payrolls numbers comes at a critical juncture for monetary policy. The strong performance in nonfarm payrolls suggests the economy may be running hotter than anticipated, which could influence the Fed’s interest rate decisions. What’s the Immediate Impact on Federal Reserve Policy? The timing of this nonfarm payrolls report makes it particularly significant. Since the Bureau of Labor Statistics has canceled October’s report and delayed November’s data until December 16th, these September nonfarm payrolls represent the only employment data the Fed will have before their December 11th meeting. This creates a situation where these specific nonfarm payrolls numbers carry extraordinary weight in policy deliberations. Strong nonfarm payrolls typically signal that the economy can handle higher interest rates without slipping into recession. However, the slightly higher unemployment rate of 4.4% provides a nuanced picture that policymakers must balance. How Should Crypto Traders React to Strong Nonfarm Payrolls? For cryptocurrency market participants, robust nonfarm payrolls data presents both challenges and opportunities. Historically, strong employment numbers have led to: Potential for higher interest rates which can pressure risk assets Dollar strength that might affect crypto valuations Revised inflation expectations influencing Fed policy Market volatility around Fed meeting dates The key takeaway from these nonfarm payrolls figures is that the US economy continues to demonstrate remarkable strength despite numerous headwinds. This resilience in nonfarm payrolls growth suggests that the Fed may maintain its hawkish stance longer than some market participants anticipated. Looking Beyond the Headline Nonfarm Payrolls Numbers While the headline nonfarm payrolls figure of 119,000 certainly grabs attention, smart investors should consider the broader context. The unemployment rate ticking up to 4.4% indicates there might be some softening in labor market conditions despite the strong job creation. This combination of factors makes the December FOMC meeting particularly unpredictable. The absence of additional nonfarm payrolls data until after the Fed’s December meeting means markets will be parsing every other economic indicator with increased scrutiny. Every inflation report, retail sales figure, and manufacturing index will take on added importance in the coming weeks. Final Thoughts: Navigating Market Reactions The surprising strength in September’s nonfarm payrolls serves as a reminder that economic data can consistently defy expectations. For cryptocurrency investors, this underscores the importance of monitoring traditional economic indicators alongside blockchain metrics. The nonfarm payrolls report remains one of the most reliable predictors of Federal Reserve policy shifts that ultimately affect all risk assets, including cryptocurrencies. As we approach the December FOMC meeting with limited additional employment data, these nonfarm payrolls numbers will likely dominate the policy discussion. The substantial beat in nonfarm payrolls creates a compelling narrative of economic resilience that could shape monetary policy for months to come. Frequently Asked Questions What are nonfarm payrolls? Nonfarm payrolls measure the number of jobs added in the US economy, excluding farm workers, private household employees, and non-profit organization employees. It’s a key indicator of economic health. Why do nonfarm payrolls affect cryptocurrency prices? Strong nonfarm payrolls can lead to tighter Federal Reserve policy, including higher interest rates, which typically pressure risk assets like cryptocurrencies. The relationship stems from monetary policy expectations. How often is the nonfarm payrolls report released? The nonfarm payrolls report is typically released monthly by the Bureau of Labor Statistics. However, the October report has been canceled and November’s data delayed until December 16th. What was the market expectation for September nonfarm payrolls? Analysts expected 53,000 jobs to be added, making the actual result of 119,000 a significant surprise that more than doubled forecasts. When is the next FOMC meeting after this report? The next Federal Open Market Committee meeting is scheduled for December 11th, making this September nonfarm payrolls report the only employment data available before that meeting. How does the unemployment rate factor into Fed decisions? While the nonfarm payrolls beat expectations, the unemployment rate of 4.4% came in slightly above the 4.3% forecast, providing a mixed signal that the Fed must consider alongside other economic data. Share This Insight Found this analysis of the surprising nonfarm payrolls data helpful? Share this article with fellow investors and traders on your social media platforms to help them understand how employment data impacts cryptocurrency markets and Federal Reserve policy decisions. To learn more about how economic indicators like nonfarm payrolls affect cryptocurrency markets, explore our article on key developments shaping Bitcoin price action amid changing macroeconomic conditions. This post Stunning 119K Nonfarm Payrolls Surge Crushes Expectations – What This Means for Crypto first appeared on BitcoinWorld . CoinTurk News